BlackRock Inc has announced weaker earnings for the first quarter of the 2025 financial year due to acquisition costs.

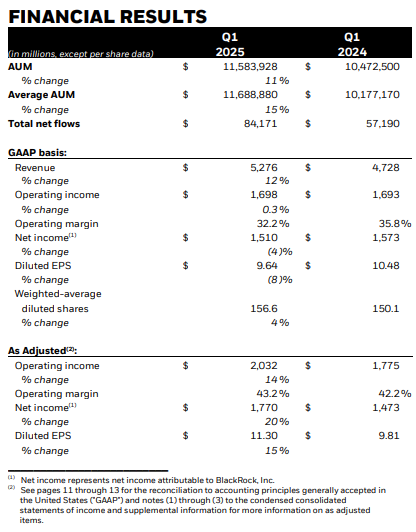

The world’s largest asset manager said net income dropped 4% to US$1.51 billion (A$2.44 billion) and diluted earnings per share (EPS) fell 8% to $9.64 in the three months ended 31 March 2025 on revenue which rose 12% to $5.276 billion.

The New York-based company, with a record $11.6 trillion under management, said operating income and EPS were affected by acquisition-related costs, which were excluded from adjusted results.

Acquisitions included SpiderRock Advisors in May 2024 and Global Infrastructure Management in October 2024.

BlackRock said adjusted net income increased 20% to $1.77 billion and adjusted EPS rose 15% to $11.30 billion in Q1.

Chairman and CEO Larry Fink said the 6% organic base fee growth in the first quarter was BlackRock’s best start to a year since 2021.

“Uncertainty and anxiety about the future of markets and the economy are dominating client conversations,” Fink said in a media release.

“We've seen periods like this before when there were large, structural shifts in policy and markets – like the financial crisis, COVID, and surging inflation in 2022.

“We always stayed connected with clients, and some of BlackRock’s biggest leaps in growth followed.”

Fink said although market weakness was damaging to Wall Street and ordinary people's retirement savings, he did not see systemic risks.

"The markets have proved to be quite successful and work quite well," Fink was quoted in a Reuters story as saying.

Although first quarter revenue was below expectations of $5.38 billion, EPS was higher than the average forecast of $10.76.

BlackRock (NYSE: BLK) shares closed $20.00 or 2.33% higher at $878.78 on Friday, capitalising the company at $136.23 billion.