Goldman Sachs surpassed market expectations for its third-quarter earnings on Tuesday, driven by strong stock trading and investment banking results.

The bank reported earnings of $8.40 per share, significantly above market expectations of $6.89 per share. Revenue climbed 7% to $12.7 billion, exceeding forecasts of $11.8 billion.

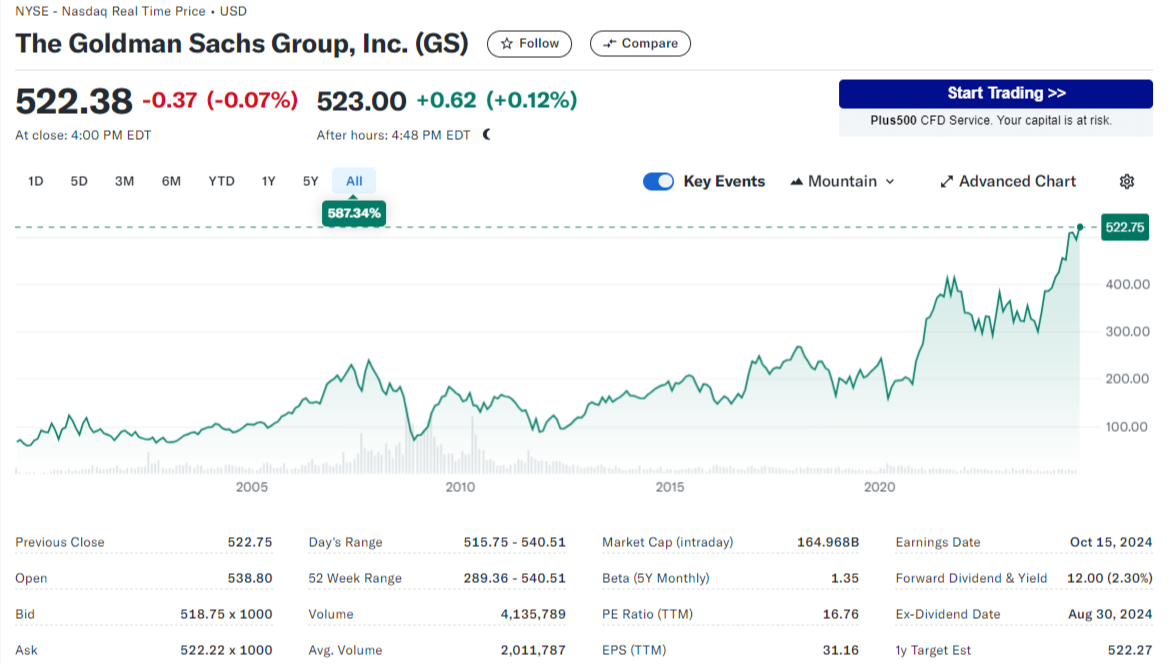

The company's net profit surged 45% compared to a year earlier, reaching $2.99 billion. Goldman’s shares were largely unchanged, despite rising 2% earlier in the day.

Over the past two years, the Federal Reserve’s interest rate hikes created a challenging environment for investment banks like Goldman.

However, with the Fed now easing its benchmark rate, Goldman is well-positioned to capitalise on opportunities as companies, previously hesitant to make acquisitions or raise capital, are now likely to proceed. Additionally, rising asset values have strengthened the bank’s asset and wealth management divisions.

David Solomon, CEO of Goldman Sachs, highlighted the firm’s strong performance in his remarks, saying, “Our performance demonstrates the strength of our world-class franchise in an improving operating environment. We continue to lean into our strengths – exceptional talent, execution capabilities and risk management expertise – allowing us to effectively serve our clients against a complex backdrop and deliver for shareholders.”

Equities trading stood out this quarter, posting an 18% revenue increase to $3.5 billion, significantly above the estimated $2.96 billion. The bank attributed this success to robust results in derivatives and cash trading.

Conversely, fixed-income trading saw a 12% year-on-year decline in revenue, totalling $2.96 billion, just above estimates, as interest-rate products and commodities slowed.

Investment banking revenues lifted 20% to $1.87 billion, surpassing expectations due to strength in debt and equity underwriting. The bank also reported an increased backlog of pending deals compared to both the previous quarter and the same period last year.

Goldman’s asset and wealth management division was another key driver of success, with revenue jumping 16% to $3.75 billion, surpassing estimates due to rising management fees and gains in investments.

This strong performance follows last week’s results from rival banks. JPMorgan Chase set high expectations with its own impressive results from trading and investment banking, while Wells Fargo also exceeded estimates, driven by its investment banking division.