Gold prices rose during Wednesday’s Asian trading after the United States reported better-than-expected inflation data.

Spot gold was up 0.5% to US$4,628.43 per ounce by 3:20 pm AEDT (4:20 am GMT). Silver increased 7.1% to $91.22.

Annual headline inflation was 2.7% in December, per today’s consumer price index data, which was in line with Dow Jones forecasts.

Annual core inflation beat estimates at 2.6%, while monthly core inflation was 0.3%. Traders project a 70% probability of interest rate cuts by the Federal Reserve’s June meeting, per CME FedWatch, but a 97% chance rates will stay steady this month.

Producer price index data for December and retail sales data for November will be released tomorrow.

“If core CPI rises 0.3% MoM or higher and retail sales roughly meet expectations, inflation stickiness concerns may resurface, delaying rate cut discussions, which would likely support the dollar and weigh on gold,” Pepperstone research strategist Dilin Wu wrote this week.

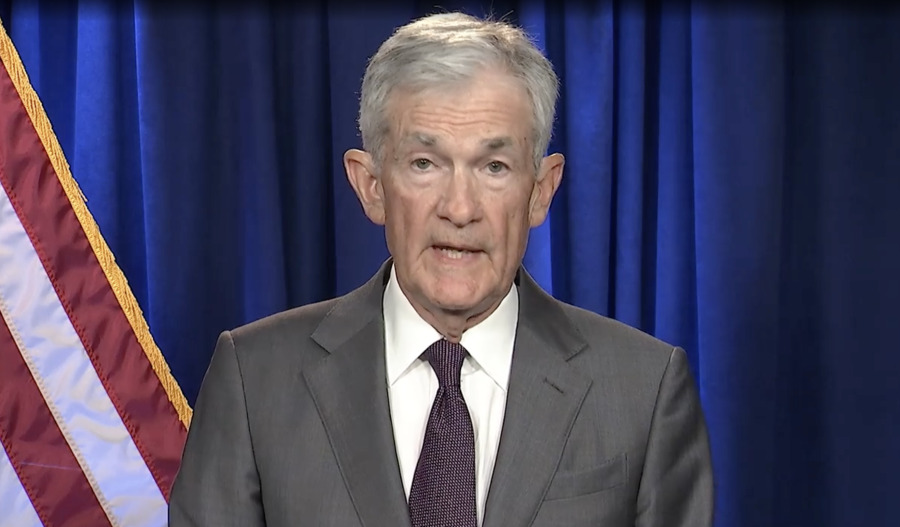

Meanwhile, central bank heads worldwide have voiced support for Fed chair Jerome Powell after the U.S. Department of Justice opened a criminal probe into Powell’s conduct.

U.S. President Donald Trump has repeatedly threatened to fire Powell for refusing to aggressively cut interest rates. The investigation concerns whether Powell lied to Congress during testimony about the renovation of the Fed’s headquarters last June.

“We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell,” wrote 14 central bank officials, including the President of the European Central Bank and the governors of the Bank of England, Bank of Canada, Reserve Bank of Australia, and Central Bank of Brazil.

“The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve. It is therefore critical to preserve that independence, with full respect for the rule of law and democratic accountability.”

Citi analysts have projected that gold prices will rise above $5,000 per ounce in 2026’s first quarter, but could drop significantly later in the year. Morningstar analysts predict gold prices will average $4,700 from 2026 to 2028.