Your weekly snapshot of price action and global reactions across the past seven days in commodities.

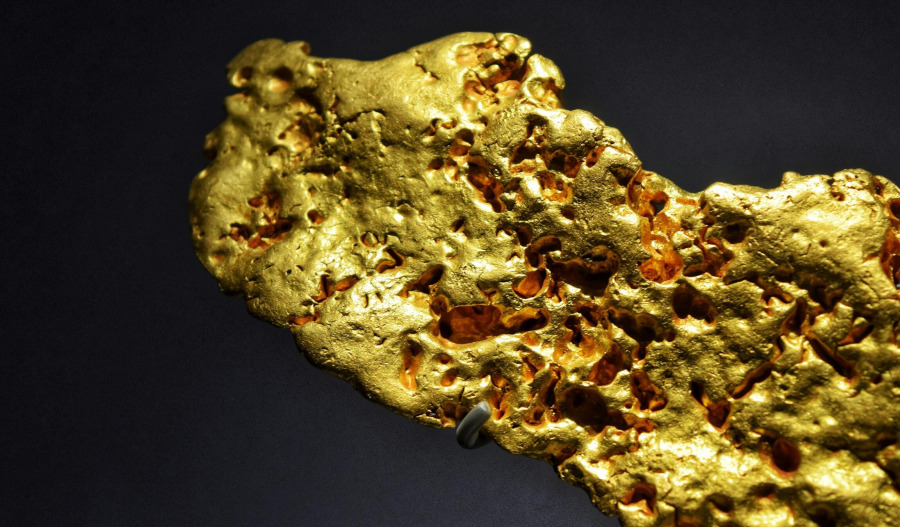

Precious Metals

Gold (US$4,596.10/oz)

Bullion values surrendered early gains following whispers that Donald Trump is wavering on his endorsement of Kevin Hassett for the Fed chair seat.

Hassett is viewed as a notably dovish successor to Jerome Powell, a profile that usually juices metal prices.

Stubborn inflation and employment metrics have also stoked fears that central bank governors might mothball rate cuts at the upcoming gathering.

In recent sessions, gold tagged record peaks near US$4,629/oz after inflation data defied cooling expectations.

Silver (US$90.10/oz)

Silver tracked the broader erosion in the precious metals space, logging a 3% slide.

The metal remains hostage to a volatile U.S. dollar and erratic industrial sentiment.

Prices previously surged by 7.1% in a single day as lukewarm inflation data prompted speculative bets on imminent rate relief.

Industrial and Battery Metals

Copper (US$12,803/t)

Prices finished the week in the red as Chinese overseers purged high-frequency trading servers from data centres to stifle “investor exuberance”.

This clampdown on speculation effectively doused the recent buying spree from Chinese traders.

Fresh trade anxieties also bubbled up after the White House telegraphed a 10% tariff on goods from various European nations.

Industry insiders are currently dissecting a potential mega-merger between Rio Tinto and Glencore, a play to monopolise massive copper deposits.

Iron Ore (US$105.80/t)

Iron ore futures sank as a glut of supply overran market appetite.

China welcomed its maiden shipment of high-grade ore from the Simandou mine in Guinea, a behemoth project slated to dump 120 million tonnes of annual capacity onto the market.

Mainland port stockpiles also climbed week-on-week, further depressing the price outlook.

BHP and Rio Tinto have unveiled plans to coordinate extraction efforts to pull 200 million tonnes of ore from adjacent Pilbara tenements.

Nickel (US$17,578/t)

Nickel endured a 5.3% drubbing as the mood across the base metals floor turned sour.

The fall was somewhat cushioned by the prospect of an Indonesian supply squeeze, with officials looking to slash mining quotas this year.

The market remains on edge as the Indonesian government iterates figures that could vanish 700,000t of global supply.

Aluminium (US$3,134/t)

Aluminium prices shed 1.1% over the trading window.

The sector is currently stuck between regulatory crosshairs in China and the looming shadow of global trade barriers.

South32 shares recently caught a bid as aluminium revisited its highest valuation since 2022 at US$3,180/t.

Lithium (US$19,800/t)

Values have recently plateaued as the market hits a structural pivot point driven by the hunger for utility-scale battery storage.

J.P. Morgan Chase analysts have recalibrated their price targets for spodumene concentrate, eyeing a return to the US$2,000/t mark by late 2026.

Energy

Crude Oil (WTI US$59.44; Brent US$64.10)

Crude oil navigated a schizophrenic week triggered by intensifying geopolitical brinkmanship.

Brent values dipped nearly 3% recently as the U.S. appeared to backpedal from a potential military entanglement in Iran's internal unrest.

Simultaneously, Washington has started liquidating Venezuelan oil after hijacking several tankers tied to the country’s sanctioned "shadow fleet".

Uranium (US$84.74/lb)

Spot prices have remained buoyant as the global supply landscape constricts following production hiccups in Kazakhstan.

Optimism is being fueled by a desperate rush for nuclear energy, evidenced by Meta inkling nuclear pacts with three U.S. utility firms to power its AI data centres.

Cameco and Brookfield have also aligned with the U.S. government to bankroll US$80 billion in fresh reactor construction.

Coal (US$108.85/t)

Thermal coal prices crept up by 0.4%.

While long-term decarbonisation targets loom, the explosion in AI-centric power demand is providing an unexpected lifeline for global producers.

LNG (US$11.155/mBtu)

North Asia spot rates rocketed more than 9% as meteorologists warned of a brutal cold front sweeping through Japan and Korea.

Temperatures in Beijing and Shanghai are anticipated to crater by 20°C, triggering a frantic hunt for heating fuel.

Despite the seasonal frenzy, analysts are flagging a global supply glut as a tsunami of new capacity prepares to exit the U.S. and Qatar.