Goodman Group returned to a bottom-line profit in the 2025 financial year (FY25) as operating earnings grew and property revaluation losses dropped out of the results.

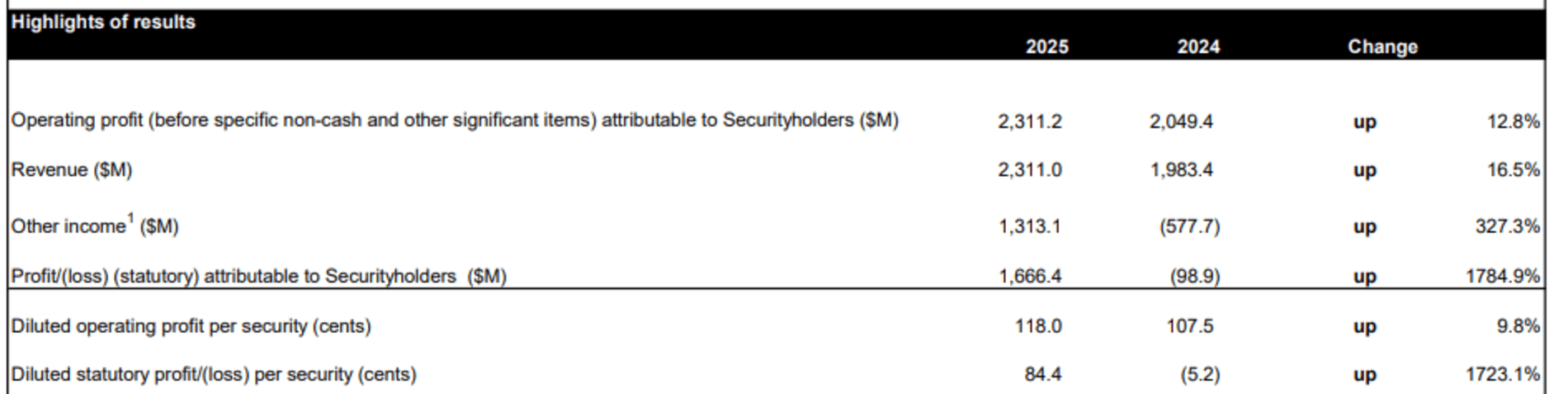

The global integrated property group said statutory profit was A$1.666 billion (US$1.08 billion) in the 12 months ended 30 June 2025, compared with a loss of $98.9 million in FY24, which was marred by non-cash factors including revaluations.

Operating profit rose 13% to $2.311 billion on revenue, which increased 16.5% to $2.311 billion.

Goodman Group announced a final distribution of 15 cents per stapled security to be paid on 26 August to security holders registered on 30 June, level with a year earlier, bringing the full year payment to an unfranked 30 cents, unchanged from FY24.

The group said it was targeting operating earnings per security growth of 9% for FY26, which equated to more than $2.6 billion of operating profit.

“Goodman has reported a strong operating result for FY25. This reflects the quality of our assets, the strength of our financial position, and the continued successful execution of our strategy,” Chief Executive Officer Greg Goodman said in an ASX announcement.

He said Goodman pursued long-term growth opportunities in FY25, including acquisitions to meet growing demand for data centres and capture growth in logistics demand across metropolitan locations.

The scale and potential impact of the data centre opportunity was significant for Goodman, which was on target to have 0.5 gigawatts of data centre development underway in key global cities by June 2026.

“Goodman is in a strong position heading into FY26 and is well placed for long-term growth, supported by the significant data centre opportunities in the near term and the group’s financial capacity and flexibility,” he said.

Goodman Group (ASX: GMG) shares lifted 2.4% to $36.95 by 10:35 am AEST (12:35 am GMT) on Thursday, touching the highest valuation since 24 January and capitalising the investment trust at $73.41 billion.

The group owns, develops and manages industrial and logistics real estate such as warehouses, business parks, and distribution centres with an increasing focus on data centres.