Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Apple posts record revenue

- Shell, TotalEnergies income dips amid lower oil prices

- Amazon beats estimates with strong Amazon Web Services growth

- Eli Lilly revenue soars due to Mounjaro, Zepbound

- Comcast earnings stagnant as broadband customers exit

- Coinbase beats on high transaction revenue and trading volumes

- Roblox losses continue despite revenue surge

_______________________________________________________________________________________

8:58 am (AEDT):

Good morning (and happy Halloween)! Harlan Ockey here to walk you through the day's earnings.

Kicking things off on the NASDAQ, Apple (AAPL) reported record revenue last quarter, though iPhone and iPad revenue were lower than expected.

Total revenue was US$102.47 billion, up 8% year-over-year and beating LSEG estimates of $102.24 billion. Earnings per share were $1.85, rising 13% and above estimates of $1.77.

iPhone revenue was $49.03 billion, growing from $46.22 billion. While this was a record for the segment, it fell below estimates of $50.19 billion.

iPad revenue was largely flat at $6.95 billion, missing estimates of $6.98 billion. Mac revenue was $8.73 billion, rising from $7,74 billion and passing estimates of $8.59 billion.

Wearables, Home and Accessories revenue declined from $9.04 billion to $9.01 billion. Services revenue was up from $24.97 billion to $28.75 billion.

“Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services,” said CEO Tim Cook.

“In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season.”

Operating income was $32.43 billion, up from $29.59 billion. Net income was $27,47 billion, surging from $14.74 billion one year ago.

Apple's operating expenses rose to $15.91 billion from $14.29 billion, driven by an increase of around $1.1 billion in research and development.

Its installed base of active devices also reached a new record across all product categories during the quarter, according to CFO Kevan Parekh. Sales were up across all regions except Greater China.

Apple's shares reached a high of $285.51 in after-hours trading following a close at $271.40, before ticking back down to $279.11.

9:31 am (AEDT):

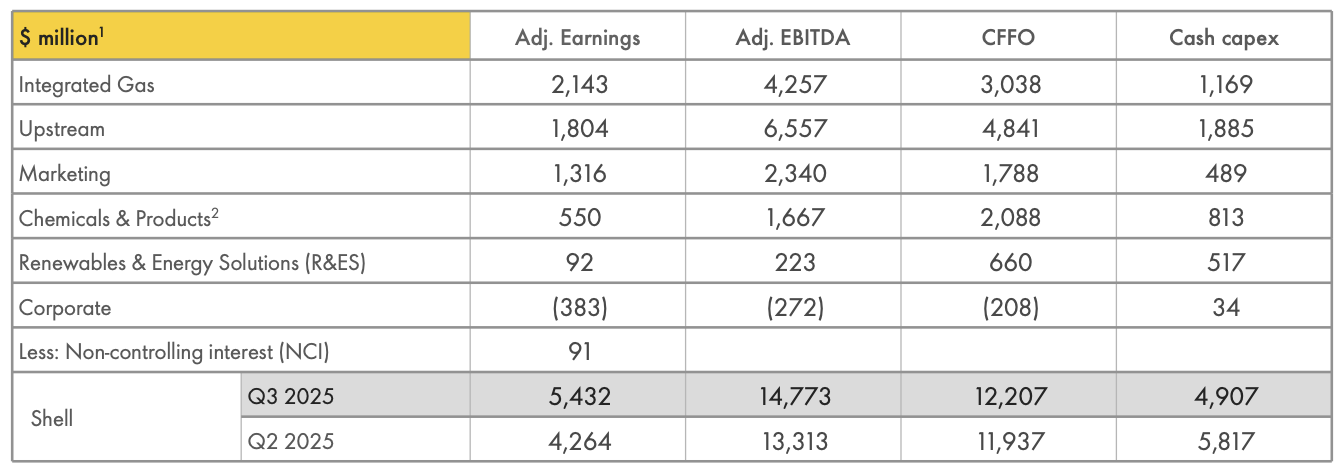

Turning to the LSE, Shell (SHEL) beat earnings estimates driven by high production, though oil prices have lowered.

Adjusted earnings were US5.43 billion, down from $6.03 billion one year ago but above LSEG estimates of $5.05 billion.

Shell's adjusted EBITDA was $14,77 billion, falling from $16.01 billion.

Its net debt was $41.2 billion last quarter, or $12.6 billion excluding leases. Net debt one year ago was $35.2 billion, or $9.6 billion excluding leases.

Adjusted earnings for its Integrated Gas and Upstream segments declined year-over-year. Integrated Gas earnings fell to $2.14 billion from $2.87 billion, while Upstream dropped from $2.44 billion to $1.80 billion.

Integrated Gas liquids prices were $58 per barrel lasts quarter, down from $63 one year ago and $60 in Q2.

Marketing segment earnings rose from $1.18 billion to $1.32 billion. Chemicals & Products and Renewables & Energy Solutions also reported earnings increases.

"Shell delivered another strong set of results, with clear progress across our portfolio and excellent performance in our Marketing business and deepwater assets in the Gulf of America [Gulf of Mexico] and Brazil. Despite continued volatility, our strong delivery this quarter enables us to commence another $3.5 billion of buybacks for the next three months,” said CEO Wael Sawan.

9:41 am (AEDT):

And over to Euronext Paris, TotalEnergies (TTE) saw income drop like fellow oil major Shell amid the quarter's low oil prices.

Adjusted net income was US$4.0 billion, down from $4.1 billion one year ago and in line with LSEG estimates, though it had said earlier in October it expected an 0-5% increase. Net income rose 11% from Q2.

Its adjusted EBITDA was $10.3 billion, up from $10.0 billion year-over-year.

“The Company's strong tinancials are underpinned by accretive nydrocarbon production growth or nore than 4% year-on-year and improved Downstream results that highlight the Company's profitable growth strategy and integrated model,” said CEO Patrick Pouyanné.

Hydrocarbon production was 2.51 million barrels of oil equivalent per day last quarter, rising 4% year-over-year.

10:07 am (AEDT):

Back to the NASDAQ, Amazon (AMZN) surged past estimates on revenue and earnings per share as Amazon Web Services (AWS) sales climbed, sending shares up 12.8% in after-hours trading.

Earnings per share were US$1.95, up from $1.43 one year ago and beating LSEG estimates of $1.57. Net sales were $180.17 billion, rising from $158.88 billion and surpassing estimates of $177.8 billion.

Total operating income was $17.42 billion, rising slightly from $17.41 billion. Operating expenses jumped to $162.75 billion, from $141.47 billion.

AWS sales grew by 20% to $33.01 billion. Its operating income increased from $10.45 billion to $11.43 billion.

North America net sales were up 11% to $107.27 billion, and International sales rose 14% to $40.90 billion. Operating income shrank across both regions, however, partly due to rising operating expenses.

“We continue to see strong momentum and growth across Amazon as AI drives meaningful improvements in every corner of our business,” said CEO Andy Jassy. “AWS is growing at a pace we haven’t seen since 2022, re-accelerating to 20.2% YoY. We continue to see strong demand in AI and core infrastructure, and we’ve been focused on accelerating capacity – adding more than 3.8 gigawatts in the past 12 months."

Amazon projects net sales will be $206-213 billion next quarter, with operating income of $21-26 billion.

Read Cameron Drummond's full story here.

10:45 am (AEDT):

Over to the NYSE, Mastercard (MA) passed estimates last quarter, with cross-border payments volume soaring.

Earnings per share were US$4.38, up from $3.89 and above LSEG estimates of $4.32. Revenue climbed 17% to $8.6 billion.

Gross dollar payment volumes increased by 9%, driven by a 15% spike in cross-border volume.

Operating income was $5.06 billion, growing by 26%. Operating expenses rose by 5%, largely due to higher general and administrative expenses.

Its fourth quarter guidance projects revenue percentage growth in the high teens, and operating expenses to increase by a high single digit percentage.

“Mastercard delivered another strong quarter, with net revenue growth of 17% year-over-year, or 15% on a currency-neutral basis, driven by healthy consumer and business spending and continued robust performance of our differentiated services,” said CEO Michael Miebach.

“This quarter, these value-added services and solutions delivered net revenue growth of 25% year-over-year, or 22% on a currency-neutral basis. We launched the Mastercard Commerce Media network, new cyber threat intelligence solutions for payments and expanded agentic commerce capabilities, all industry-shaping innovations aimed at driving customer value and unlocking new buying centres.”

Rival Visa narrowly beat earnings per share estimates earlier this week, and saw 12% growth in its cross-border volumes.

11:15 am (AEDT):

And still with the NYSE, Eli Lilly (LLY) raised its full-year guidance after seeing major revenue growth from drugs Mounjaro and Zepbound.

Revenue was up 54% to $17.60 billion, well above LSEG estimates of $16.01 billion. Earnings per share were $7.02, passing estimates of $5.69.

Diabetes medication Mounjaro saw a 109% increase in revenue, reaching $6.52 billion. United States revenue was up 49%, while international revenue rose from $728 million to $2.97 million

Weight loss treatment Zepbound's revenue rose by 185% to $3.59 billion. The company credited this to increased demand.

"Lilly delivered another strong quarter, with 54% revenue growth year-over-year driven by continued demand for our incretin portfolio," said CEO David A. Ricks. "We advanced orforglipron through four additional Phase 3 trials, enabling global obesity submissions by year-end, and we achieved U.S. FDA approval of Inluriyo (imlunestrant)—marking key progress across our pipeline.

Eli Lilly also announced new manufacturing facilities in Virginia and Texas during the quarter.

The company's full-year guidance expects $63.0-63.5 billion in revenue, and reported earnings per share of $21.80-22.50. Previous guidance projected revenue of $60.0-62.0 billion and earnings per share of $20.85-22.10.

Chloe Jaenicke has the full story.

11:50 am (AEDT):

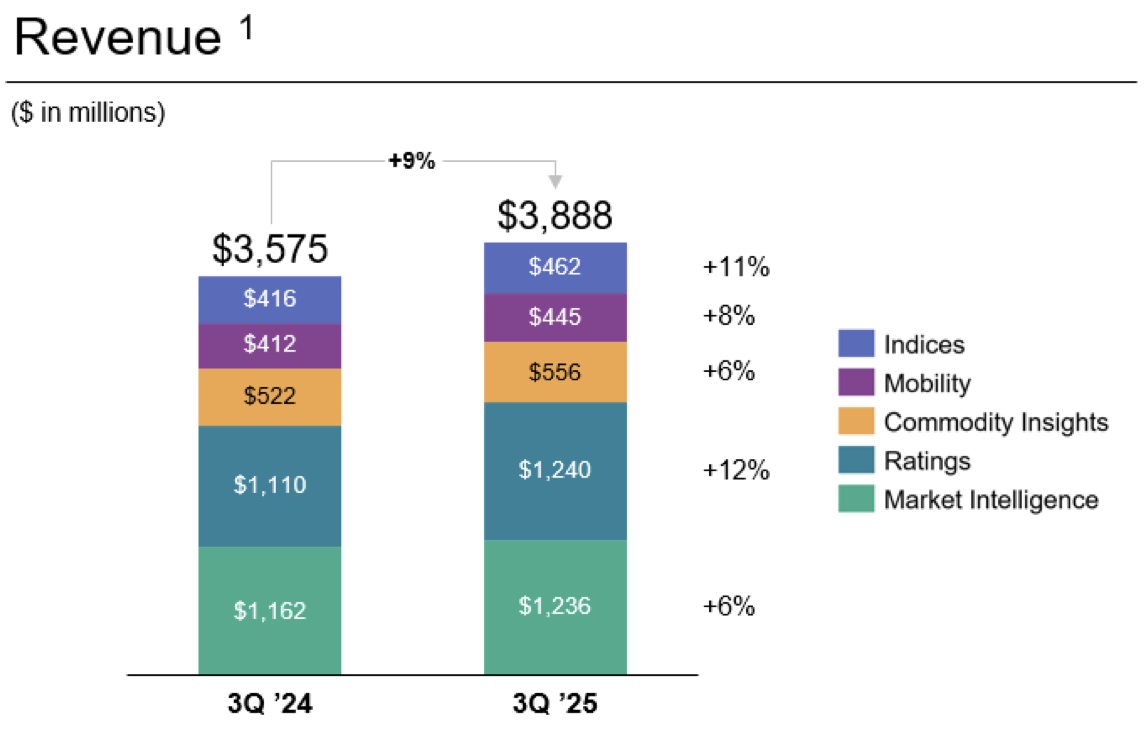

At the NYSE again, S&P Global (SPGI) reported major growth in its Ratings and Market Intelligence segment, and has lifted its guidance.

Revenue was US$3.89 billion, up 9%. Earnings per share rose by 22% to $4.73.

Ratings revenue increased by 12% to $1.24 billion, while Market Intelligence revenue climbed 6% to $1.24 billion.

S&P Global will acquire With Intelligence, the company said during the quarter, which it expects will further boost its market intelligence segment. The transaction is set to close in late 2025 or early 2026.

Operating profit was $1.68 billion, growing by 17%.

"S&P Global delivered exceptional financial results in the third quarter, with accelerating revenue growth and significant margin expansion," said CEO Martina Cheung. "Our teams continued the rapid pace of organic innovation in the quarter, and the acquisition of With Intelligence will help us accelerate our growth in private markets."

Its full-year guidance includes revenue growth of 7-8% and diluted earnings per share of $17.60-17.85. The company previously expected revenue growth of 5-7% and earnings per share of $17.00-17.25.

12:20 pm (AEDT):

Back to the NASDAQ, Comcast (CMCSA) posted a decline in revenue as residential broadband customers continued to exit.

Revenue was US$31.20 billion, down 2.7% year-over-year but above LSEG estimates of $30.70 billion. Earnings per share were $1.12, flat from last year and above estimates of $1.10.

Comcast's Connectivity & Platforms business saw an 0.6% drop in revenue to $20.18 billion, driven by a 1.5% decrease in residential revenue. It lost 104,000 domestic broadband customers year-over-year, its 10th straight quarter of declines, and shed 210,000 total Connectivity & Platforms customers.

“We're making steady progress as we reposition the company for long-term, sustained growth," said CEO Brian Roberts. “In Connectivity, we're taking deliberate steps to strengthen our broadband foundation and accelerate wireless as a meaningful growth engine, adding a record 414,000 wireless lines this quarter – clear evidence of the value of our converged offerings.”

Content & Experiences revenue fell by 6.8% due to greater-than-usual revenue from 2024 Olympics broadcasts in the year-ago quarter. While its Media sub-segment posted a 19.9% drop in revenue, it saw a 4.2% increase when excluding the Olympics.

The company's Peacock streaming service posted a loss of $217 million, improving from a $436 million loss one year ago. Peacock had 41 million paying subscribers, up from 36 million last year but unchanged from the June quarter.

Several of Comcast's NBCUniversal cable networks, including MSNBC and CNBC, will be separated into a new company known as Versant from 1 January, with the spin-off process ramping up last quarter. NBC correspondents will no longer appear on these news networks, and MSNBC will rebrand to MSNOW in November.

Shares fell by 4.3% during the day.

12:50 pm (AEDT):

Good afternoon, Chloe Jaenicke here to take over the blog for a little bit.

Gilead Sciences (NASDAQ: GILD) announced that revenues in the third quarter of 2025 rose by 3% to US$7.8 billion, compared to the same time last year.

However, total sales fell by 2% compared to Q3 2024 to US$7.3 billion, primarily due to a 60% decrease in sales of Veklury. The fall in Veklury sales was attributed to the lower rates of COVID-19-related hospitalisations.

When excluding Veklury, total sales for the pharmaceutical company increased by 4% to US$7.1 billion.

Earnings per share for the business rose to US$2.43, up from US$1 last year and surpassed Wall Street expectations of US$2.15.

The company expects to end the year in the US$8.05 to US$8.25 per share and revenues of US$28.4 billion to US$28.7 billion.

Gilead’s chairman and CEO, Daniel O’Day, said the company is well-positioned for the future.

“With multiple potential product launches in 2026, the strongest clinical pipeline in Gilead’s history, and no major loss of exclusivity expected until 2036, we are well-positioned to drive positive impact for patients and continued growth of our business,” he said.

1:20 pm (AEDT):

Cybersecurity company Cloudflare (NYSE: NET) shares rose 8% following the release of its third-quarter earnings.

Revenue was up 31% from the same time last year to US$562 million, pushing it ahead of the US$544.56 expected by analysts.

Adjusted earnings per share were also up from 20 cents per share to 27 cents per share. This surpasses analysts' forecasts of 23 cents per share.

Net loss for the company has also decreased from US$15.3 million in Q3 2024 to US$1.3 million.

The positive results can be attributed to customer growth, with its customer base growing 33% to 295,552 paying customers as of the end of September.

2:00 pm (AEDT):

Thank you, Chloe! Harlan Ockey back with you now.

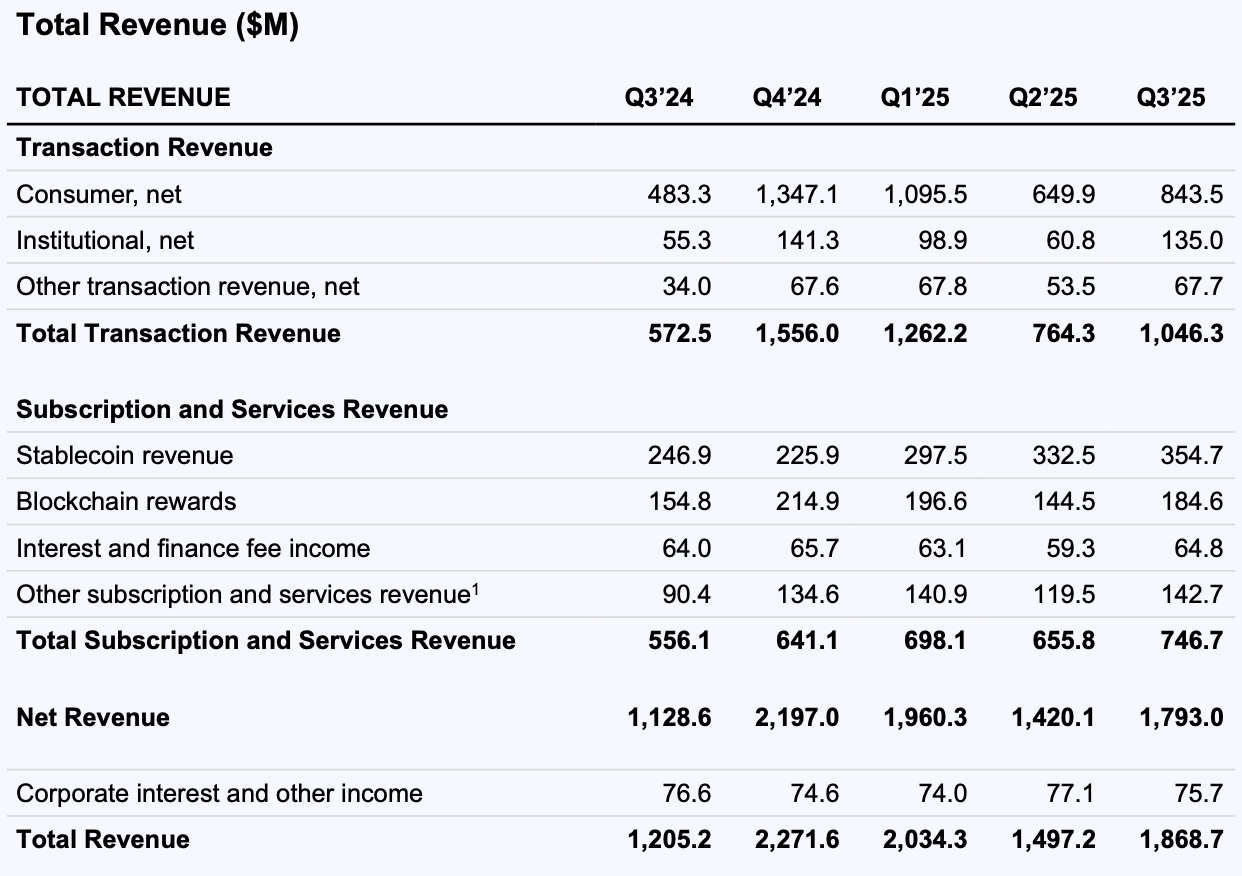

Back to the NASDAQ, Coinbase (COIN) beat estimates on earnings per share last quarter as transaction revenue surged.

Diluted earnings per share were $1.50, rising from $0.28 year-over-year and above Zacks estimates of $1.03. Revenue was $1.79 billion, up from $1.13 billion.

Transaction revenue nearly doubled, increasing to $1.05 billion from $572.5 million. This was driven by a surge in cryptocurrency market spot trading volumes, the company said, which were up 38% from Q2.

Total trading volumes were $295 million, up from $185 billion one year ago.

Subscription and Services revenue rose to $746.7 million, from $556.1 million. Coinbase predicts this will be $710-790 in Q4.

Operating expenses increased from $1.04 billion to $1.39 billion year-over-year, but fell from Q2's $1.52 billion. Operating income was $80.5 million, growing from $169.5 million one year ago.

“Q3 was a strong quarter for Coinbase. We drove solid financial results, maintained focus on shipping innovative products, and continued building the foundation of the Everything Exchange,” the company wrote in a letter to shareholders. “With regulatory clarity accelerating, crypto rails are set to power more of global GDP, and we believe Coinbase is positioned to lead.”

Shares rose by 3.6% in after-hours trading following the earnings release, after declining 5.8% during the day.

2:33 pm (AEDT):

At the NYSE, Cigna (CI) surpassed estimates on revenue and earnings per share, despite a slump in overall customers.

Revenue was US$69.57 billion, rising 9.2% year-over-year and above Zacks estimates of $67.16 billion. Earnings per share were $7.83, up from $7.51 and beating estimates of $7.70.

Adjusted income from operations was $2.10 billion or $7.83 per share, down from $2.11 billion or $7.51 per share.

Pharmacy customers increased to 122.5 million from 120.0 million. Medical customers declined from 19.05 million to 18.06 million due to a drop in U.S. Healthcare customers, with overall customer relationships dipping from 183.5 million to 182.5 million.

“Our strong quarterly results reflect the breadth of our businesses and focused execution on our growth strategy, even in a dynamic environment,” said CEO David Cordani. “We continue to lead positive change and are addressing some of healthcare’s biggest challenges. Our new market-defining rebate-free pharmacy benefit model will further lower costs and enhance transparency for the benefit of those we serve.”

Its full-year outlook expects at least $29.60 in adjusted income from oeprations per share.

3:05 pm (AEDT):

And at the NYSE again, video game company Roblox (RBLX) saw its losses continue, sending shares down by 15.5%.

Revenue was US$1.36 billion, growing by 48% year-over-year. Its loss per share was $0.37, flat from one year ago and above Zacks estimates of a $0.53 loss.

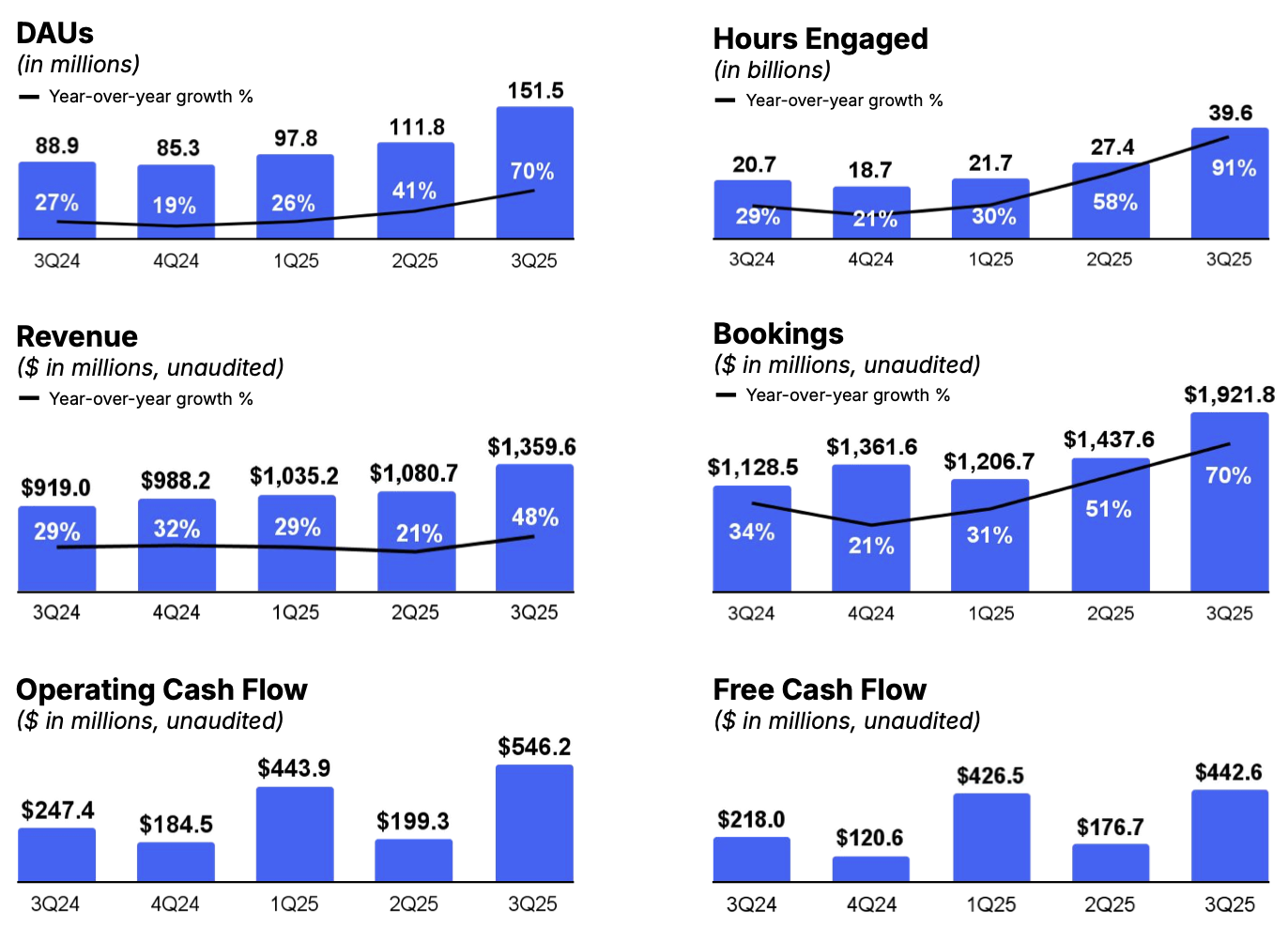

Bookings were up 70% to $1.92 billion, beating estimates by 12.48%. Daily active users (DAUs) increased by 70% to 151.5 million, with DAUs outside the U.S. and Canada rising by 81%.

Roblox's loss from operations widened last quarter to $296.5 million, from $278.93 million. Its loss before income taxes was $256.6 million, compared with $240.1 million one year ago.

Its infrastructure and trust & safety expenses increased by 61% to reach $208.2 million, driven partly by rising cloud infrastructure expenses as it gains more players.

“Our Q3 results significantly exceeded both our top and bottom line guidance,” the company wrote. “Notably, revenue and bookings growth accelerated significantly across all regions on both a year-over-year and sequential basis.”

Its Q4 guidance projects revenue of $1.35-1.40 million, bookings of $2.00-2.05 million, and a loss before income taxes of $375-345 million.

3:41 pm (AEDT):

Staying with the NYSE, Estee Lauder (EL) returned to a positive operating profit last quarter, driven by skin care and fragrance sales.

Adjusted earnings per share were US$0.32, up from $0.14 and passing FactSet estimates of $0.18. Sales grew by 4% to $3.48 billion, beating estimates of $3.38 billion.

Operating profit was $169 million, compared with a loss of $121 million last year. Gross profit increased by 5% to $2.55 billion.

Sales in its Skin Care segment were up 3% to $1.58 billion, and Fragrance sales rose by 14% to $721 million. Makeup sales sank 1% to $1.03 billion, and Hair Care sales were down 7% to $129 million.

Estee Lauder grew its market share in China across all product categories, the company said. In the U.S., it gained market share in Skin Care, Makeup, and Fragrance.

“We had a strong start to fiscal 2026 as we execute on our Beauty Reimagined strategy—returning to organic sales growth, gaining prestige beauty share in a few key strategic areas of focus, and improving profitability. Encouragingly, we are building momentum across the organization from the significant operational changes we have executed to-date to be faster and more agile,” said CEO Stéphane de La Faverie."

Its full-year guidance to 30 June 2026 expects sales growth of 2-5%, with earnings per share of $1.90-2.10.

Read Chloe Jaenicke's full report here.

4:25 pm (AEDT):

And ending with the NYSE, Reddit (RDDT) beat estimates on revenue and earnings per share, with a strong increase in international users.

Earnings per share were US$0.80, growing from $0.16 and above LSEG estimates of $0.51. Revenue was $585 million, up 68% and passing estimates of $546 million.

U.S. revenue was up 67% to $480 million, while International revenue rose to $105 million. Daily active unique users grew by 19% to 116 million, with U.S. users up 7% to 51.6 million and international users increasing by 31% to $64.4 million.

Adjusted EBITDA was $236 million, rising from $94 million.

Its Q4 guidance includes revenue of $655-665 million, with adjusted EBITDA of $275-285 million.

Shares were up 10.2% in after-hours trading.

Thank you for joining us today. Tomorrow, during U.S. Friday trading, we'll see earnings from companies like Exxon Mobil, Chevron, and Colgate-Palmolive. See you next time!