When Nvidia announced a US$100 billion investment in OpenAI on 22 September, Wall Street erupted in applause. What they missed: that same money flows straight back to Nvidia as chip purchases.

It's the most elegant circular financing scheme in modern history. And it's making infrastructure investors extraordinarily rich while everyone else chases the AI dream.

While venture capitalists place billion-dollar bets on which AI startup will dominate, private equity firms have doubled down on a safer play - the picks and shovels.

Data centres. Power plants. Steel and concrete. The assets every AI company needs, regardless of who wins.

"In some ways, it's like selling shovels to people looking for gold," Jon Mauck, Senior Managing Director and Head of Data Centre Investment Strategy at DigitalBridge, told Pitchbook in January 2025.

"I don't know who is going to find gold or be the largest AI platform, but whoever is doing anything in that world needs an environment, i.e. a data centre, to deploy it."

That realisation is reshaping global capital flows.

King-making data centre growth

"This is the biggest AI infrastructure project in history," Nvidia CEO Jensen Huang told CNBC when announcing Nvidia's OpenAI partnership.

He also let slip something more revealing: "The limiting factor is no longer chips, but power."

The CEO of the world's most valuable chipmaker just confirmed his product isn't the constraint anymore. Electricity is.

Utility stocks now rank among the S&P 500's top performers.

One of them is Constellation Energy, the largest U.S. nuclear operator, having secured 20-year power agreements with Microsoft and Meta.

Others include NRG Energy, which partnered with GE Vernova to build 5.4GW of natural gas plants exclusively for computing facilities.

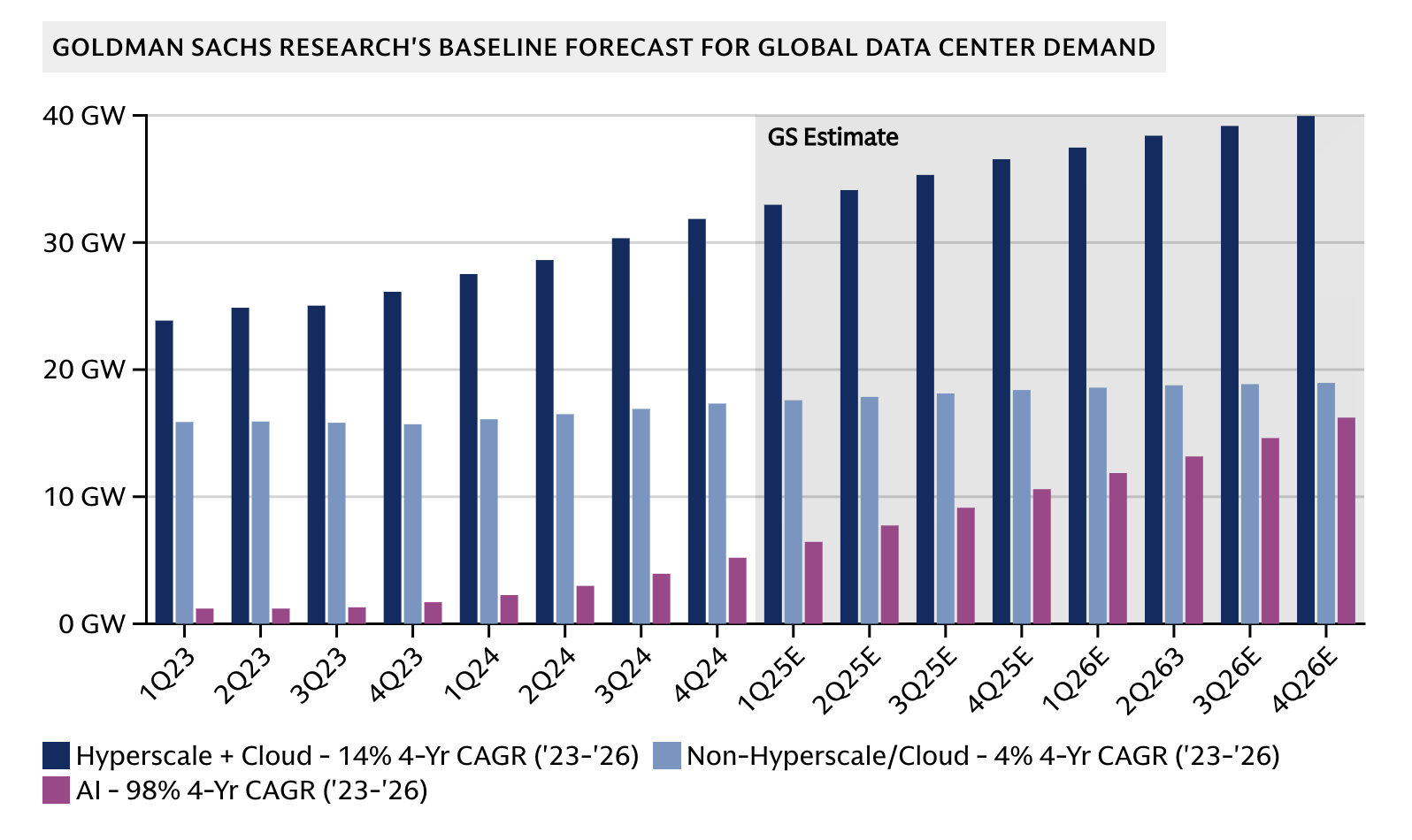

Goldman Sachs reckons computing hub power demand will increase a whopping 165% by 2030, requiring some $720 billion in grid spending.

According to Deloitte's 2025 AI Infrastructure Survey, electricity requirements from AI facilities are expected to grow more than 30-fold by 2035 to 123 gigawatts.

The graph shows exponential growth from ~4 GW in 2023 to 123 GW by 2035, with a 165% increase milestone at 2030.

America's infrastructure buildout

"The battle for AI innovation will be won by the states that can deliver compute, power, and people," Senator Dave McCormick told attendees at Pennsylvania's inaugural Energy and Innovation Summit in September 2025. "Pennsylvania is at the centre of it."

The state secured up to $90 billion in AI and energy backing.

Google committed $25 billion for facilities across the PJM grid, Blackstone pledged another $25 billion, and PowerHouse Data Centres will deploy $15 billion across three hyperscale campuses - with the flagship project, Pennsylvania Digital I, designed for 1.35 gigawatts of capacity.

Ohio is seeing similar momentum, with Amazon Web Services unveiling a $10 billion expansion that brings its total state commitment to $23 billion since 2015, while CoreWeave will commit up to $6 billion into Lancaster County.

These secondary markets outside Silicon Valley offer faster permits, cheaper land, and excess energy capacity built for manufacturing that never fully recovered from deindustrialisation.

Circular economics of AI growth

When Nvidia backed OpenAI with $100 billion, OpenAI used that capital to buy Nvidia chips and rent Oracle computing infrastructure.

Oracle itself then signed a five-year, $300 billion deal with OpenAI beginning in 2027.

And Microsoft has injected nearly $14 billion into OpenAI, which the latter used mostly as Azure cloud credits to become the software giant's largest cloud customer.

"There's no partner but NVIDIA that can do this at this kind of scale, at this kind of speed," OpenAI CEO Sam Altman said.

The same capital circles endlessly, creating the illusion of independent backing when it's one interconnected web where everyone needs everyone else to succeed.

"We would like to see more traditional investors step up to fund the great data centre buildout," wrote Stacy Rasgon, Bernstein semiconductor analyst, in September 2025.

"It is not healthy that the only investor willing to fund OpenAI's ambitions at this scale is their chip provider who will get most of that investment back as chip sales."

Someone still has to erect the buildings, generate the electricity, supply the steel, and pour the concrete.

Smart Money's Exit

The overall value of deals involving computing hub targets more than doubled in 2024, says Ropes & Gray's H1 2025 AI investment report.

While PE firms scaled back direct stakes in risky AI startups, they channelled capital into the physical backbone those startups need to exist.

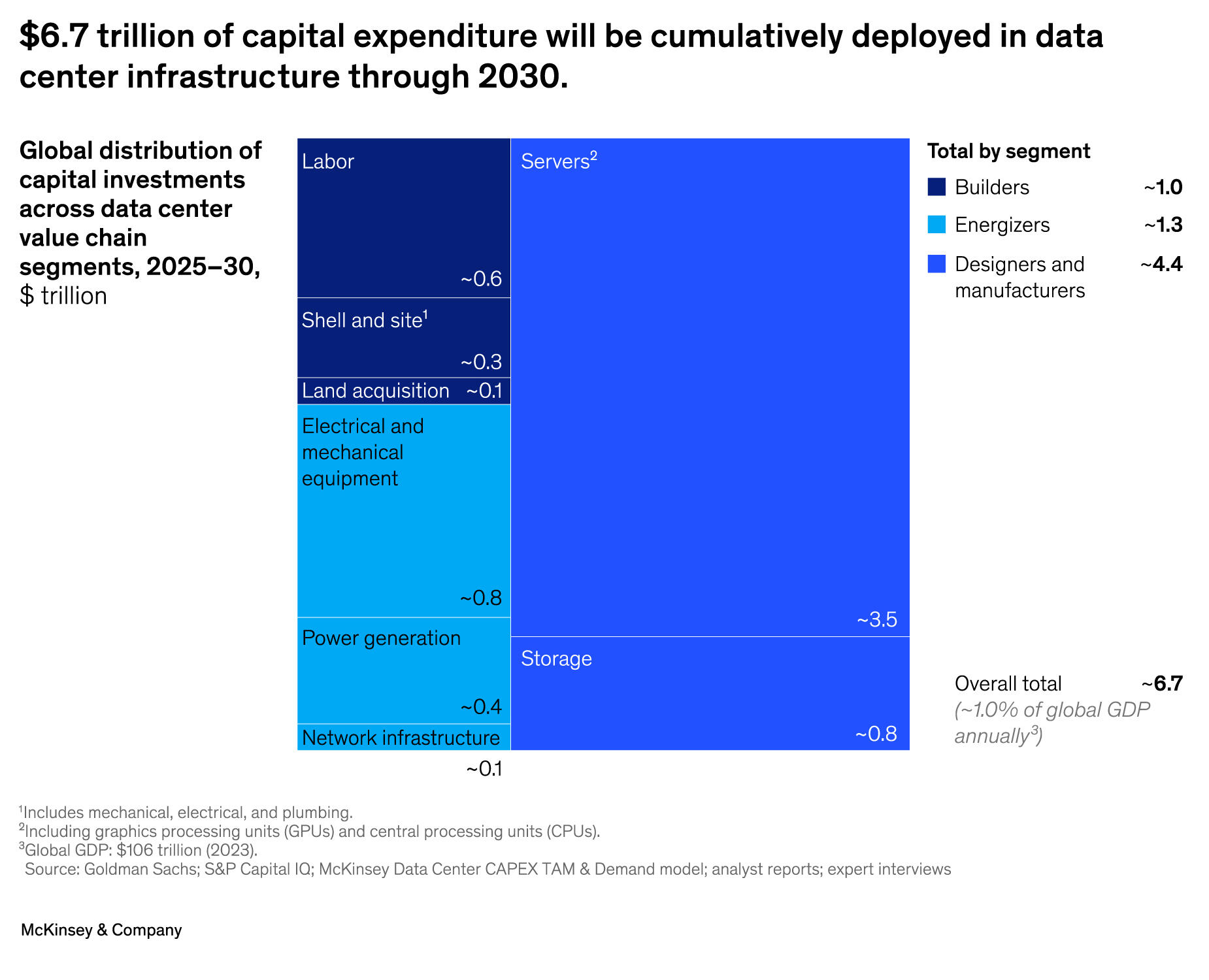

McKinsey projects that a cumulative $106 trillion in global buildout will be necessary through 2040.

Digital assets account for $19 trillion. But AI's expansion requires simultaneous deployment across energy ($23 trillion), transportation ($36 trillion), and water systems ($6 trillion).

"Infrastructure's definition is changing and demands a mindset shift among stakeholders," McKinsey said. "Those who act decisively today will shape the future for generations."

75% of buildout capital raised from H2 2023 through H1 2024 targeted cross-vertical strategies, according to IJInvestor data.

Antin Infrastructure Partners raised €10.2 billion for Fund V in December 2024, explicitly targeting opportunities bridging energy transition, digital assets, transportation, and social systems.

Computing hubs need electricity. Electricity needs cooling. Cooling needs water, and water needs treatment facilities.

All of it needs materials, and full value can only be extracted when these assets operate as an integrated system.

Materials boom

AI facilities will drive copper use from 500,000 tonnes annually to 3 million by 2050 - as just one hyperscale facility requires up to 20,000 tonnes of steel.

The American Cement Association predicts the U.S will need 1 million tonnes of cement for AI computing hubs by 2028.

Mentions of "data centre" in investor earnings calls across manufacturing and energy sectors grew fivefold - from 997 in 2023 to 5,402 in 2024, according to McKinsey.

And these aren't tech companies in the discussions, they're the construction firms, materials suppliers and industrial manufacturers.

McKinsey estimates capital spending on mechanical and electrical systems for computing facilities will exceed $250 billion by 2030.

UBS projects global AI buildout spending will hit $375 billion in 2025 and $500 billion by 2026.

Overcapacity?

Public opposition delayed or blocked roughly $64 billion in U.S. computing hub projects between May 2024 and March 2025, with community concerns focusing on water usage, environmental impact, and strain on local resources.

In his annual letter to investors, BlackRock CEO Larry Fink pointed out that it usually takes longer to permit infrastructure projects than to construct them in both the U.S. and the EU.

"A high-voltage power line can take 13 years to get approved - something China does in a quarter of the time."

But what if AI demand doesn't materialise at its projected scale?

When DeepSeek - a Chinese AI model - achieved comparable results with supposedly lower buildout needs earlier this year, markets panicked over whether everyone just overbuilt by trillions of dollars.

"The risk of under-investing is dramatically greater than the risk of over-investing," Google CEO Sundar Pichai said in July 2024.

That's what every bull market says.

McKinsey hedged with three scenarios in its April 2025 compute analysis - constrained (78 incremental gigawatts, $3.7 trillion), accelerated (205 gigawatts, $7.9 trillion), and base case (125 gigawatts, $5.2 trillion).

Even in the pessimistic scenario, trillions flow to physical assets.

Rushing in on infrastructure

"AI has the potential to transform the global economy if we can build the necessary infrastructure to support it," Larry Fink wrote, announcing BlackRock's AI Infrastructure Partnership in March 2025.

"We believe this unparalleled partnership of leading global companies across the AI ecosystem brings technology expertise together with private capital to meet this demand and creates unique investment opportunities for our clients."

If today's AI applications don't materialise as promised, tomorrow's cloud services, enterprise software, or applications nobody's imagined yet will still need computing hubs, power plants, and cooling systems.

Private buildout assets under management grew from approximately $500 billion in 2016 to $1.5 trillion in 2024, according to McKinsey data.

Nearly half (46%) of surveyed limited partners in McKinsey's May 2025 Global Private Markets Report expressed intention to increase allocations in the next year, because they're "attracted by infrastructure's predictable cash flows, inflation protection, and strategic alignment with digitalisation and energy transition trends."

Most prospectors go broke while the merchants selling shovels stay rich. In 2025's AI gold rush, the infrastructure investors could very well be those merchants.

Picks and shovelers

Constellation has surged over 180% in the past year, ranking among the top 30 S&P 500 performers as its nuclear capacity becomes critical infrastructure for AI.

Vistra, another utility play, climbed nearly 250% over the same period after securing massive power contracts with hyperscalers.

GE Vernova, spun off from General Electric in April 2024, has gained over 380% since its debut as utilities race to secure gas turbines for data centre power projects.

On the real estate side, Equinix and Digital Realty Trust - the two largest data centre REITs - have attracted record institutional investment, with Blackstone committing $25 billion across multiple infrastructure platforms focused on computing facilities and co-located power generation.

Applied Digital, which designs AI-optimised data centres from the ground up, secured a marquee lease with CoreWeave for its flagship Polaris Forge campus, planned to scale to 1 gigawatt of capacity.

Even legacy construction and materials companies are catching the wave - Caterpillar and Vulcan Materials have seen earnings call mentions of "data centre" projects multiply, with analysts upgrading targets based on multi-year infrastructure buildout visibility.