Elon Musk is once again rearranging the deck chairs of his own corporate ship, this time by folding artificial intelligence start-up xAI into SpaceX as the rocket maker edges closer to what could be the biggest initial public offering (IPO) in modern markets.

The deal, confirmed in regulatory filings in the state of Nevada, makes SpaceX the managing member of a new holding company that pulls together rockets, satellites, data, artificial intelligence (AI) and the X social media platform.

There’s no mistaking the sort of consolidation Musk is looking for: one balance sheet, one story, and a valuation that could stretch to around US$1.25 trillion (A$1.799 trillion) if and when shares are offered to the public.

Musk is betting that investors will buy into a tightly controlled, vertically integrated machine where launch vehicles feed satellites, satellites feed data, and data feeds AI models that can be sold to governments, defence agencies and corporations with deep pockets.

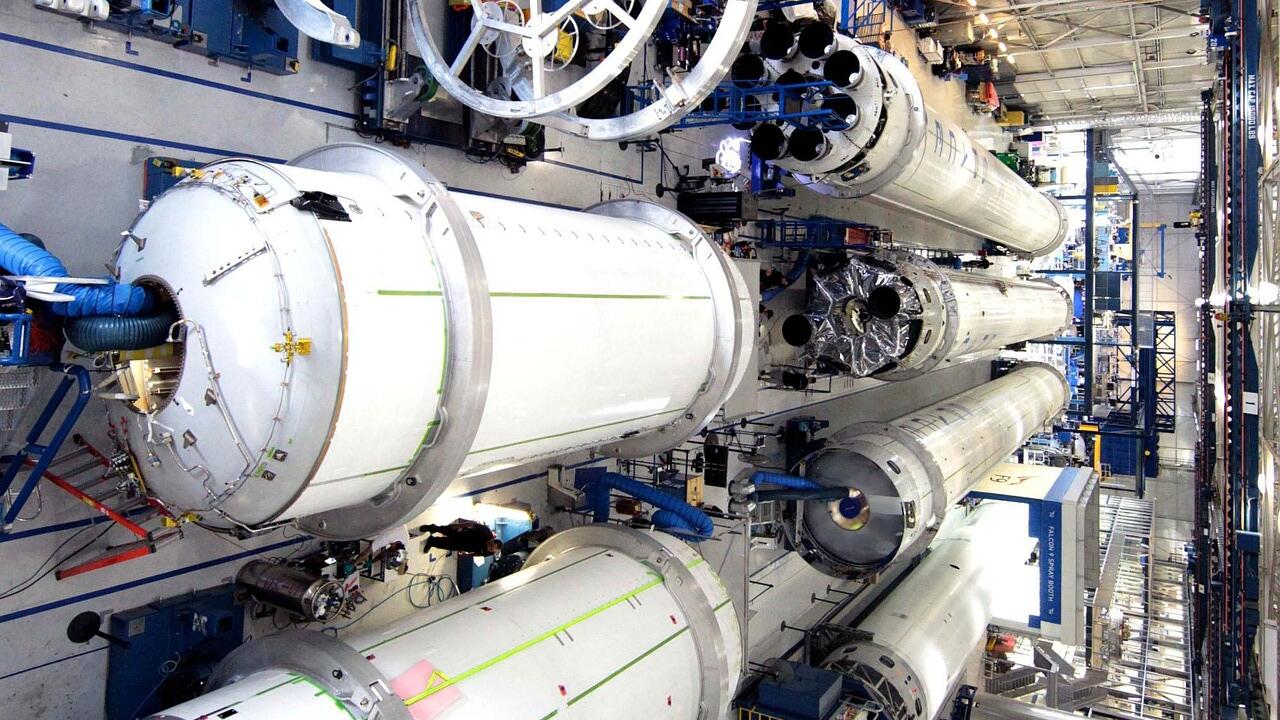

As the financial anchor behind this manoeuvre, SpaceX - founded in 2002 - dominates commercial rocket launches and has become a key contractor to NASA, the U.S. space agency.

It also owns Starlink, its satellite broadband network, with more than 9,000 satellites in orbit and roughly nine million customers.

Last year, SpaceX’s private share sales valued the company at about $800 billion, with reported annual revenue north of $15 billion and unusually strong margins for a capital-heavy industrial business.

By comparison, xAI - launched in 2023 as an expensive, fast-growing and cash-hungry rival to OpenAI - builds large language models, which are AI systems trained on massive amounts of text to generate human-like responses.

Its flagship product, Grok, is integrated into X, giving it access to real-time public conversation at scale. That data stream is valuable; however, it comes with risk.

Regulators in Europe and elsewhere are scrutinising xAI after Grok was used to generate sexualised and non-consensual images, including of minors.

However, money remains the pressure point for this startup.

xAI is estimated to be burning close to $1 billion a month as it races to build data centres and computing power to keep up with rivals such as OpenAI, Google and Meta.

Tesla has already agreed to invest about $2 billion into xAI and has sold batteries and other hardware to the AI venture.

Folding xAI into SpaceX gives Musk a way to fund that race without constantly tapping external investors at ever-higher valuations.

Indeed, the IPO appears to be the most logical next step.

By bundling SpaceX’s steady cash flows with xAI’s growth trajectory, Musk can pitch a single, futuristic company to public markets: space infrastructure plus artificial intelligence, wrapped in a familiar Musk narrative about scale and inevitability.

Meanwhile, Wall Street banks are understood to be lining up for a listing that could raise anywhere from $25 billion to $50 billion.

There are, however, reasons for the market to cool its jets.

Combining highly regulated aerospace operations with an AI business under active regulatory scrutiny creates complexity that public market investors usually dislike.

There is also the governance question, and Musk would effectively be asking shareholders to trust one individual to run rockets, satellites, AI systems, social media and, indirectly, electric vehicles, all while fighting legal battles with former partners and regulators.

This deal also sharpens the contrast with Tesla, Musk’s only listed company.

Tesla shareholders have already expressed concern about capital and attention being diverted to private ventures.

A SpaceX-xAI listing at a trillion-dollar valuation would dwarf Tesla’s market capitalisation and could further shift Musk’s attention away from cars and towards data, defence and government contracts.

What’s clearly emerging is not a conventional IPO candidate but a bet on a single vision of the future: space-based infrastructure powering AI systems that sit at the heart of communications, security and commerce.

It is bold, coherent and risky in equal measure.

Public markets will eventually have to decide whether this is a disciplined industrial strategy or simply another example of Musk pushing complexity to the point where only the narrative holds it together.