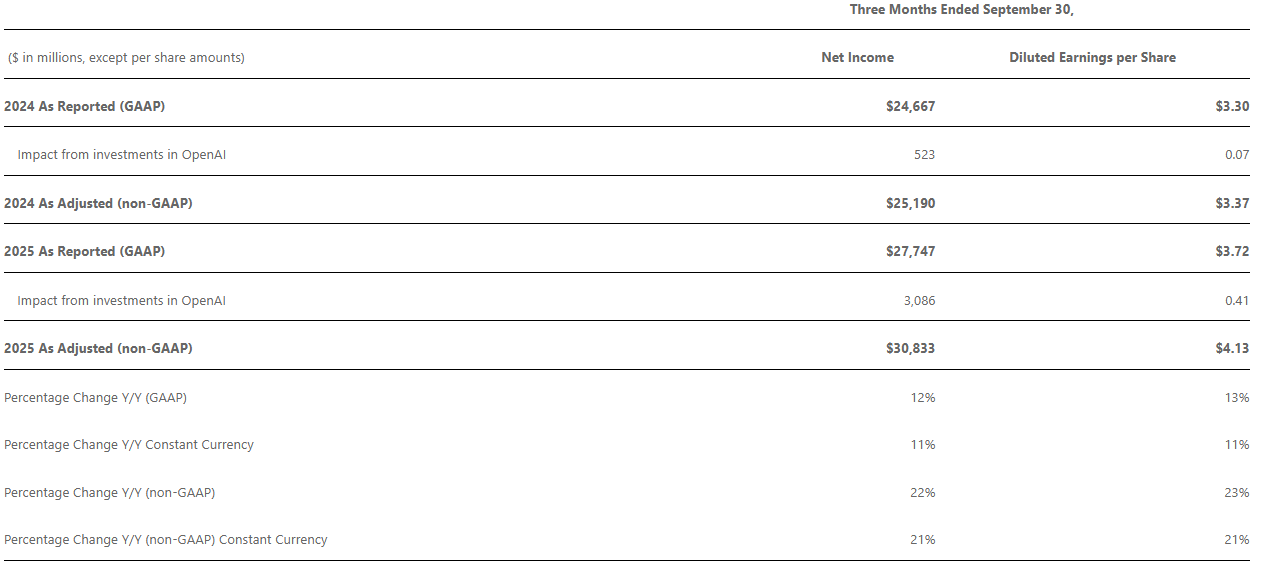

Microsoft shares eased despite the company reporting a 12% increase in net income to $27.7 billion (A$42.16 billion) in the first quarter of the 2026 financial year (Q1 FY26).

The technology giant said diluted earnings per share (EPS) grew 13% to $3.72 and operating income jumped 24% to $38.0 billion on revenue, which rose 18% to $77.7 billion in the three months ended 30 September.

Microsoft shares (NASDAQ: MSFT) closed 52 cents (0.096%) lower at $541.55 before the result, capitalising the company at $4.03 trillion, and they slid a further 3.2% in after-market trading to $524.20.

Executive Vice President and Chief Financial Officer Amy Hood said the company delivered a strong start to the fiscal year and exceeded expectations for revenue, operating income and EPS.

“Continued strength in the Microsoft Cloud reflects the growing customer demand for our differentiated platform,” Hood said in a press release.

Chairman and Chief Executive Officer Satya Nadella said Microsoft continued to increase its investments in AI to meet “the massive opportunity ahead”.

Microsoft Cloud revenue grew 26% to $49.1 billion, and commercial remaining performance obligations increased 51% to $392 billion.

Revenue in Productivity and Business Processes rose 17% to $33.0 billion, with revenue rising 17% from Microsoft 365 Commercial cloud, 26% from Microsoft 365 Consumer cloud, 10% from LinkedIn and 18% from Dynamics 365.

Revenue increased 28% in Intelligent Cloud, 40% from Azure and other cloud services, and 4% in More Personal Computing.

“Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact," Nadella said.

“It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead.”