Goldman Sachs reported solid financial results for the fourth quarter of 2024, with a net revenue of $53.51 billion and an operating profit of $14.28 billion.

The American multinational investment bank and financial services company's diluted earnings per share (EPS) for the year were $40.54, compared to $22.87 in 2023, reflecting significant growth. For the fourth quarter, EPS was $11.95, up from $5.48 in the same quarter the previous year.

The firm's return on average common shareholders' equity (ROE) was 12.7% for the year, with an annualised ROE of 14.6% for the fourth quarter. Return on average tangible common shareholders' equity (ROTE) was 13.5% for the year, with an annualised ROTE of 15.5% for the fourth quarter. These metrics indicate strong profitability and an efficient equity use.

Goldman Sachs' Asset & Wealth Management division generated net revenues of $16.14 billion, including record management and other fees. In addition, it generated private banking and lending net revenues. The firm also ranked #1 in worldwide announced and completed mergers and acquisitions for the year.

Global Banking & Markets saw net revenues of $34.94 billion, driven by record net revenues in Equities and strong performances in Investment Banking fees and Fixed Income, Currency, and Commodities (FICC).

David Solomon, Chairman and CEO of Goldman Sachs, said, "We are very pleased with our strong results for the quarter and the year. I’m encouraged that we have met or exceeded almost all of the targets we set in our strategy to grow the firm five years ago, and as a result, have both grown our revenues by nearly 50% and enhanced the durability of our franchise. With an improving operating backdrop and growing CEO confidence, we are harnessing the power of One Goldman Sachs to continue to serve our clients with excellence and create further value for our shareholders."

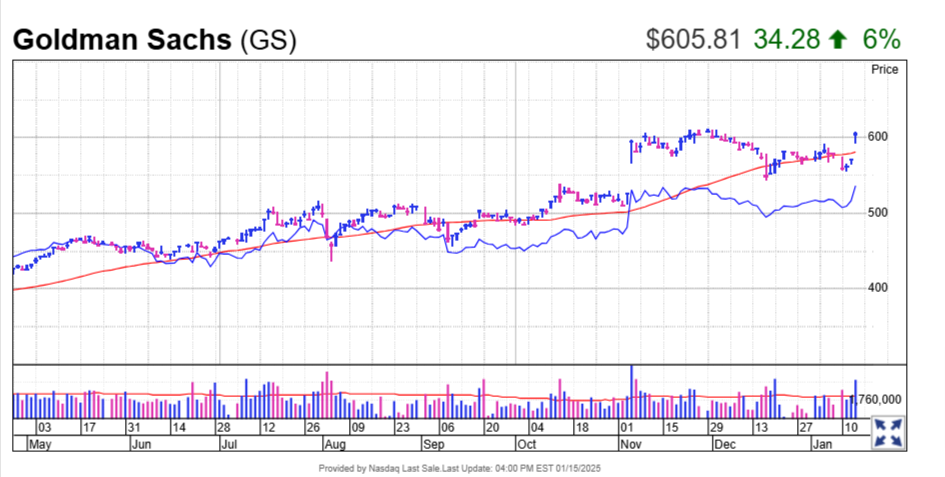

At the time of writing, Goldman Sachs' (NYSE: GS) stock price was $605.92, with a market cap of approximately $190.2 billion. The stock has seen a significant increase, reflecting investor confidence in the firm's performance and strategic direction.