An increase in share price volatility was the stand-out feature of the Australian profit-reporting season, which had been the weakest for many years, according to stockbroking strategists.

Morningstar equity strategist Lochlan Halloway said results had been progressing reasonably well up to 27 August, when the research firm had seen announcements from 151 of the Australian Securities Exchange-listed (ASX) companies it researched.

Morningstar had raised fair valuations for 44% of these companies, slightly higher than in recent reporting seasons, and cut valuations for 14% of them, which was a meaningful increase but not inconsistent with recent reporting seasons.

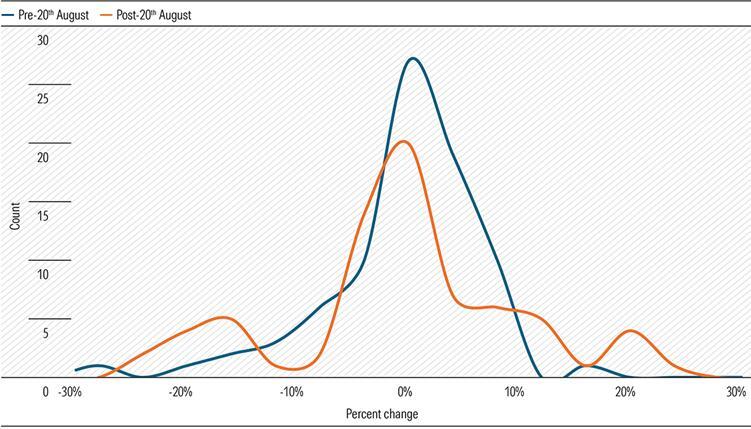

“Perhaps most remarkable is the big uptick in share price volatility,” Halloway wrote in a note.

The standard deviation of price changes on results days had spiked from about 7% a week earlier, which at that time was well below the level seen during the February 2025 and August 2024 reporting seasons, to more than 10%.

Although the results were disappointing, “the noise” was amplified by passive money and algorithmic traders, which was emblematic of market behaviour with earnings ‘beats’ and ‘misses’ generally met with a similar move in the share price.

Volatility was not limited to small companies, whose prices often swung wildly on results day, with ‘blue chips’ also behaving in this way.

Halloway noted the falls in James Hardie (ASX: JHX), which dropped almost 30%, CSL (ASX: CSL), down 17%, and Woolworths (ASX: WOW), declining 15%, which was its heaviest selloff since 1994.

Morningstar did not necessarily agree with the market verdicts and noted some investors had taken the opportunity to buy shares in these companies.

“The animal spirits of the market are fickle, and when the winds change, it can be brutal. That’s one lesson we can take from this reporting season,” Halloway wrote.

Exhibit 1: Distribution of results day price changes (Morningstar coverage)

Goldman Sachs agreed, writing when about half of the ASX's companies had reported, that share price moves on results days had set new records with 43% of stocks moving +/-5%, which was about twice the long-run average.

Co-head of Australian Research, Head of Portfolio Strategy & Quant Research Matthew Ross and Associate Tony Wu said companies that missed forecasts (-1.7% on the day) were being finalised more than those that beat expectations were being rewarded (+1.2%).

They said “misses” were continuing to trade noticeably lower after results and large negative moves were more concentrated in large stocks.