CSL has announced a major restructuring including a spin-off of its influenza vaccine business and a workforce reduction after posting a 17% increase in net profit after tax (NPAT) for the 2025 financial year (FY25).

The global biotechnology company said the 'transformation initiatives’ included:

- demerging CSL Seqirus as a substantial ASX-listed entity before the end of FY26

- combining the medical and commercial functions of CSL Behring and CSL Vifor

- consolidating its research and development (R&D) footprint and integrating its R&D, business development and commercial teams, and

- reducing its headcount by up to 15% of its 32,000 person workforce

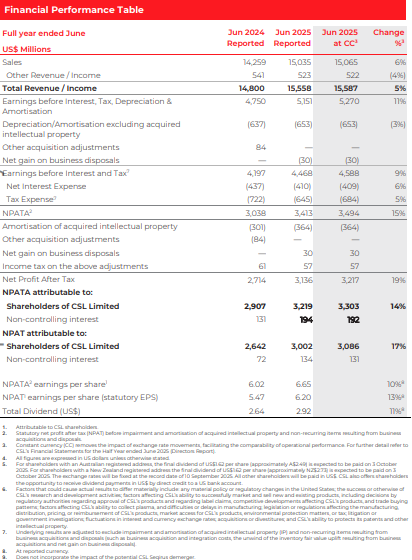

CSL said NPAT climbed 17% to US$3.0 billion (A$4.6 billion) and underlying profit (NPATA) rose 14% to US$3.3 billion in the 12 months ended 30 June 2025 on revenue which grew 5% to $15.6 billion.

A final unfranked dividend of US$1.62 per share, up 12% on the previous corresponding half, will be paid on 3 October to shareholders registered on 10 September, bringing the full year payment to $2.92, up 11%.

The company also said underlying profit, excluding the non-recurring restructuring cost, was expected to rise by 7-10% to $3.45 billion to $3.55 billion in FY26.

CSL also announced it would begin a multi-year and on-market share buyback, starting with A$750 million in FY26 and increasing progressively over the medium term.

Chief Executive Officer and Managing Director Paul McKenzie said the on-target result was led by biotherapeutics business CSL Behring and continued strong demand for its life-saving plasma therapies.

He said ‘flu vaccine division CSL Seqirus grew in a challenging environment, while pharmaceuticals unit CSL Vifor grew strongly.

However, the operating environment had changed significantly in recent years with a dynamic geopolitical backdrop, competitive pressure and organisational complexity challenging the company and hindering its ability to deliver superior returns.

“It is from this position of strength that we are taking the opportunity to make significant changes that will continue to drive shareholder returns over the long run,” McKenzie said in an ASX announcement.

The initiatives would result in $560-$620 million of one-off post-tax restructuring costs in FY26 and were expected to drive annualised cost savings of $500-550 million progressively over the next three years, with most achieved by the end of FY27.

They would reshape and simplify the business, provide a platform to focus on core strengths and create even value through sustainable and profitable growth, CSL said.

CSL (ASX: CSL) shares closed up 95 cents (0.35%) at $271.32 on Monday, capitalising the company at $131.38 billion.

Founded in 1916 as the Commonwealth Serum Laboratories, it was privatised in 1994.