Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Domino's faces profit loss to the tune of $58 million

- Hims & Hers faces another stock tumble

- Zoom beats revenue estimates

____________________________________________________________________________________

8:45 am (AEDT):

Morning everyone, its Frankie Reid with you today for our earnings news!

Up ahead, we will have results from Zoom, Nine Entertainment, Woodside, Dominos and more.

9:00 am (AEDT):

Domino's Pizza (NASDAQ: DPZ) has faced a loss in the six months to the end of 2024, with results that felt under analysts' expectations.

Its earnings before interest and taxes (EBIT) took a tumble to US$100.6 million (A$158.4 million) for the first half of FY2025, driven by underperformance in Asia (-19.0%) and Europe (-11.1%), even with stronger results in Australia (+7.6%).

The pizza company also faced a loss of $22.2 million in the face of over 200 stores closing their doors in the six months leading up to 31 December last year.

Azzet's Garry West has the full story here.

9:12 am (AEDT):

Hims & Hers Health (NYSE: HIMS) did well in its fourth quarter (Q4) growth but despite revenue getting a boost of US$1.5 billion, stock still fell by 18% in after hours trading.

According to the telehealth company's earnings release, revenue was showing an increase of 95% year-over-year as it came in at US$481.1 million (A$757.8 million) for the Q424 compared to $246.6 million (A$388.7 million) in Q423.

Andrew Dudum, co-founder and CEO said “2024 was a fantastic year at Hims and Hers" and that he expected "2025 will be another exciting step toward our vision of this next-generation of healthcare.”

Despite this, Hims & Hers faced its second stock market fall in under a week, as shares dropped 18% on Monday, local time, less than a week after they plummeted by 26% the week before, following an announcement from the U.S. Food and Drug Administration.

9:30 am (AEDT):

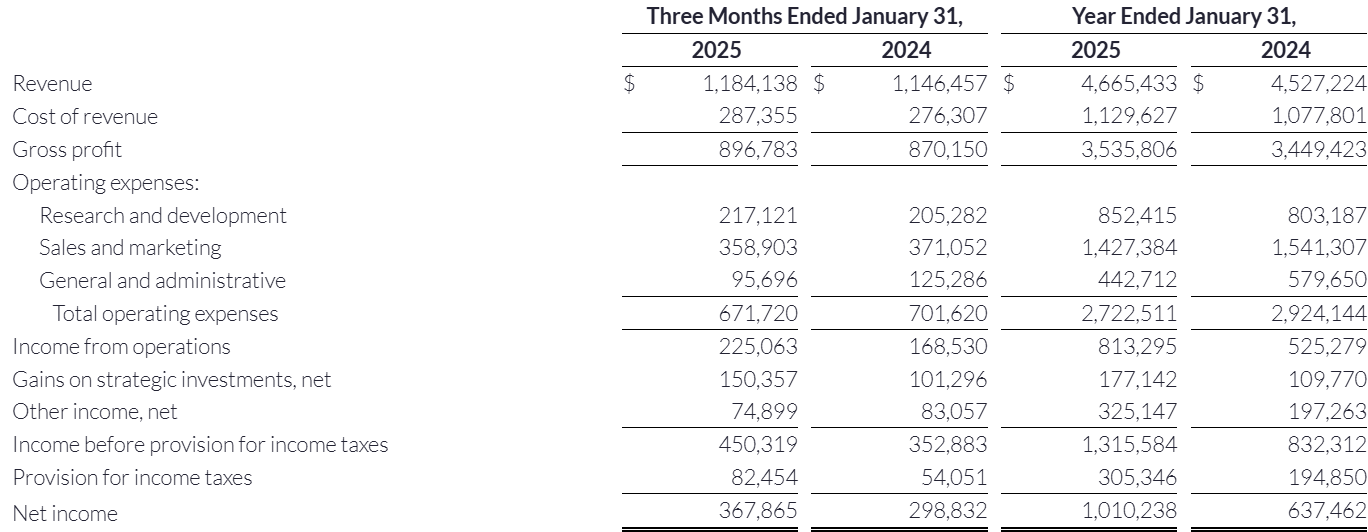

Hopping back to the NASDAQ, Zoom (ZM) saw revenue ahead of estimates, with Q4 total revenue coming in at US$1,184.1 million (A1,864.6 million), up 3.3% year over year.

On an adjusted basis, Zoom earnings for the fourth quarter were $1.41 per share, with Zoom stock analysts having predicted $1.30.

Renewed guidance for the video-call software company was slightly less than expected, with expectations for the full-year 2025 revenue sat at $4.79 billion against estimates of $4.81 billion, while earnings per share (EPS) guidance came in as expected at $5.34 to $5.37.

9:55 am (AEDT):

Amplitude Energy (ASX: AEL), has had a strong first half of record results after reporting a A$7.57 million profit, up from a $90.8 million loss the same time a year before.

Gas and oil production also came in 20.8% higher than the same time in 2024 as well as up EBITDAX up by 53% compared to the same time period the previous year.

“We delivered strong financial performance, with the business generating strong underlying cash flow in the half,” said managing Director and CEO Jane Norman.

“We are excited about the remainder of FY25, with further improvement trials at Orbost, initiatives to further improve our realised gas prices, and an expectation that our operating margins and underlying cash flow will continue.”

10:15 am (AEDT):

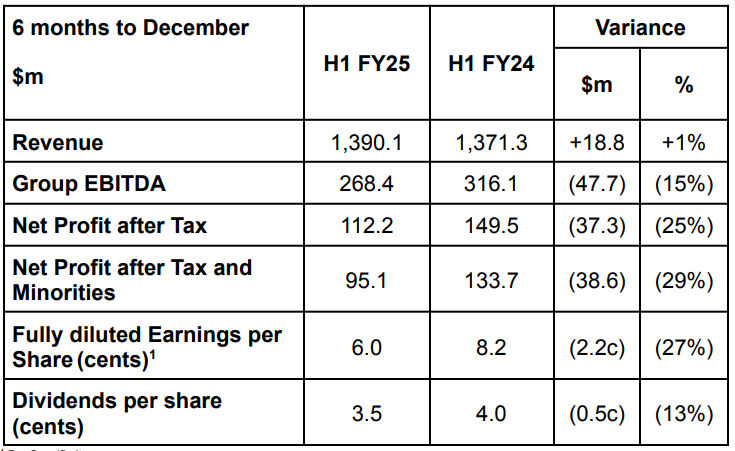

Nine Entertainment (ASX: NEC) has seen a dive in net profit of 25% or A$112.2 million for the first half of the 2025 financial year (H1 FY25).

The parent company for many Australian media staples, including Nine television network, The Age, The Sydney Morning Herald and The Australian Financial Review, also took a loss in EBITDA as it fell 15% to $268 million.

This was due to a weaker economic and advertising market and the impact of the loss of revenues from Facebook parent company Meta (NASDAQ: META).

Garry West has the full story again.

10:43 am (AEDT):

Zip Co (ASX:ZIP) posted an update to their 1H FY25 results, with cash earnings before interest, taxes, depreciation and amortization (EBTDA) up by an impressive 117.1% compared to the same time last year, to the tune of A$67million.

Total income was up 19.8% to $514 million and net bad debts were down to 1.6% from 1.8%.

Merchants using the buy now pay later platform also rose by 7.6% compared to the same time last year, an increase of 81.9 thousand.

11:05 am (AEDT):

Woodside Energy (ASX: WDS) announced their full year results for 2024 today, with the release focusing on major growth projects as it continues with gas projects in both Western Australia and the United States.

However, underlying net profit did fall to A$4.54 billion in the year ending 31 December, thanks to the impact of lower oil and gas prices.

Sales pitched down 6 per cent on record breaking production production that reached 193.9 million barrels of oil equivalent.

Mark Story has the full story.

11:42 am (AEDT):

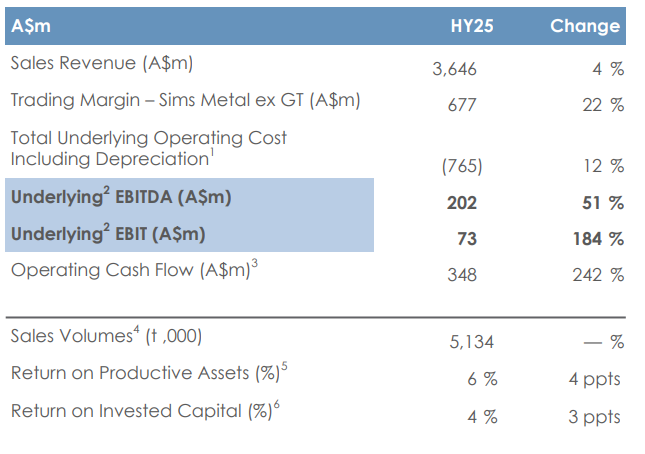

Sims Ltd. (ASX: SGM) had a busy start to the day, announcing not only a 184% increase in underlying earning for the first half of FY25 but also the retirement of a company director.

The metal recycling company's EBIT jump came in at A$73.0 million, and operating Cash was also up by 242% pushed along by sale of UK Metal, operational performance, and reducing working capital levels.

Sims Limited also announced a new dividend distribution for its ordinary fully paid securities, amounting to A0.10 per share.

Meanwhile, Deborah O’Toole stepped down having first joined the board of director in November 2014 and served as Chair of the Audit Committee, with her retirement coming into effect immediately.

12:04 pm (AEDT):

Heading back stateside now with Realty Income (NYSE : O) whose earnings per share came in $0.14 worse than analysts predictions for the quarter, at US$0.23.

The company released both its results for the three months and year ending on 31 December.

Revenue for the quarter just crept above estimates, at US$1.28 billion (A$2.02 billion) compared to $1.27 billion.

This month its board of directors also authorised a share repurchase program for up to US$2.0 billion in shares.

“I am pleased with our performance in 2024 as we delivered a 4.8% increase in AFFO per share, representing our 14th consecutive year of annual AFFO per share growth,” said Sumit Roy, Realty Income's President and CEO.

“Looking forward, we have positioned our platform for continued growth and dependable, long-term returns for our shareholders.”

12:30 pm (AEDT):

Good afternoon, it's Chloe Jaenicke here to take you through some afternoon earnings.

Pacific Current Group Limited (ASX: PAC) has reported a jump in first-half profit.

Statutory net profit after tax (NPAT) skyrocketed to A$100.3 million from $11.7 million a year ago while underlying profit was down 8% to $15.3 million.

The company's earnings come on the back of revaluation of its stake in Victoria Park Capital and gains on disposals.

Pacific Current said their focus for 2025 includes reducing corporate costs and debt, delivering growth initiatives and optimising organisational effectiveness.

“After a busy and exciting start to FY2025, PAC management is focused on executing a clear and disciplined plan to continue the strong momentum in 2H25,” executive director and acting CEO, Michael Clarke said.

12:48 pm (AEDT):

KBR Inc. (NYSE: KBR) reported higher-than-expected revenues for the quarter of US$2.12 billion, surpassing the Zacks consensus estimate by 8.04%. This is also an increase of the $1.73 billion revenue from a year ago.

The company’s revenue for all of 2024 was up 11% to $7.7 billion and its net income was $375 million.

“KBR delivered sustained performance throughout the year culminating in a strong fourth quarter, with significant revenue and earnings growth as well as margin expansion,” president and CEO, Stuart Bradie said.

“This positioning enables us to approach our fiscal year 2025 outlook with a high degree of confidence, with more than 75% of our projected Revenues already under contract across our global, diversified contract base.”

1:03 pm (AEDT):

Student learning platform, Chegg (NYSE: CHGG) reported a decrease in revenue both for the the fourth quarter of 2024 and the entire fiscal year.

For Q4, total revenues dropped 24% year-on-year to US$143.5 million and for the full year revenues dipped 14% year-on-year to $617.6 million.

Chegg CEO, Nathan Schultz said they are making decisions to maximise the future of the business and shareholder value.

“We are launching a strategic review process and filed a complaint against Google, which has unjustly retained traffic that has historically come to Chegg, impacting our acquisitions, revenue and employees,” he said.

“As we look to stabilise Chegg’s business in 2025, we have a strong and trusted brand, millions of global subscribers, a large market opportunity, and amazing employees.”

1:10 pm (AEDT):

Diamondback (NASDAQ: FANG) surpassed Zacks Consensus Estimate by 9.18% with revenues of US$3.71 billion for the fourth quarter of 2024. At the same time last year, the company's revenue was $2.23 billion.

The company also increased its annual base dividend by 11% to $4.00 per share.

1:40 pm (AEDT):

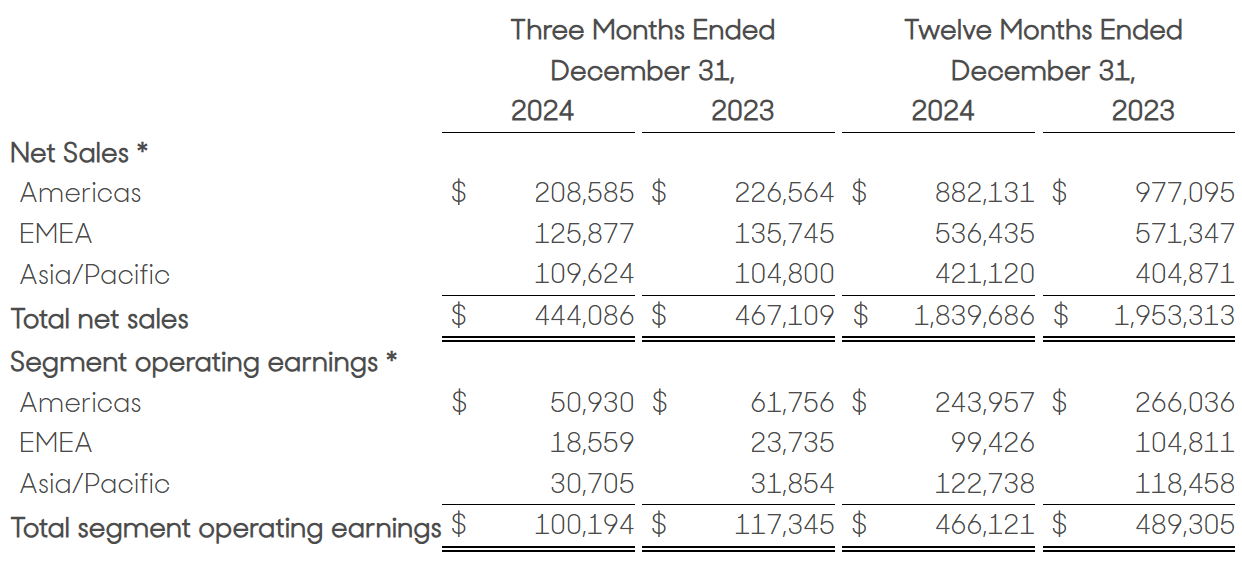

Frankie back on deck again folks, hopping right into again with the Q4 results from Quaker Houghton (NYSE: KWR).

Sales were down by 5% from the same time the year before, or US$444.1 million (A699.6 million).

The full FY24 saw net sales of $1.84 billion with net income of $116.6 million but Q4 adjusted EBITDA decreased 16% to $64.8 million

2:15 pm (AEDT):

Riot Platforms (NASDAQ:RIOT) released their full FY24 report today, with Q4 EPS coming in US$0.06 below estimates but revenue landing above.

Revenue however came in at a record of US$376.7 million and net income of $109.4 million,

It also produced 4,828 Bitcoin, as compared to 6,626 during the same time period in 2023.

2:45 pm (AEDT):

Clearway Energy (NYSE:CWEN) came out with quarterly earnings of $0.03 per share, missing the Zacks Consensus Estimate of $0.13 per share and in comparison to EPS of $0.32 the same time a year ago.

For the full year, the company reported a net loss of US$63 million, adjusted EBITDA of $1,146 million, cash from operating activities of $770 million, and cash available for distribution (CAFD) of $425 million.

The company also reaffirmed its full-year 2025 CAFD guidance range of $400 million to $440 million.

Over the previous four quarters it has passed EPS and revenues estimates just once each.

Craig Cornelius, Clearway Energy CEO, however said that the results “exceeded guidance with excellent performance across all technologies”.

3:05 pm (AEDT):

Viva Energy Australia (ASX: VEA) today reported a fall in full-year profits causing shares to follow suit.

The company reported a A$76.3 million loss on an historical cost basis last year, compared with a $3.8 million profit a year earlier.

These plunging figures were driven by due to lower demand and reduced refining margins.

Viva, which operates Shell-branded service stations in Australia and the Geelong oil refinery, however said that revenue had grown by 12.7% to $30.142 billion in the 12 months to the end of 2024.

As of At 1pm AEDT (2pm GMT) shares were 65 cents, or 26.88%, lower at $1.76.

Garry West reports the full story.

3:30 pm (AEDT):

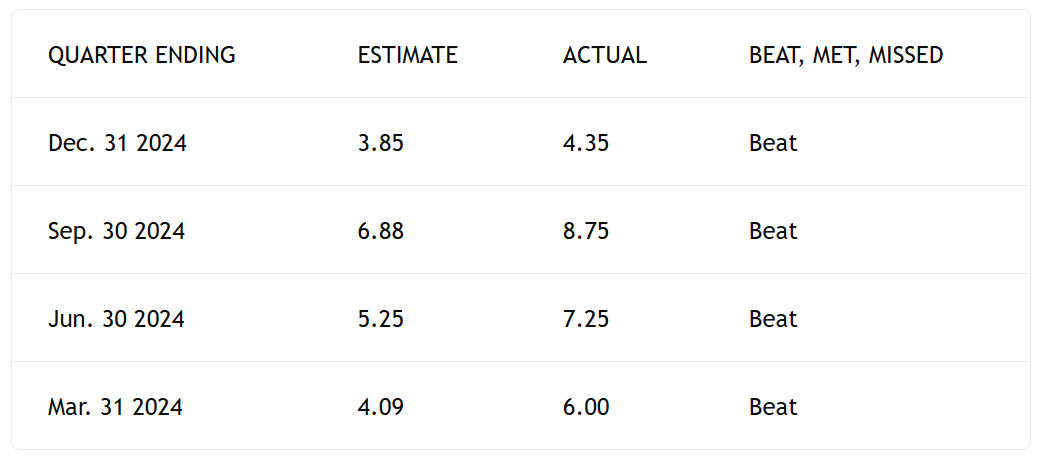

Trip Group (NASDAQ: TCOM; HKEX: 9961) reported quarterly adjusted EPS of CNY4.35 (A0.914), higher than the same time last year, when it sat at CNY2.74.

The result came above expectations from analysts for the Q4 which was an EPS of CNY3.85.

Revenue was up by CNY12.74 billion, or 23.4%, from a year ago also creeping above expectations which sat at CNY12.32 billion.

3:55 pm (AEDT):

Alright everyone, that's it from me and the blog today!

Taking over the reigns tomorrow will be Sienna Martyn, with plenty to look forward to from American Tower, the Bank of Montreal, Keurig Dr Pepper Inc and more!