With international investors actively seeking alternative markets to the United States, it’s hardly surprising that large-cap international equities – which often serve as an investor's core holding for non-U.S. exposure – were the top performing asset class for managed funds in FY 2024-25.

Given that International equities have underperformed U.S. equities over the better part of the last 15 years, last year’s outperformance marks a watershed moment for this asset class, especially value-oriented sectors.

While the MSCI All Country World Index (ACWI) ex-USA index has returned around 22.29% year to date, the S&P 500 Index is up around 9.22%.

While the sustained outperformance of U.S. mega-cap technology (tech) stocks has helped to drive the U.S. exceptionalism narrative for several years now, the technology sector makes up only 8% of the MSCI EAFE Index (Europe, Australasia, and Far East).

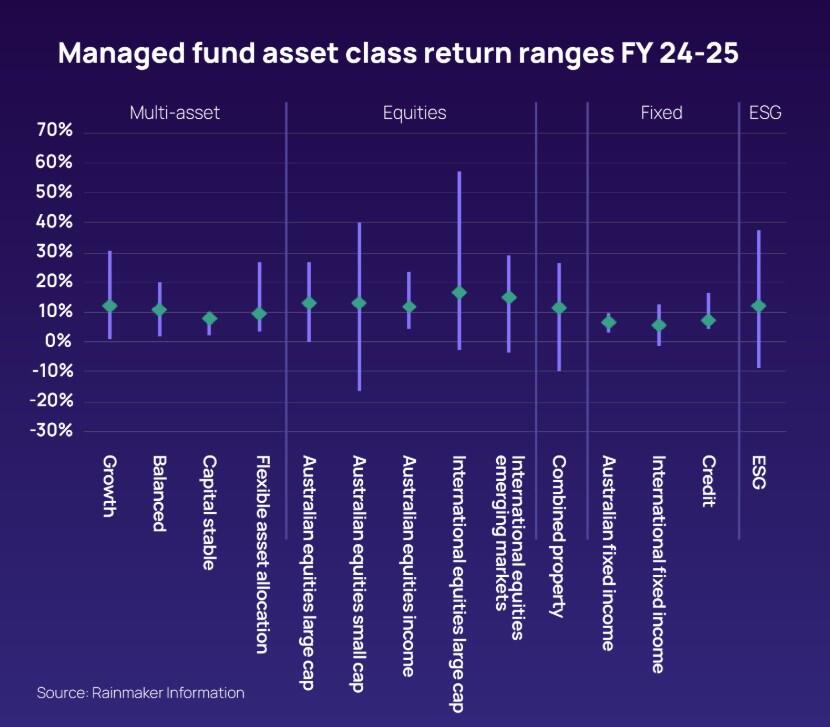

According to Rainmaker Information, international equities large cap delivered 16.6% median return for the financial year, followed by emerging markets (15.2%), Australian large cap (13.3%), Australian small cap (13.1%) and Australian income focused (12.2%).

“International equities performance over the past financial year have been very strong, outpacing even the S&P 500 for the same period,” said David Gallagher, executive director of research at Rainmaker Information.

“Many factors have contributed to this outcome including economic and policy factors, fiscal stimulus in Europe, improved investor sentiment, investors pivoting toward diversification amid U.S. headwinds, as well as attractive valuations relative to the U.S."

While a record 91% of institutional investors say U.S. equities are overvalued, there's a prevailing view that generally attractive valuations and a fiscal shift signal a turning point for the European region.

Meanwhile, medians for multi-asset diversified products in different sectors were higher than in May, with 12.1% for growth, 10.8% for balanced, and 8.0% for capital stable.

While credit products recorded a median return of 7.4% over the 12-month period, the ESG sector (diversified and sector-specific products) recorded a median return of 12.1%.

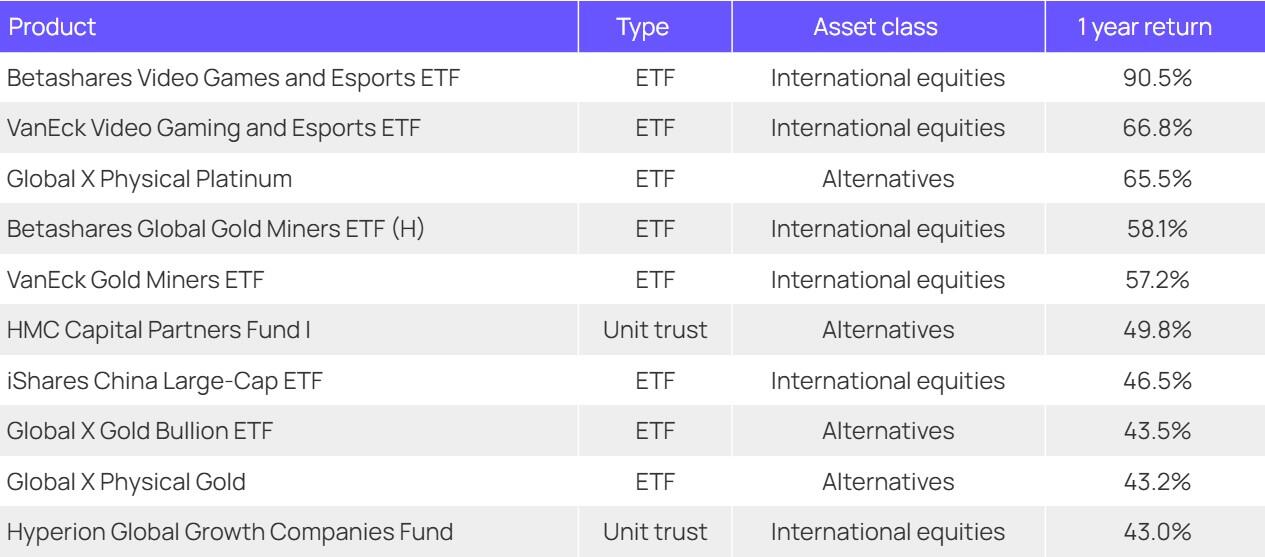

Overall, the top five performing products over the 12-month period were Betashares Video Games and Esports ETF with 90.5% followed by VanEck Video gaming and Esports ETF with 66.8%, Global X Physical Platinum with 65.5%, Betashares Global Gold Miners ETF (H) with 58.2% and VanEck Gold Miners ETF with 57.2%.

“The top 10 positions are still dominated entirely by international equities and alternatives, which hold six and four spots, respectively,” said Gallagher.

“ETFs were also dominant across the best of the performing funds, representing eight of the top 10, and 19 of the top 30”.