Goldman Sachs Group's equities traders took advantage of volatile financial markets to power the global investment bank and financial services company to a 15% increase in net earnings for the first quarter of the 2025 financial year.

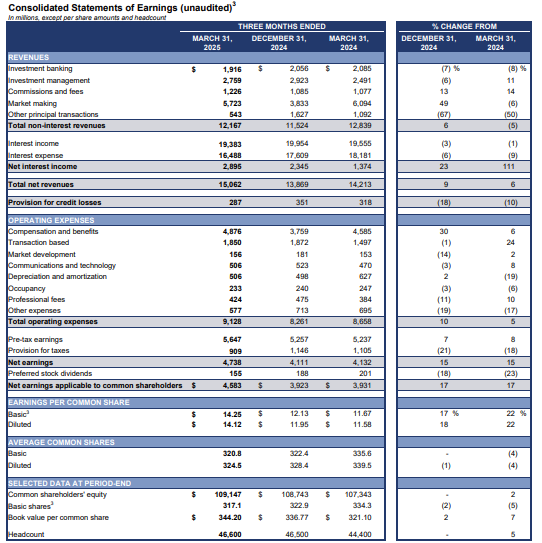

Goldman Sachs reported record net revenue from its equities business as it unveiled net earnings of $US4.74 billion ($7.52 billion) for the three months to 31 March 2025, compared with $4.13 billion in the previous corresponding period (PCP).

The result was its third highest quarterly net revenue of $15.062 billion, a 6% increase on the PCP, as higher net revenues in its Global Banking & Markets business were partially offset by slightly lower net revenues in Asset & Wealth Management.

The firm said the 10% lift in Global Banking & Markets net revenues to $10.71 billion was driven by record net revenues in equities. It also had strong performances in fixed income, currency and commodities and debt underwriting.

Net equities revenues surged 27% to $4.19 billion due to significantly higher net revenues in equities intermediation and equities financing.

Diluted earnings per share rose 22% to $14.12, above analysts’ forecasts of $12.33 to $12.35.

“Our strong results this quarter have demonstrated that in times of great uncertainty, clients turn to Goldman Sachs for execution and insight,” Chairman and CEO David Solomon said in a press release.

“While we are entering the second quarter with a markedly different operating environment than earlier this year, we remain confident in our ability to continue to support our clients.”

Investment banking fees fell 8% to $1.91 billion mainly due to significantly lower advisory net revenues than in the strong prior year period, partially offset by higher net revenues in debt underwriting.

Net revenues were unchanged in equity underwriting, 2% higher in fixed income, currency and commodities (FICC) and slightly lower in FICC intermediation.

Annualised return on average common shareholders’ equity was 16.9% and annualised return on average tangible common shareholders’ equity was 18.0% for the first quarter of 2025.

Goldman Sachs shares (NYSE: GS) closed $9.23 or 1.87% higher at $503.98 on Monday, (Tuesday AEST), capitalising the company at $156.63 billion.