Shareholders may not appreciate it from the savage reaction to some results, but investors have been relatively kind to Australian-listed companies during the profit reporting season.

That is the view of investment research firm Morningstar, which has found that, with the reporting season in full swing, share price reactions on results days up to Wednesday 20 August have been a little more subdued than usual.

This conclusion is based on research showing the standard deviation of returns from the 81 companies listed on the Australian Securities Exchange (ASX) it covered was just below 7% compared with 8% in both February 2025 and August 2024.

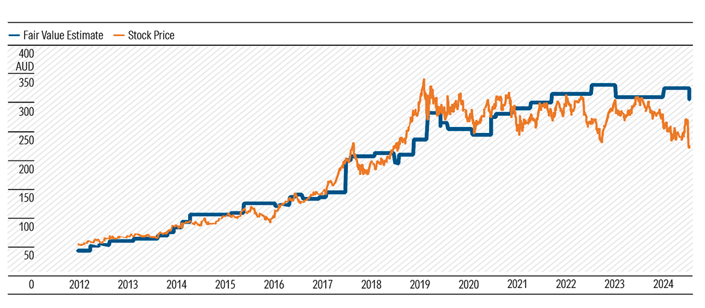

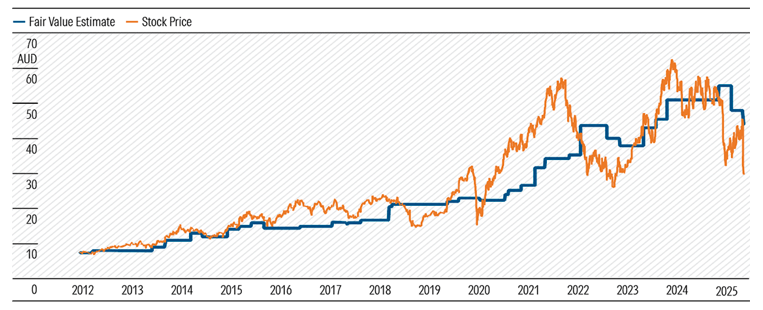

It comes in the wake of some companies being savaged on the ASX this week, particularly James Hardie (ASX: JHX), which dropped almost 30%, and CSL (ASX: CSL), which fell 17%, after they posted full-year results.

“A handful of names were hammered this week, opening a window of opportunity we’ve rarely seen for these businesses,” Morningstar Market Strategist Lochlan Halloway wrote.

The firm had upgraded fair value estimates for about 40% of stocks, slightly more than in recent cycles, with downgrades below 10%.

“All up, a solid start, though there’s plenty to go,” said Halloway, who described the market as “content”.

He noted that among the handful of names that were “hammered” this week were CSL and James Hardie, two blue chips that Morningstar was positive about.

“Both updates were disappointing, but the savage reaction from the market looks overdone. And the selloff has opened a window of opportunity we’ve rarely seen for either business,” he said.

“At some point, just about every stock falls out of favour with the market. Today, it’s CSL and James Hardie. But these established businesses have strong track records, and recent missteps are more than priced in.”

James Hardie had only briefly traded at such a steep discount to its valuation in the period since Morningstar rated the stock in 2012, and CSL had never looked this undervalued.

A 1.8% return for the ASX 200 was in the top half of performances for this point in the August reporting season over the past two decades.