Elon Musk’s SpaceX is reportedly gearing up for a colossal public listing in 2026, and the numbers being floated are so huge they make even the AI boom look modest. But behind the staggering valuations and sky-high expectations lies a simple question: how much of this story is real growth — and how much is simply rocket-fuelled optimism?

SpaceX is preparing for what could be one of the biggest IPOs of all time, with plans to raise more than US$25 billion (A$37.63 billion) and potentially push its valuation north of $1 trillion, according to a source speaking to Reuters.

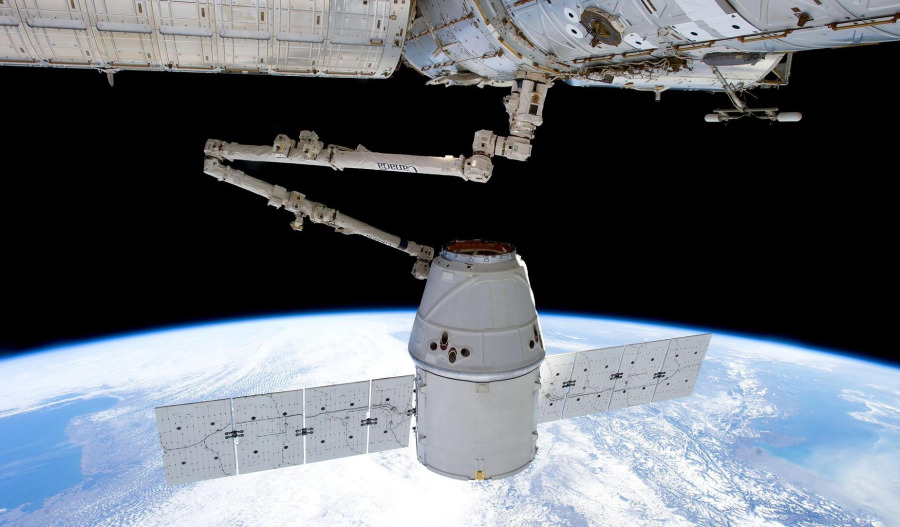

The momentum behind this move comes largely from the explosive growth of Starlink, the company’s global satellite-internet network, and steady progress on its deep-space ambitions through the Starship program.

Discussions with major banks are reportedly underway, with a target launch window of June or July 2026.

Neither Musk nor the company has commented publicly on the plans.

The timing aligns with a broader revival in the IPO market, which rebounded in 2025 after years of sluggish activity.

Wall Street expects even more activity heading into 2026 as high-profile private giants finally consider going public.

Industry analysts view SpaceX’s IPO as exactly the kind of listing investors have been waiting for.

Samuel Kerr of Mergermarket noted that the company sits at the intersection of defence, satellite technology and digital infrastructure — areas experiencing rapid expansion.

A public debut from such a dominant player could even nudge other large startups, long comfortable in private markets, to pursue their own listings.

SpaceX currently ranks as the second-most valuable private company in the world, behind OpenAI.

With reports circulating about both OpenAI and Anthropic weighing IPOs of their own, next year could reshape the tech market landscape.

The buzz around SpaceX’s listing intensified recently after reports suggested a secondary share sale valuing the company at around US$800 billion — a figure Musk quickly dismissed as inaccurate.

Newer reporting points to an even more ambitious target: a valuation of US$1.5 trillion, which would put SpaceX among the most valuable companies on the S&P 500 from day one.

For context, only Saudi Aramco has ever debuted publicly above the $1 trillion mark.

If SpaceX does go public at this level, Musk’s personal wealth would skyrocket.

Bloomberg estimates that his stake in the company could exceed $625 billion, more than quadrupling its current value, and that’s before counting his holdings in Tesla and other ventures.

But to justify these extraordinary numbers, SpaceX will need extraordinary growth.

Starlink brings in most of the company’s revenue, projected to climb from about $15 billion this year to $23 billion next year.

Even with that increase, a $1.5 trillion valuation represents a multiple of roughly 65 times sales, which are the kind of numbers typically reserved for hyper-speculative tech plays.

That’s where the next big idea enters: Space-based data centres.

Big Tech giants like Alphabet are already experimenting with orbital computing, and Musk envisions a future where Starlink satellites are equipped with AI chips and linked via laser to form data centres in space.

Supporters argue that space offers natural cooling, limitless solar power and superior global connectivity.

Musk claims Starship could deliver enormous computing capacity into high orbit within just a few years, but that’s contingent on the spacecraft moving from prototype to full commercial use.

Of course, the challenges remain enormous: deploying and maintaining hardware in space, managing debris, ensuring durability and pushing Starship into reliable operation.

However, none of these hurdles appear to dampen Musk’s animal spirits.

For investors, however, the question is whether SpaceX’s bold vision matches reality.

While running one trillion-dollar public company would be hard enough, critics ponder whether Musk can effectively lead two — Tesla and SpaceX — at the same time.

Meanwhile, market analysts say the stock could become one of the most polarising in years.

The broader takeaway? SpaceX’s IPO would be a perfect reflection of this moment in tech: part genuine innovation, part AI-era exuberance, and fully loaded with ambition.

Whether it becomes the next great success story or a cautionary tale about hype remains to be seen.

Join our community of decision-makers. No card required

Join now