Shares in Viva Energy Australia plunged after the service station and oil refinery operator reported a deterioration in full-year profits due to lower demand and slimmer refining margins.

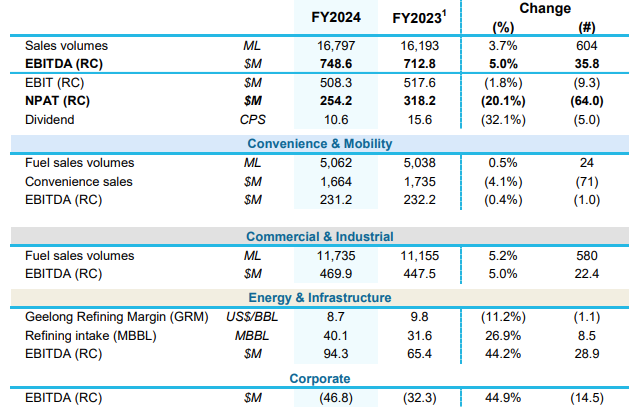

Viva posted a $76.3 million loss on an historical cost basis in 2024, compared with a $3.8 million profit a year earlier, and a $254.2 million profit on a replacement cost basis, 20.1% below 2023. Replacement cost removes the distorting impact of changes in the oil price over time.

At 1pm AEDT (2pm GMT) Viva (ASX: VEA) shares were 65 cents, or 26.88%, lower at $1.76, capitalising the company at $4.35 billion.

Viva, which operates Shell-branded service stations in Australia and owns and operates the Geelong oil refinery in Victoria, said revenue grew by 12.7% to $30.142 billion in the 12 months to 31 December 2024.

Viva said group earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 5% to $748.6 million, including record Commercial & Industrial (C&I) EBITDA of $469.9 million, also up 5%.

A fully-franked final dividend of 3.87 cents per share will be paid on 31 March 2025 to shareholders registered on 10 March 2025, compared with an interim dividend of 7.1 cents a year earlier, bringing the full year payout to 10.6 cents (15.6 cents).

The company also forecast combined EBITDA from its convenience and mobility and C&I businesses of between $270 million and $330 million in the first half of 2025.

CEO and Managing Director Scott Wyatt said the 5% lift in EBITDA in 2024 was supported by strong sales growth in the commercial business and a higher crude intake due to lower maintenance and an improved performance by the refinery.

“Group performance was negatively impacted by lower demand within our convenience business due to cost-of-living pressures and illicit tobacco trade, coupled with high inflation lifting the cost of doing business,” Wyatt said in ASX announcement.

“Regional refining margins also declined in the second half of the year, triggering federal government support in the third quarter.

“Notwithstanding these challenges, I am pleased with progress we have made on transforming our business over the last year.”