Gold prices rose to new highs during Tuesday’s Asian trading, as threats to the Federal Reserve’s independence intensified and unrest in Iran continued investor transfer of wealth into bullion.

Spot gold was up 1.9% to US$4,596.15 per ounce by 3:10 pm (4:10 am GMT), having briefly crossed the $4,600 mark for the first time earlier in the day. Silver increased 7.2% to $85.62.

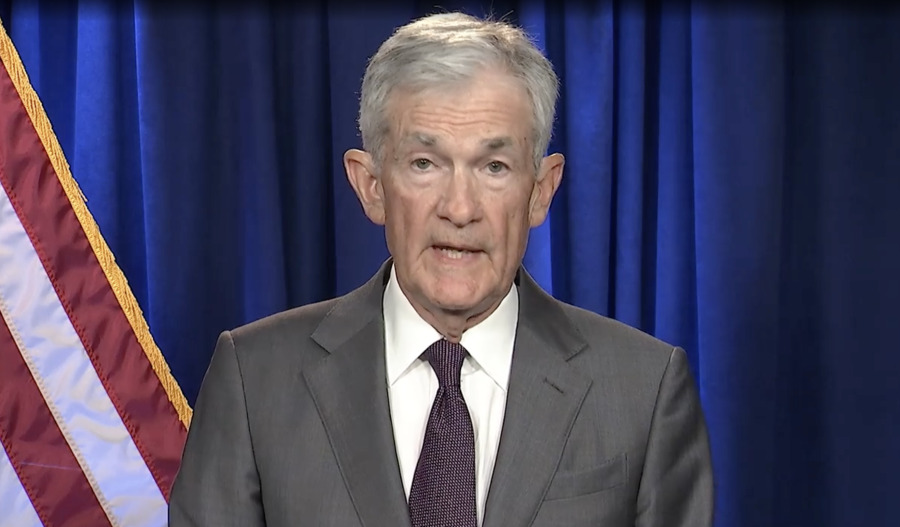

Gold also surged to fresh highs yesterday as the U.S. Department of Justice opened a criminal probe into Fed chair Jerome Powell. The probe is examining whether Powell lied to Congress during testimony about the renovation of the Fed’s office buildings last June.

U.S. President Donald Trump has repeatedly threatened to fire Powell for refusing to aggressively cut interest rates.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” Powell said.

Protests against Iran’s government have stretched into a third week, meanwhile. At least 646 people have been killed, including 505 protesters, per the Human Rights Activists News Agency nonprofit.

“Geopolitical tension remains the core driver of the current gold rally,” Pepperstone research strategist Dilin Wu wrote in a note.

“Uncertainty surrounding the Fed and U.S. institutional stability is also rising.

“These factors combined are gradually eroding confidence in the established order, which creates fertile ground for gold’s sustained gains.”

The Bloomberg Commodity Index and S&P GCSI are also continuing their annual rebalancing, leading to increased volatility in gold and silver prices.

The U.S. will report consumer price index data for December tomorrow and retail sales data for November on Wednesday (Thursday AEDT).

“If core CPI rises 0.3% MoM or higher and retail sales roughly meet expectations, inflation stickiness concerns may resurface, delaying rate cut discussions, which would likely support the dollar and weigh on gold,” wrote Wu.