United States stock futures advanced on Thursday night (Friday AEDT) as investors digested another wave of corporate earnings, led by upbeat results from Big Tech heavyweights.

By 9:50 am AEDT (10:30 pm GMT), Dow futures were up 0.1%, S&P 500 futures gained 0.6%, and Nasdaq 100 futures rose 1.1%, signalling a positive start to the final trading day of the week.

Amazon shares surged 13% in after-hours trading after the e-commerce giant posted stronger-than-expected third-quarter results, underpinned by robust growth in its cloud-computing arm, AWS.

The company reported earnings per share (EPS) of $1.95, exceeding expectations of $1.57, while revenue rose to US$180.17 billion against expectations of $177.91 billion.

Apple also impressed investors, with shares climbing 2.7% after the tech giant reported EPS of $1.85 on revenue of $102.47 billion, both ahead of forecasts. Markets had expected $1.78 per share on $102.23 billion in revenue.

The company issued a stronger-than-expected outlook for the December quarter, citing robust demand for its new iPhone 17 lineup.

Coinbase shares rose 2.8% after the cryptocurrency firm posted EPS of $1.50 on $1.87 billion in revenue, compared with estimates of $1.13 per share and $1.8 billion in revenue.

Software group Atlassian gained 5.3% after reporting EPS of $1.04 on $1.43 billion in revenue, surpassing projections of $0.84 per share and $1.40 billion.

Netflix climbed 3.5% after announcing a 10-for-1 stock split, a move designed to make its shares more accessible to retail investors.

Social media platform Reddit jumped 9.6% after reporting EPS of $0.80, beating the $0.52 estimated. Revenue of $585 million also topped consensus expectations of $549.12 million.

Thursday’s gains followed a negative session on Wall Street, where all three major indexes ended lower. The Dow Jones Industrial Average fell 109.9 points, or 0.2%, while the S&P 500 dropped 1%, and the Nasdaq Composite slid 1.6%.

Losses were driven largely by sharp declines in Meta, Microsoft, and Nvidia, as investors fretted over rising AI-related capital spending. Meta in particular suffered its steepest one-day drop in three years.

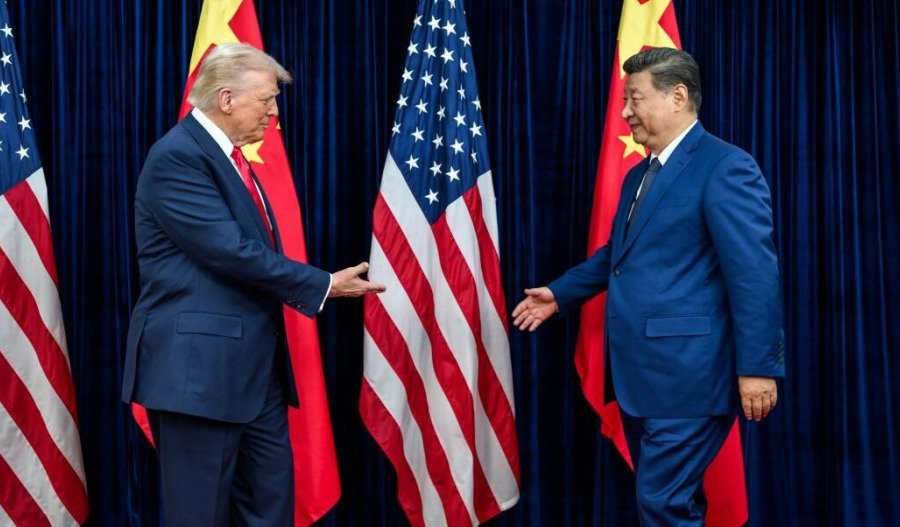

Markets also drew some relief from diplomatic developments after U.S. President Donald Trump and Chinese President Xi Jinping reached a one-year trade truce during their meeting in South Korea.

The agreement helped ease investor concerns about an escalation in trade tensions between the world’s two largest economies.