Global biotechnology giant CSL has announced a 6% increase in half-year net profit to US$2.1 billion and forecast double-digit earnings growth in the medium term.

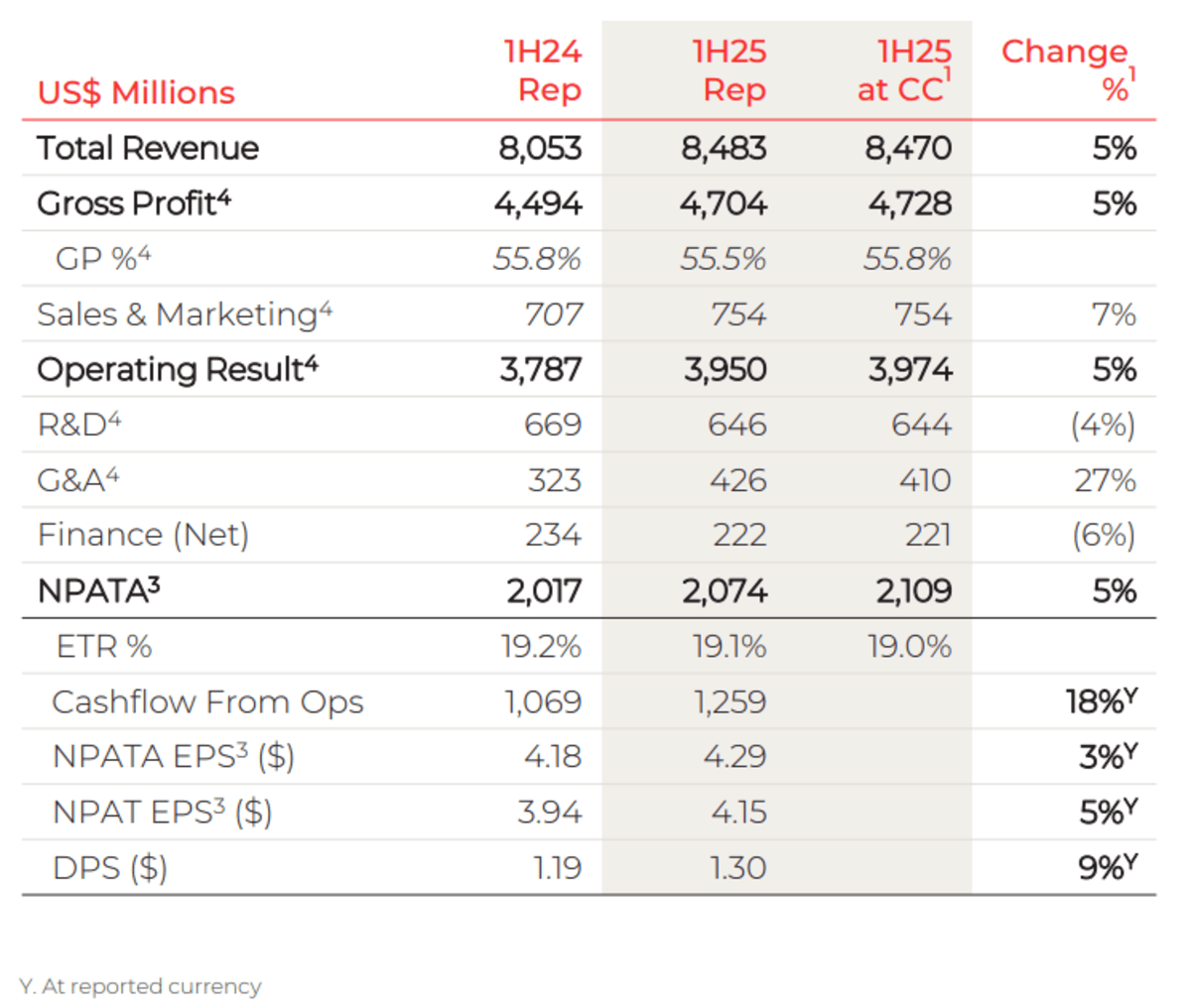

CSL, the former Commonwealth Serum Laboratories, said earnings per share rose 3% to $4.292 in the six months to 31 December and it declared an interim dividend of $1.30 per share (A$2.08), up 16% on the previous corresponding period (PCP).

It said net profit after adding back the tax-effected amortisation of acquired intangible assets (NPATA) rose 3% to $2.07 billion on revenue which advanced 5% to $8.48 billion, both in constant currency terms.

The Australian company also reaffirmed guidance that NPATA was expected to be between $3.2 billion and $3.3 billion in the 2025 financial year, up about 10-13% on the pcp.

Chief Executive Officer and Managing Director. Paul McKenzie said the solid result was led by CSL Behring, the division that produces medicines for rare and serious diseases.

He said strong demand for many of its market-leading therapies translated into sales growth, particularly in the core Ig (immunoglobulins) franchise, and it continued to advance key initiatives to improve gross margin, which tracked according to plans.

Influenza vaccine producer CSL Seqirus was negatively affected by significantly low immunisation rates, particularly in the United States, while iron deficiency and anaemia therapies producer CSL Vifor grew sales, underpinned by robust iron volumes in Europe and the expansion of nephrology products.

“The fundamentals of CSL's underlying business units are robust and we are in a strong position to deliver annualised double-digit earnings growth over the medium term,” McKenzie said in an ASX announcement.

CSL has been one of the best performing companies on the Australian Securities Exchange (ASX) since it was privatised by the Australian Government in 1994 with its share price rising 11,387% since then.

At 12.30pm AEDT (1.30am GMT) CSL (ASX: CSL) shares were trading at A$264.22, down $6.11 (2.26%) on the day, after ranging between $263.86 and $275.57, and capitalising CSL at A$128.96 billion.