Selling takeaway pizzas is not always certain to drive profit growth as Domino’s Pizza Enterprises demonstrated when it delivered investors a A$22.2 million (US$14.2 million) loss for the first half of the 2025 financial year (H1 FY25).

Investors did not like the taste with Domino’s (ASX: DMP) shares falling $3.50 (10.85%) to $28.77 by 11.40am AEDT (12.40pm GMT), capitalising the master franchisee and largest operator of Domino's Pizza stores outside the United States at $2.66 billion.

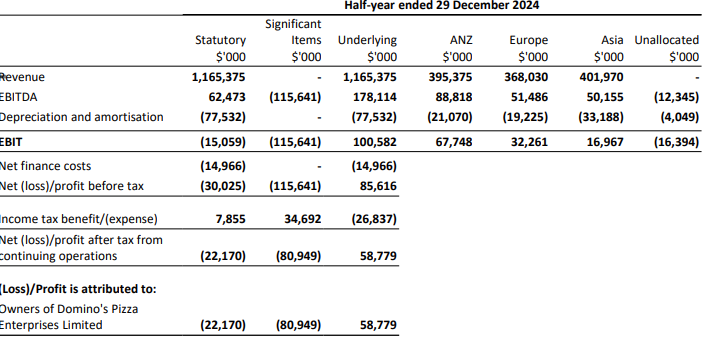

The company, which has more than 3,800 stores in Australia and 11 other markets in Asia and Europe, said the results included $115.6 million of pre-tax significant items not directly attributable to primary operating activities.

The items included impairments and write-downs related to store closures, intangible assets, land and buildings and inventory, along with the costs of terminations, transitioning to a shared services centre model, finance, supply and litigation.

Excluding these items, underlying profit before tax for continuing operations increased 4.5% to $85.6 million in the six months to 31 December 2024, on revenue which fell 6.4% to $1.165 billion.

Strong performances in Australia and Benelux, and improvements in Germany and South East Asia, were offset by challenges in Japan and France.

The Board kept the interim dividend steady with an unfranked 55.5 cents per share to be paid on 2 April to shareholders on record on 4 March.

“Despite a challenging economic environment, Domino’s continues to demonstrate resilience, growing market share underpinned by a strong brand and a menu offering delivering high quality food for customers at an affordable price,” the company said in an ASX announcement.

CEO and Managing Director Mark van Dyck said the results demonstrated early progress from an ongoing comprehensive business review, but the company had more work to do to restore value for shareholders, franchise partners and customers.

“While challenges remain, we are making early progress, we understand the urgency of the task and we invite shareholders to track our progress,” said van Dyk who in 2023 took over from former delivery driver Don Meij, who had been CEO since 2002.

E&P retail analyst Phillip Kimber said Domino’s failure to provide profit guidance would keep the share price under pressure and result in FY26 and FY27 earnings downgrades.