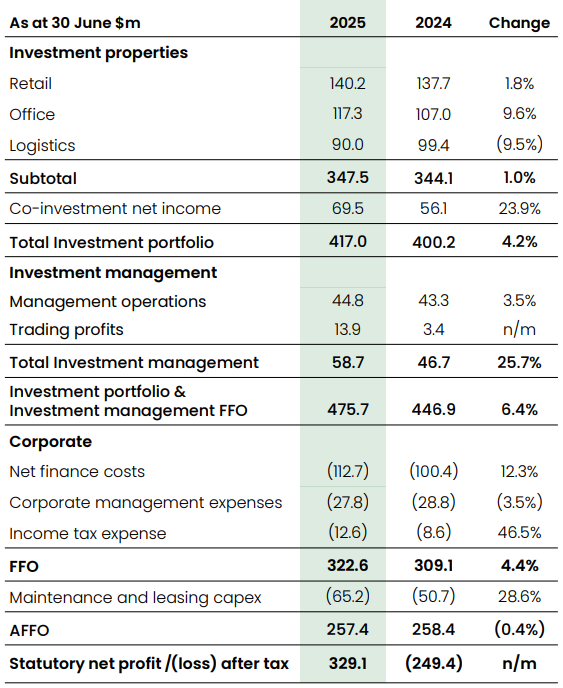

GPT Group has returned to profit in the first half of the 2025 financial year (H1 FY25) with a statutory net profit after tax of A$329.1 million (US$214.8 million) compared with a $249.4 million loss in the previous corresponding period (pcp).

The property group said funds from operations (FFO) grew 4% to $322.6 million while adjusted FFO eased by just 0.4% to $257.4 million as total investment portfolio & investment management FFO rose 6.4% to $475.7 million in the six months to 30 June 2025.

GPT had suffered a statutory loss in H1 FY24 due to write-downs in the value of its properties, mainly its office buildings.

Directors declared an unchanged interim distribution of 12 cents per security to be paid on 29 August to security holders who were registered on 30 June.

The group said it expected FFO to grow a least 3% to a minimum of 33.2 cents per security in FY25, from which it would pay a distribution of 24.0 cents per security, unchanged from 2024, “barring unforeseen circumstances”.

“Our success in the half has been built on the strong operational performance at the asset level, a testament to the quality of our portfolio and ability of our people to drive earnings,” Chief Executive Officer Russell Proutt said in an ASX announcement.

“We continue to focus on our investment management strategy and have added significantly to our depth of capability in areas including research, corporate development and investor engagement.

“Looking forward, our ambition and strategy is unchanged and we are focused on delivering long-term value to our stakeholders.”

GPT said growth in investment properties income from an improvement in office occupancy was offset by retail and logistics divestments.

Like-for-like investment portfolio property income rose 5.8% with strength across all sectors and occupancy of 98.5%, up from 97.9% in the pcp.

GPT (ASX: GPT) stapled securities closed two cents (0.38%) at $5.27 on Friday, the highest level in more than three years, capitalising the group at $10.10 billion and compared with net tangible assets per security of $5.31 at balance date.

Created in 1971 as Australia’s first property trust, GPT (General Property Trust) owns, develops and manages shopping centres, central business district office towers and warehousing and distribution facilities.