The copper market is getting more complex. Simple supply-demand models don't capture data centre build-outs, geopolitical supply chain shifts, or Argentina's mining renaissance. Let's take a look at the latest machinations in the red metal business.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains; the geopolitical machinations that affect the industry - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

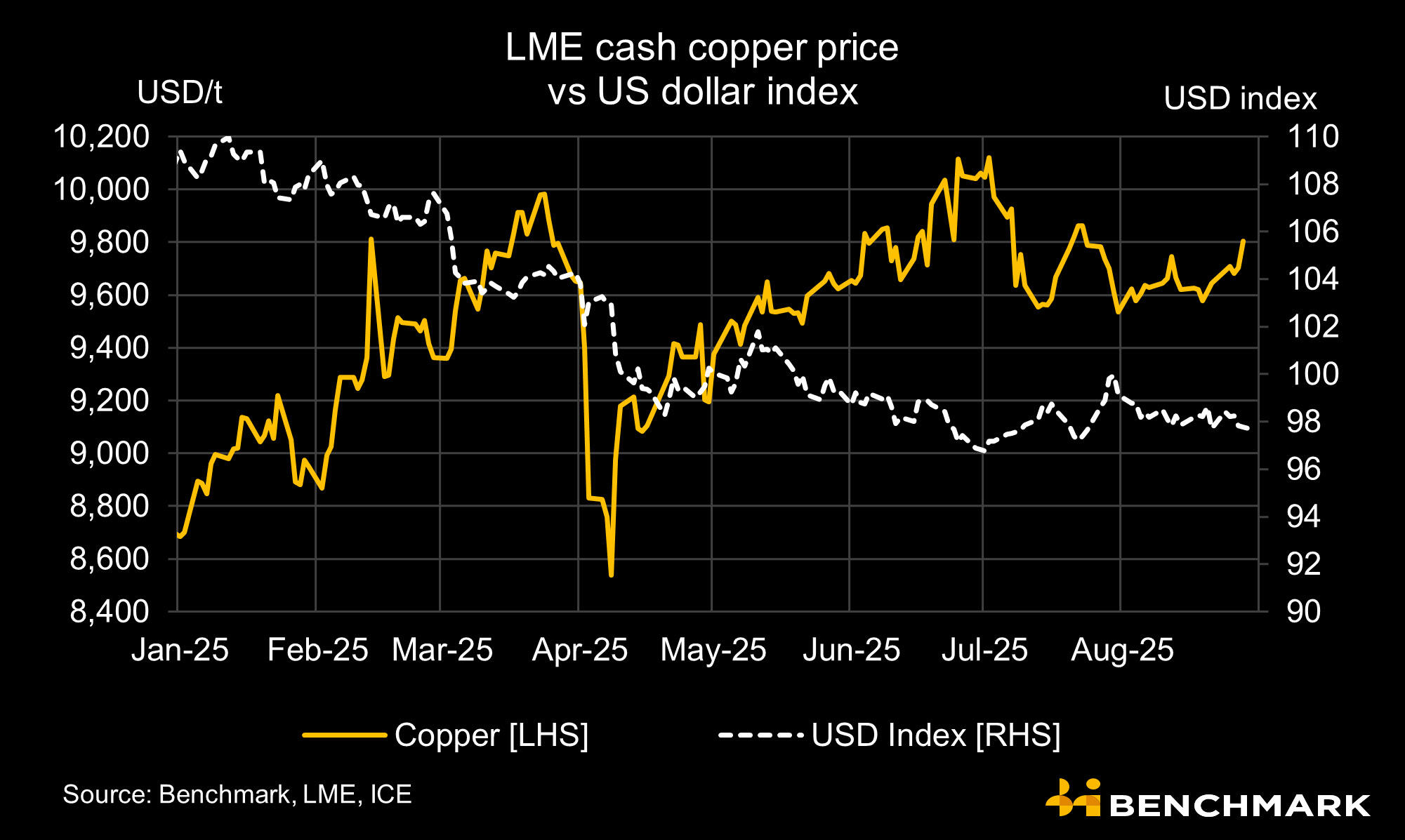

Copper LME cash prices hit US$9,805 per tonne (t) on Friday, up 1.7% for that week, with the dollar doing most of the heavy lifting.

The USD index fell to 98.4 by Friday's close, down 0.8% week-on-week - and as we all know - when the dollar weakens, commodities like copper gets cheaper for buyers holding other currencies. Simple as that.

Over the past month, copper's gained a healthy 3.18%, and year-on-year, it's up 13.84%.

Argentina's copper drive

Argentina hasn't produced any copper since Bajo de la Alumbrera shut down in 2018.

That's about to change, spearheaded by its recently elected President Javier Milei and his push to revitalise the country's resources sector through the Large Investment Incentive Regime (RIGI) is incentivising foreign companies to set up shop.

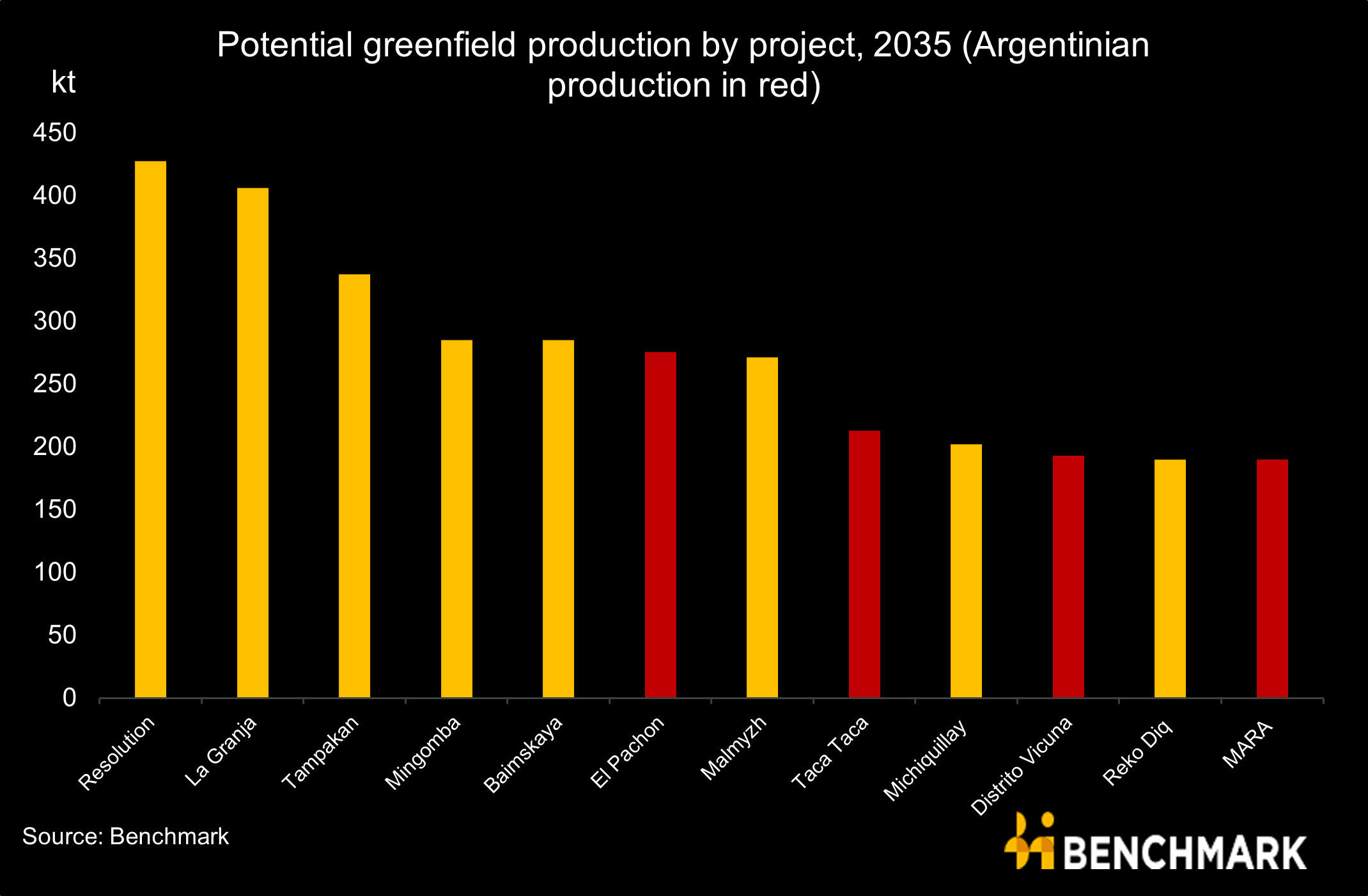

Global mining giant Glencore has just filed applications worth US$13.5 billion for two massive copper projects under Argentina's new investment regime. El Pachón gets $9.5 billion, Agua Rica gets $4.0 billion. Combined, they'd create 10,000 jobs during construction and 2,500 permanent positions.

El Pachón sits on 6 billion tonnes of ore averaging 0.43% copper and Agua Rica has 1.2 billion tonnes at 0.47% Cu. Those aren't small deposits.

The timing isn't coincidental. Argentina's RIGI launched this year, offering what mining companies have wanted for decades: certainty.

- Corporate tax drops from 35% to 25%

- Thirty-year tax stability guarantees

- Constitutional protection against policy reversals

- Customs exemptions on imported equipment

- For an industry that plans in decades, not quarters, this matters

Other miners piling in

BHP and Lundin Mining are advancing their Distrito Vicuña project, with RIGI applications planned after their announcement at Argentina Copper 2025.

McEwen Mining's Los Azules' application has already been submitted - the first copper project to formally apply; while Aldebaran Resources has a deadline this month for its Altar project's economic assessment.

A whopping 20 projects have now applied for RIGI, worth an estimated US$33.6 billion, according to Economy Minister Luis Caputo.

Supply complications

The International Copper Study Group expects a 289,000t copper surplus in 2025. That's more than double last year's 138,000t.

Chile's mining association says production will hit 5.4-5.6Mt this year. It's still the world's largest producer, but growth is slowing due to declining ore grades and labour issues.

Chinese smelters keep making money despite treatment charges hitting $41.27/t. Jiangxi Copper posted its highest net income since 2011, and Yunnan Copper set records for first-half earnings.

Sulphuric acid prices explain part of it. At RMB 718/t ($101/t), they're up from last year's peak of RMB 481/t ($68/t). By-product revenues matter when your main business runs on negative margins.

The concentrate market stayed quiet. One trader called it “as dead as a dodo” amd Los Pelambres recently closed a tender at $105/t for quarterly deliveries.

However production additions are coming. As Benchmark Intelligence pointed out in a note, Uzbekistan's Almalyk expansion adds 148,000tpa, Kamoa-Kakula in the DRC contributes 139,000tpa, and Chile's QB2, Peru's Las Bambas, and Mongolia's Oyu Tolgoi each deliver around 80,000tpa.

The DRC as a country keeps adding the most tonnes, shipping 3.3Mt last year. It's been the top contributor for red metal growth four out of the past five years.

Data centre shift

The copper demand story is changing. Data centres now matter.

BHP estimates data centre copper consumption will grow six-fold by 2050 - from 500,000tpa today to 3Mt. Global electricity consumption from data centres will jump from 2% of total demand today to 9% by 2050.

Microsoft committed $2.9 billion in Japan and $3.2 billion in the U.K. for data infrastructure. Amazon and Google are spending similar amounts. AI requires 10 times the computing resources of regular cloud applications, according to Macquarie Data Centres.

EVs still drive demand, just not as explosively as some predicted. Vale estimates copper demand for EVs will grow 10.5% annually over the next decade. Other transport modes? Just 0.5% annual growth.

The math works. EVs use four times more copper than conventional cars. But you need charging infrastructure first. The International Copper Association says 40 million charging ports are needed over the next decade, consuming an extra 100,000 tonnes of copper annually by 2027.

China's demand is moderating. Copper usage growth expected to slow from 2% this year to 0.8% in 2026. Construction activity continues declining, offsetting gains from electrification.

Trade policy uncertainty doesn't help. Prolonged tensions between major economies typically reduce industrial activity and copper consumption.