The global mining industry is bracing for a fundamental restructuring as two of its largest players move towards a monumental consolidation based on sky high gold prices and a shared belief that copper will be the key commodity and driving force into the next decade of industrialisation.

The potential combination of Rio Tinto (ASX: RIO) (US$145 billion) and Glencore Plc (LON: GLN) ($55 billion) - a deal that would create a behemoth with an enterprise value of an eye-whopping $250 billion - stands to be the largest mining transaction ever seen.

It would also create the world's largest miner, pipping BHP's (ASX: BHP) current market capitalisation of $242 billion.

"The first potential deal of 2026, a merger between Rio Tinto and Glencore, would be the biggest mining deal ever," Morningstar analysts wrote in a note.

“This will likely have a domino effect on other large-scale miners, looking for opportunities to expand their mining portfolio in fear of being left behind.”

Decades in the making

On 8 January Rio Tinto confirmed it had entered preliminary discussions regarding a possible combination with Glencore.

This announcement comes more than a decade after Rio Tinto famously rejected a A$182 billion merger offer from the Swiss-headquartered miner, marking a dramatic reversal in corporate strategy for the company.

The history of merger and acquisition (M&A) attempts between Rio Tinto and Glencore - and the broader sector - has seen values escalate from multi-billion dollar asset "hijacks" to the quarter-trillion dollar "mega-miner" discussions.

In 2017 Glencore attempted to "hijack" a deal between Rio Tinto and Yancoal for Rio’s Coal & Allied (C&A) assets in Australia's Hunter Valley.

Glencore bid $2.55 billion - $2.05 billion in upfront cash and $500 million in deferred payments.

Rio subsequently rejected the higher Glencore bid in favor of Yancoal’s $2.45 billion offer, citing greater "transaction certainty" and faster regulatory approval times.

The Swiss miner and trader later secured a 49% stake in the Hunter Valley Operations for $1.14 billion through a joint venture with Yancoal after the deal closed.

Today's M&A parlay between the two is the largest, and most promising yet.

“The parties' current expectation is that any merger transaction would be effected through the acquisition of Glencore by Rio by way of a court-sanctioned scheme of arrangement,” Rio announced to the market.

For its part, Glencore confirmed the talks in its own official company announcement, noting that it "is in preliminary discussions with Rio about a possible combination of some or all of their businesses".

Under the UK’s Takeover Code, Rio has until 5:00pm GMT on 5 February to either announce a firm intention to make an offer or formally walk away.

Cycle convergence and high prices

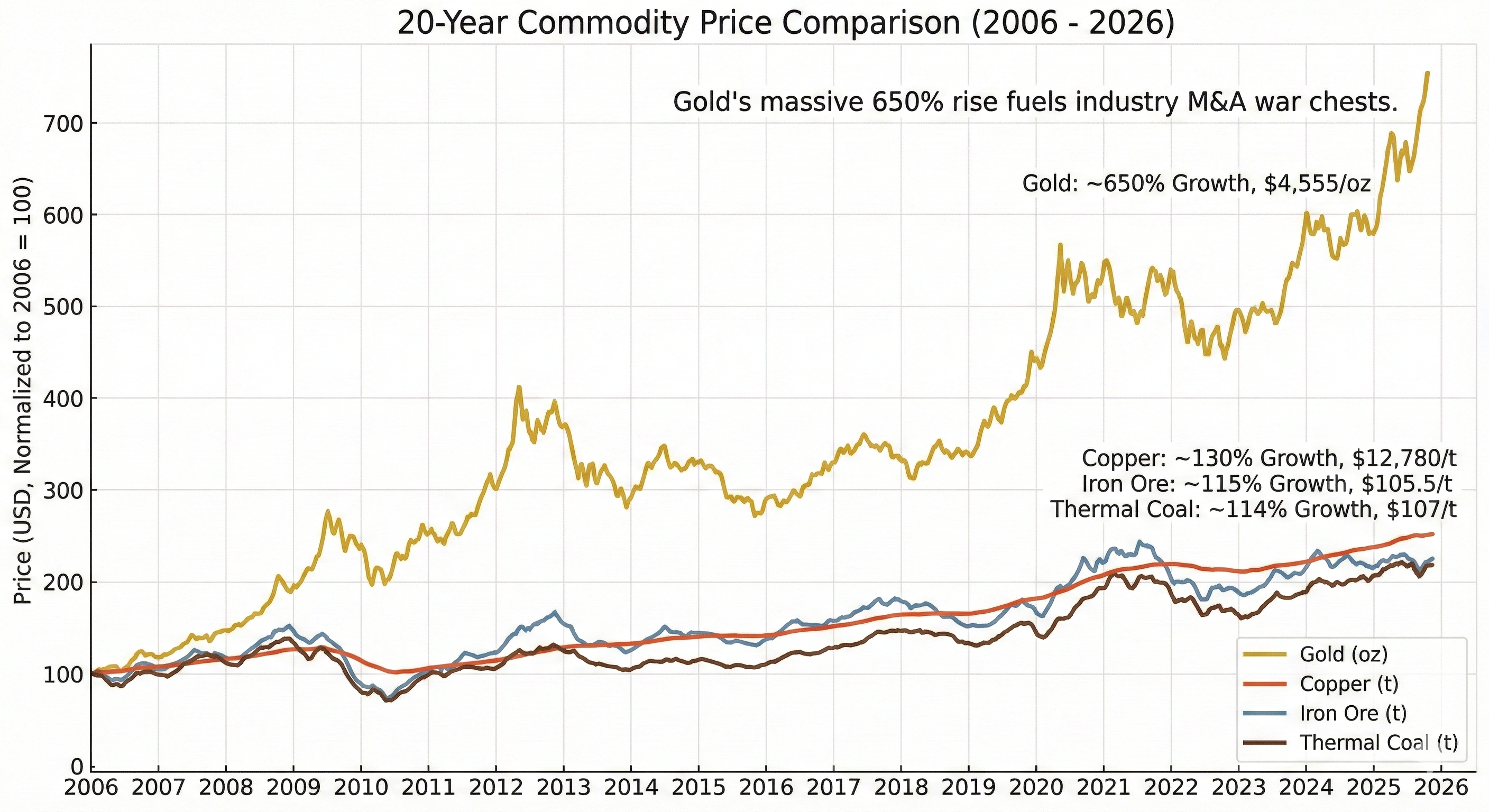

High commodity prices since 2020 have allowed mining companies to deleverage, resulting in robust credit metrics.

Following the 2008 crash, the industry entered a decade of "repair" where indices such as the S&P GSCI fell by more than 50% in less than a year.

The current bull market, which began in late 2020, differs from the 2008 peak because it is driven by a strategic shift in demand towards electrification metals like copper and lithium.

As of January 2026, precious metals have experienced a historic 40% rally, providing the enormous cash reserves required to fund the $250 billion Rio-Glencore merger.

While the World Bank projects a slight decline in general energy prices for 2026, the scarcity of "Tier 1" copper deposits continues to drive acquisition premiums to record levels.

The macroeconomic landscape for the mining sector is defined by several key price drivers that are bolstering the business case for mega-mergers.

- Gold bullion reaches record highs: Prices are reaching new peaks on a weekly basis, having surpassed the $4,500/oz level in early 2026 and reaching as high as $4,629/oz.

- Iron ore remains above the $100 mark: Prices remain robust, consistently holding above the $100/t mark and reaching nearly two-year highs of approximately $109/t to $117/t in early January.

- Low oil prices reduce operating costs: Subdued prices, with Brent crude forecast to average between $56 and $62 per barrel, are significantly lowering energy-related operating expenditure (opex) and leading to reduced overall opex for major mining operations.

- Copper demand drives market resurgence: The metal is experiencing a strong recovery with prices hitting record highs above $13,000/t in January 2026, driven by supply disruptions and voracious demand for electrification, artificial intelligence (AI) data centres, and power grid infrastructure.

Add to the fact that often when you find a workable copper deposit, you also find significant amounts of gold - a natural hedge against copper price volatility.

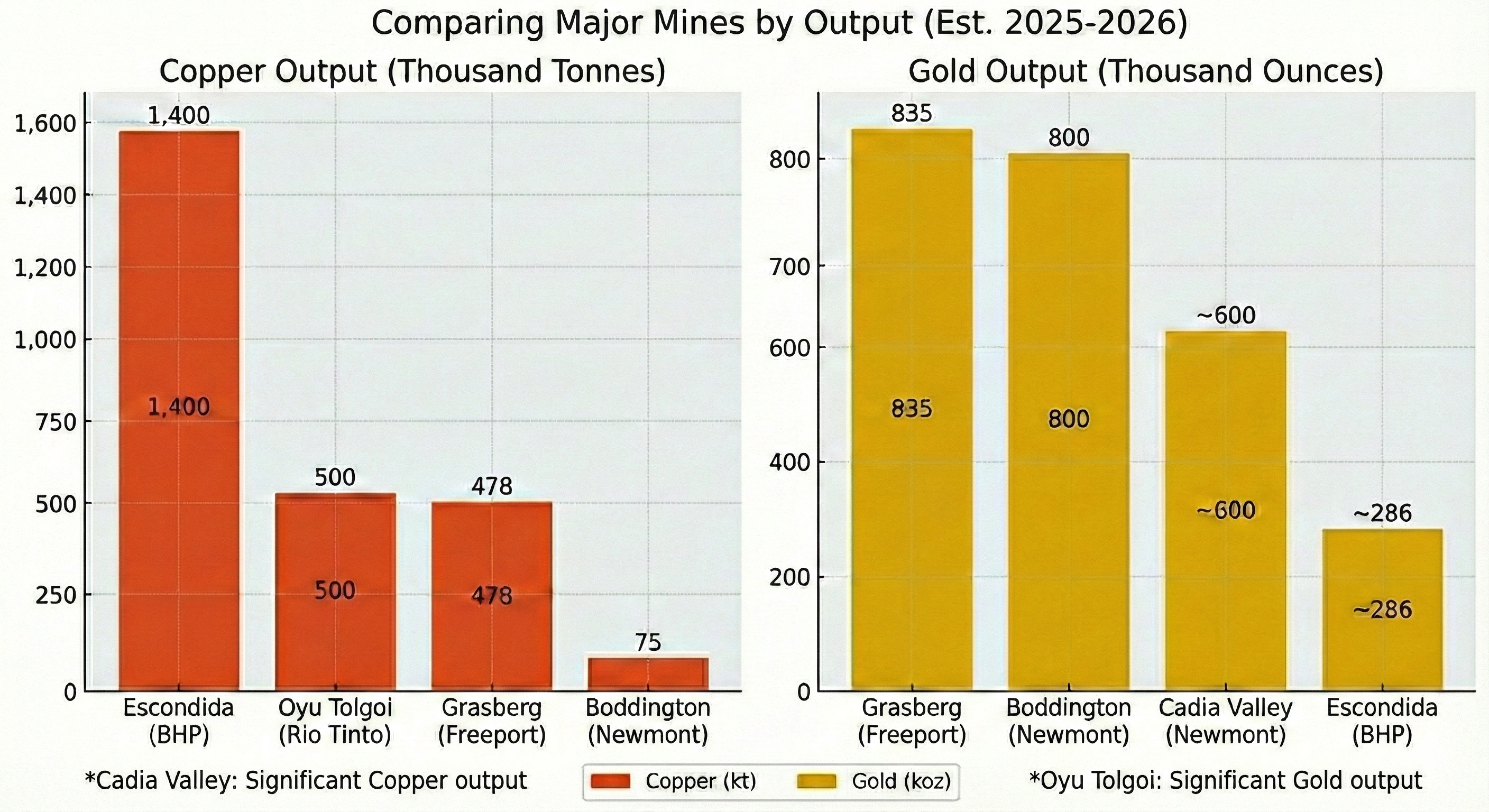

"Grasberg is a dual giant for both copper and gold," Morningstar said.

“It remains a cornerstone of the global supply chain, where the revenue from gold helps offset the high capital expenditure required for deep underground block-caving.”

In Australia, Newmont's Boddington mine serves as a model for this convergence, being the country's largest gold mine while simultaneously producing over 70,000tpa.

This trend is expected to continue as developers like Hudbay Minerals advance projects like Copper World in the USA, which are designed to produce "Made in America" copper for critical mineral supply chains.

It is no wonder Rio chair Dominic Barton signalled the miner was now more "open-minded when it comes to making acquisitions" after moving on from prior disastrous deals.

If successful, the merger will redefine the global mining hierarchy and likely spark a fresh wave of transformative industry deals.

LSEG (London Stock Exchange) data highlights that market activity is no longer just about volume but about securing the supply chains for the next century of global energy needs.

This 20-year view suggests that although the "Big Is Beautiful" strategy is at its zenith the industry must avoid the disastrous over-leverage that followed the 2008 peak.

M&A race for red metal

A central narrative driving this potential merger is the surging global demand for copper, which is essential for the energy transition and AI data centres.

Find out more: Mission Critical: Electrification blue skies for red metal

Glencore CEO Gary Nagle has argued the industry needs to consolidate "not just for the sake of size, but also to create material synergies, to create relevance, to attract talent, to attract capital".

The combined entity would hold significant copper assets alongside substantial reserves of cobalt and lithium, positioning it as a global leader in critical transition metals.

From a business risk assessment standpoint, a merger will significantly increase production levels and the number of operating assets for the combined mining entity.

The merger is viewed as the first major M&A for 2026 - and perhaps the biggest - putting immense pressure on other mining majors such as ‘the Big Aussie’ BHP.

"It is safe to say that the Rio Tinto and Glencore merger will provide added pressure for BHP to complete its own version of a mega merger," Morningstar analysts said.

BHP finds itself in a defensive position after four failed attempts to acquire Anglo American which culminated in a final offer of $53 billion, however, shareholders opted to merge with Teck Resources instead.

"Anglo Teck will be positioned to deliver long-term value through a world-class copper growth portfolio," Teck CEO Jonathan Price said in a recent official company statement.

"It will be a stronger platform to meet growing demand for minerals essential to the energy transition".

A merged Anglo/Teck is valued as a $53-60 billion “critical minerals powerhouse” but would still pale in comparison to Rio or BHP.

Other major firms such as Vale, Southern Copper and Freeport-McMoRan are viewed as a tier below the Australian majors, which may prompt further market consolidation.