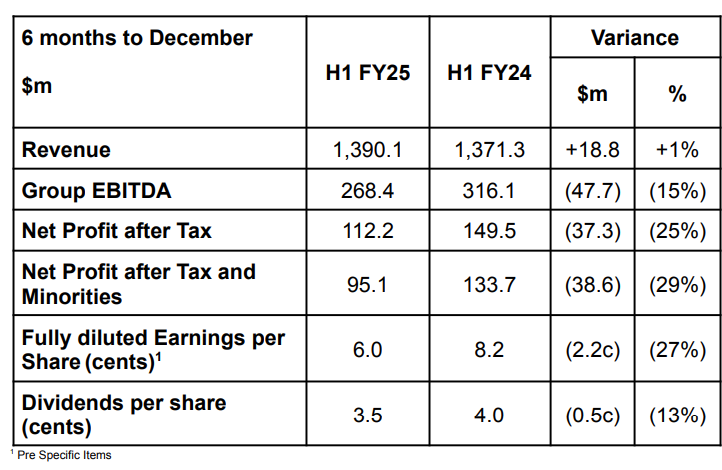

Nine Entertainment has reported a 25% fall in net profit after tax to A$112.2 million for the first half of the 2025 financial year (H1 FY25).

Nine, which owns the Nine television network, Fairfax newspapers like The Age, The Sydney Morning Herald and The Australian Financial Review (AFR), and a stake in the Macquarie Radio network, said this included a $16 million ‘specific items’ charge.

Group earnings before interest, tax, depreciation and amortisation (EBITDA) fell 15% to $268 million due to a weaker economic and advertising market and the impact of the loss of revenues from Facebook parent company Meta Platforms (NASDAQ: META).

Revenue grew 18.8% to $1.39 billion in the six months to 31 December 2024.

Nine said streaming and broadcast audiences grew, underlying subscription revenues (excluding Domain and the impact of Meta/Google) increased 8%, Domain’s EBITDA contribution rose 15%, digital revenue soared 33% in audio, and costs fell $35 million.

Directors declared a fully franked dividend of 3.5 cents per share to be paid on 24 April to shareholders registered on 11 March, compared with 4.0 cents a year earlier.

“In a challenging market environment, we have continued to perform well operationally, while simultaneously strengthening our strategic position and implementing our cultural reset,” Chair Catherine West said in a statement.

“The Board, bolstered by recent appointments bringing further diversity of views and experience among directors, continues to see real opportunities for Nine to thrive by harnessing the power of the Nine Group.”

Nine Acting Chief Executive Officer Matt Stanton said he was generally pleased with the performance, particularly at streaming service Stan where EBITDA grew 16%, while digital newspaper subscription revenue grew 15%, excluding the impact of the Meta and Google revenue loss.

Nine Entertainment (ASX: NEC) shares closed on Monday at $1.63, down 10 cents (5.78%), capitalising the company at $2.58 billion.Nine Entertainment has reported a 25% fall in net profit after tax to A$112.2 million for the first half of the 2025 financial year (H1 FY25).