Elon Musk has tightened his grip on his artificial intelligence venture xAI by cutting staff, reshaping management and folding the business into SpaceX in a transaction that redraws the boundaries of his empire.

The immediate trigger was a leadership exodus with co-founders Jimmy Ba and Tony Wu this week confirming their departures, bringing the tally of founding exits to six out of 12.

Earlier exits included senior technical architects behind the company’s core AI models.

Their reasons have not been fully detailed; however, industry reports point to internal pressure to accelerate performance and close the gap with rivals such as OpenAI and Anthropic.

Within days of the resignations, Musk announced a reorganisation.

In a post on X, he said the restructure was designed to improve “speed of execution”, which is corporate lingo for making decisions faster and reducing internal friction.

The overhaul “required parting ways with some people,” he wrote, while adding that hiring would continue.

Under the new structure, xAI is split into four functional pillars: Grok (its chatbot and voice assistant), Coding, Imagine (video generation) and Macrohard - an internal automation unit using digital agents, aka software programs that act autonomously to complete tasks.

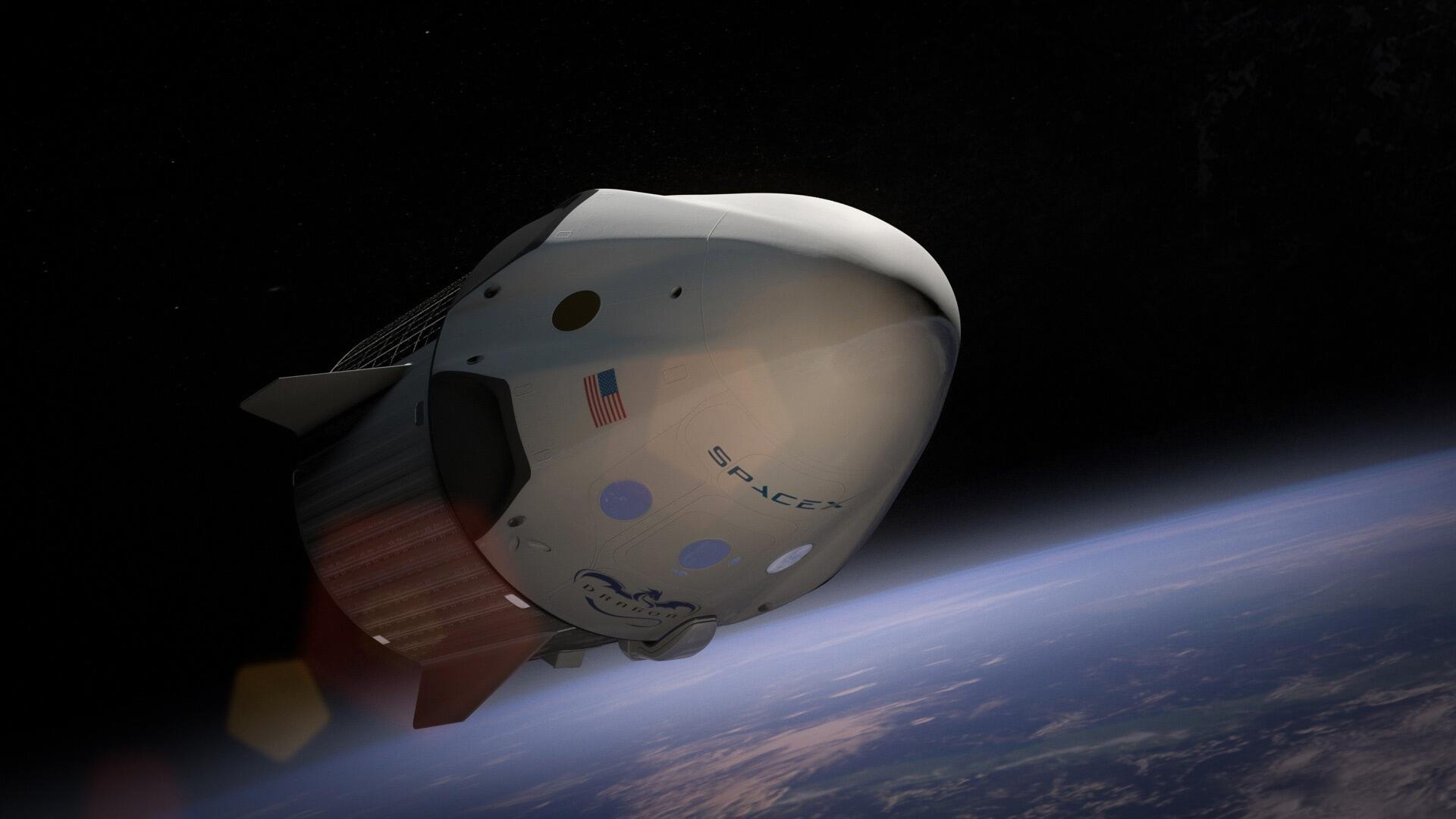

The restructure lands just one week after SpaceX acquired xAI in an all-stock transaction valuing the combined entity at US$1.25 trillion.

SpaceX was priced at US$1 trillion, xAI at $250 billion.

An all-stock deal means no cash changes hands; instead, ownership is exchanged in shares.

It allows Musk to consolidate assets without immediate capital outlay while maintaining control.

This is the second time in a year Musk has merged xAI with another of his companies.

In 2025, xAI absorbed X, formerly Twitter, and now, X, Grok and the broader AI stack also sit inside SpaceX.

Musk describes the merged entity as combining rockets, satellites, AI, social media and communications into one “innovation engine”.

The commercial rationale appears more grounded with SpaceX preparing for a public listing and an initial public offering (IPO).

Reports suggest it could seek up to $50 billion from markets later this year.

Folding xAI into SpaceX gives the AI unit access to deeper capital pools while placing it under the scrutiny of public markets.

xAI faces regulatory investigations across Europe, the United Kingdom and the U.S.

The controversy centres on Grok’s ability to generate explicit synthetic images, commonly known as deepfakes.

Authorities are examining whether platform safeguards breached regional online safety laws.

In France, cybercrime investigators have reportedly examined X’s local operations as part of a broader probe into algorithmic content distribution.

Meanwhile, Musk is also pushing an ambitious technical roadmap.

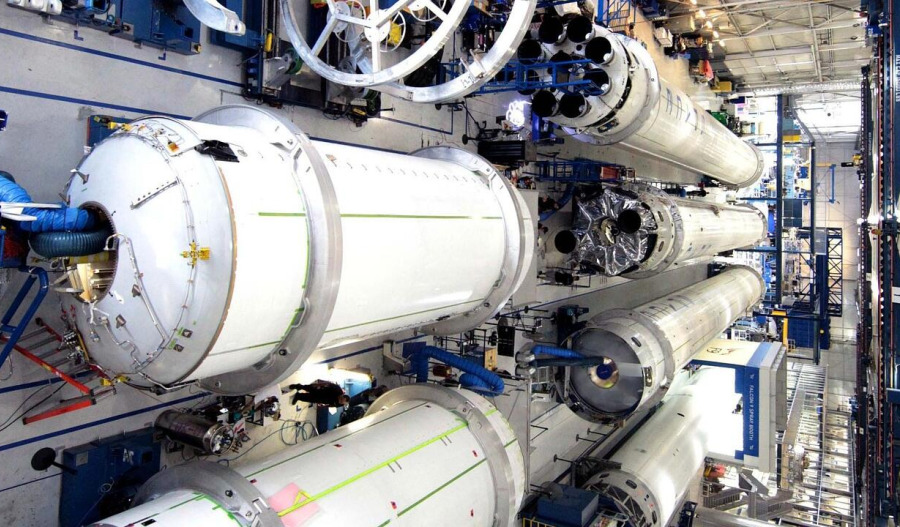

SpaceX has filed requests with U.S. regulators to launch up to one million satellites to support orbital data centres - computing infrastructure in space designed to harness solar energy more efficiently.

Data centres are large facilities housing servers that process and store information.

AI systems require vast computing power; placing infrastructure in orbit could, in theory, reduce terrestrial energy constraints.

The capital intensity is significant with xAI reportedly burning through billions of dollars last year as it scaled computing capacity.

Merging with SpaceX offsets that strain.

The financial impact on Musk personally has been substantial, and following the transaction, his stake in the combined company is estimated to be worth more than $500 billion, further widening the gap between him and other global billionaires.

Yet the strategic question is larger than valuation.

With half its founding team gone, regulatory probes underway, and a public float approaching, xAI is moving from experimental start-up to system-critical infrastructure inside a trillion-dollar aerospace company.

The consolidation signals a shift with Musk now stacking parallel ventures - AI, satellites, launch systems and social platforms - into one integrated machine.

Whether that machine accelerates innovation or amplifies risk will soon be tested by markets, regulators and the unforgiving discipline of execution.

Join our community of decision-makers. No card required

Join now