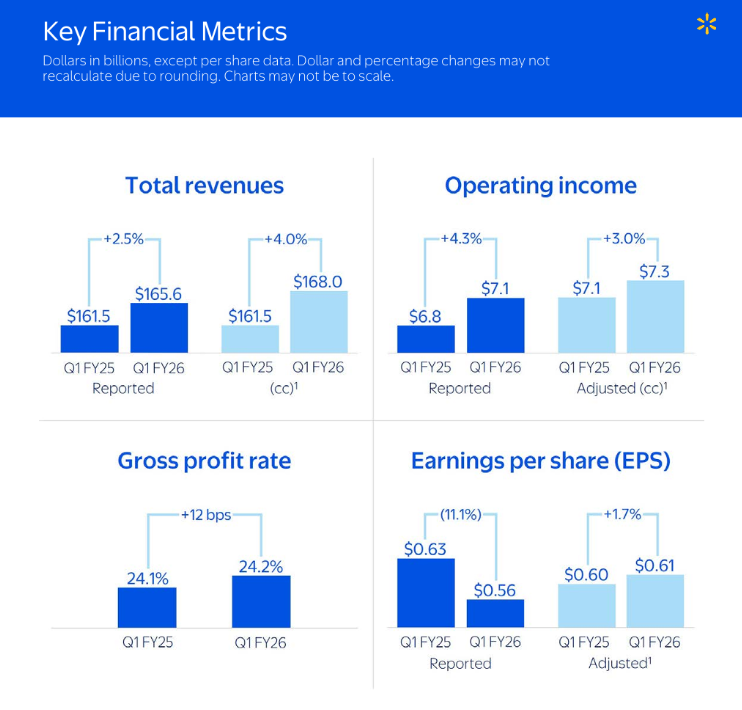

Walmart posted Q1 FY26 revenue of US$165.88 billion, up 2.7% YoY, but net income slipped 9% to $4.64 billion.

The United States retail giant has maintained its 3-4% annual growth outlook, despite tariff pressures.

E-commerce now accounts for 20% of total revenue, achieving profitability for the first time. Walmart+ membership growth remains a key focus as it competes with Amazon Prime and Costco.

Doug McMillon President and CEO, Walmart said, "We delivered a solid first quarter in a dynamic operating environment. We’re serving customers and members in more ways, which is fuelling our growth. We’re well positioned, maintaining flexibility to navigate the near-term while continuing to invest to create value for the long-term.”

Tariffs remain a wildcard. The U.S.-China trade war saw duties slashed to 30%, easing cost pressures. Walmart’s scale gives it leverage, but CFO John David Rainey flagged week-to-week sales volatility. Analysts expect Walmart to capitalise on the 90-day tariff pause, stocking up ahead of the back-to-school and holiday seasons.

Looking ahead, Walmart’s low-cost positioning and advertising expansion will bolster its resilience. Analysts expect 4% U.S. comp sales growth, with Sam’s Club membership revenue up 6%. Tariff uncertainty lingers, but Walmart’s scale and efficiency keep it ahead of rivals. Investors are watching consumer spending trends as the retail landscape shifts.

What analysts predict for Walmart's next quarter

Analysts expect Walmart's Q2 FY26 to show 3.5% to 4.5% net sales growth, but profit guidance remains uncertain due to tariff volatility. The retail giant withheld its EPS forecast, citing unpredictable cost pressures.

Despite this, e-commerce profitability strengthens, with U.S. online sales up 21% and global e-commerce rising 22%. Walmart's advertising revenue surged 31%, reinforcing its push into the high-margin digital segment.

Tariffs remain a wildcard. Walmart warned that price hikes are inevitable, with Rainey stating that consumers will see increases by June. The company is leveraging supplier negotiations and efficiency gains to minimise impact, but margins could face pressure.

Stock performance remains solid. Walmart shares rose 2.5% premarket following its Q1 earnings beat, with analysts maintaining bullish ratings.

The stock is up 7% YTD, outperforming the broader retail benchmark.

Walmart shares (NYSE: WMT) closed at $96.79. After-hours trading saw a 0.5% dip, reflecting cautious sentiment. Market cap now exceeds $700 billion, outpacing most of the Magnificent Seven tech giants. Analysts maintain bullish ratings, with a 12-month target of $108.51. In Australian dollar terms, revenue hit ~$250 billion, with net income at ~$7 billion. The stock price is ~$150, with a market cap nearing ~$1.1 trillion.