While SpaceX has not officially announced a definitive date for it’s much talked about initial public offering (IPO), multiple media reports - which founder and owner Elon Musk incidentally confirmed 2 February - point to a public listing somewhere between mid to late 2026.

A merger had been rumoured since SpaceX invested US$2 billion (A$2.86 billion) in xAI in the northern summer.

While there’s some talk that Musk may schedule the public launch to coincide with his 55th birthday on 26 June, others are speculating that the world’s richest person will synchronise the event along with the rare planetary alignment between Jupiter and Venus on 8-9 June 2026.

Wouldn’t that be a Musk thing to do?

While the actual timing will clearly keep the market guessing, the magnitude of this IPO, whenever it occurs, will have universal appeal.

Like the IPO date, the final pricing also remains unconfirmed.

However, SpaceX recently set a secondary share sale price at around $420 a share.

This suggests a private valuation - up from an estimated valuation of around $46 billion in 2020 - north of $800 billion – cementing its perch as the world’s largest private company.

Valuation could exceed $1.5 trillion

Given that the IPO could raise as much as $50 billion - making it the largest float of all time, exceeding the $29 billion raised by Saudi Aramco in 2019 - the market expects a potential valuation on SpaceX of around $1.5 trillion.

Based on these sorts of numbers, it’s possible to work out some back-of-the-envelope calculations.

For instance, if the entity offered 1 billion shares, it would put the share price at US$1,500; ipso facto doubling the shares on issue would half the share price to $750 and so on.

However, assuming SpaceX issues considerably more new shares - to pay for the transaction - it could clearly dilute the holdings of existing owners.

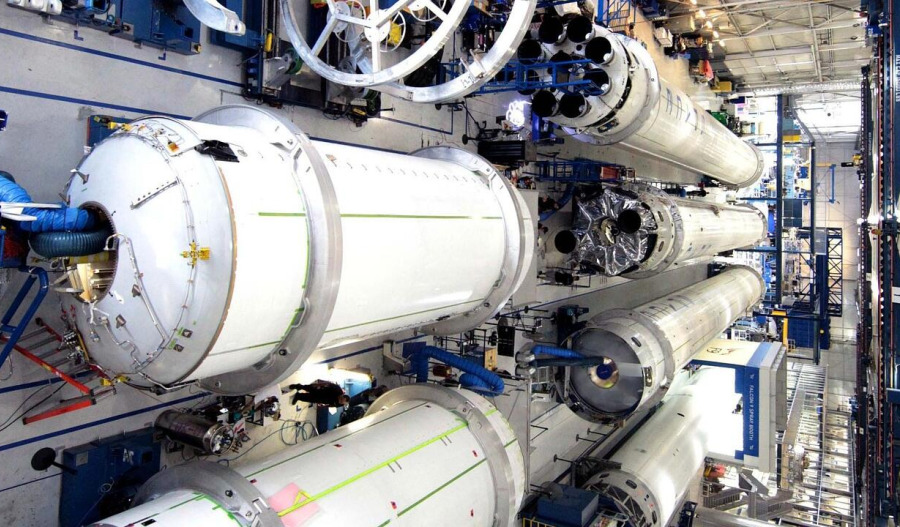

For those of you who haven’t been playing along at home, SpaceX plans to bring three highly complementary platforms - reusable rockets, the Starlink network of satellites, together with the data from X and models from xAI - under one umbrella.

A merger of these three entities initially surfaced when SpaceX invested US$2 billion in xAI in the northern summer.

What followed were revelations by SpaceX financial chief, Bret Johnsen, that the company would buy xAI for $250 billion, matching the price of a recent $20 billion funding round that valued the two-year-old start-up at $230 billion.

Shares of xAI will be converted into SpaceX stock at an exchange rate of roughly seven to one, with stock in the combined entity priced at $527.

Meanwhile, due to its monopoly on commercial rocket launches and a surge in subscriptions to Starlink, SpaceX annual revenue is understood to have grown to $16 billion.

By comparison, last year xAI’s revenue was in the low hundreds of millions of dollars.

The group recently flagged the potential capex of more than US$10 billion in 2025 to buy chips and construct the vast data centres needed to train and run advanced AI systems.

How to pre-empt access SpaceX IPO

Local investors looking to pre-empt their exposure to SpaceX – pre-IPO – could gain access via Pengana’s ASX-listed Private Equity Trust (ASX: PE1), with SpaceX accounting for 7.7% of its portfolio.

While PE1 is still valuing SpaceX at US$400 billion, that number is expected to explode after Pengana updates its valuations over the next few months, which will result in outsized returns.

Then again, if you’re an accredited investor - aka sophisticated/wholesale investor - you can buy shares directly from employees or early investors on secondary platforms like:

- Hiive: Currently a popular platform with multiple listings for SpaceX shares.

- Forge Global & EquityZen: These platforms connect buyers with sellers of private shares.

However, if you are contemplating this opportunity, you should remember that shares are highly illiquid, and the company often has a right of first refusal (ROFR).

Secondary platforms

Several funds hold significant stakes in SpaceX, allowing retail investors to gain indirect exposure without needing accredited status. These include:

- The ARK Venture Fund (ARKVX): Managed by Cathie Wood, this fund has a high allocation to SpaceX and is accessible to retail investors.

- Destiny Tech100 (DXYZ): A closed-end fund that trades on the NYSE, with a significant portion of its portfolio in SpaceX.

- The Private Shares Fund (PRIVX/PRLVX): An interval fund that holds a substantial portion of its portfolio in SpaceX.

- Baron Partners Fund (BPTRX) & Baron Focused Growth Fund (BFGFX): These funds have substantial allocations to SpaceX.

- ERShares Private-Public Crossover ETF (XOVR): An ETF that holds a mix of public companies and special purpose vehicles (SPVs) that own private shares, including SpaceX.

Public companies

Meantime, while the exposure is small relative to their total business, you can also invest in public companies that have previously invested in SpaceX, these include:

- Alphabet Inc. (GOOGL): Google's parent company holds a significant, long-term stake in SpaceX.

- Bank of America (BAC): Invested in a 2018 funding round.

- EchoStar (SATS): Positioned as a major beneficiary due to a 2025 deal to sell spectrum to SpaceX, which was partly funded with SpaceX equity.

Suppliers

Another approach is to invest in companies that are suppliers or competitors, which may rise on the back of SpaceX's growth. These include:

- Rocket Lab (RKLB): A direct competitor in the launch market.

- HEICO Corporation (HEI): Supplies critical aerospace components used by SpaceX.

- Redwire Corporation (RDW): Supplies space infrastructure components.