Amazon shares have jumped 10% in after-hours trading after reporting a Q3 earnings per share of US$1.95, beating Street expectations of $1.57, capping a turbulent period marked by a major outage and mass layoffs.

Revenue hit $180.2 billion - up 13% year-over-year - topping the $177.8 billion Wall Street projection, though $4.3 billion in one-time charges from the FTC settlement and severance costs complicated the profitability picture.

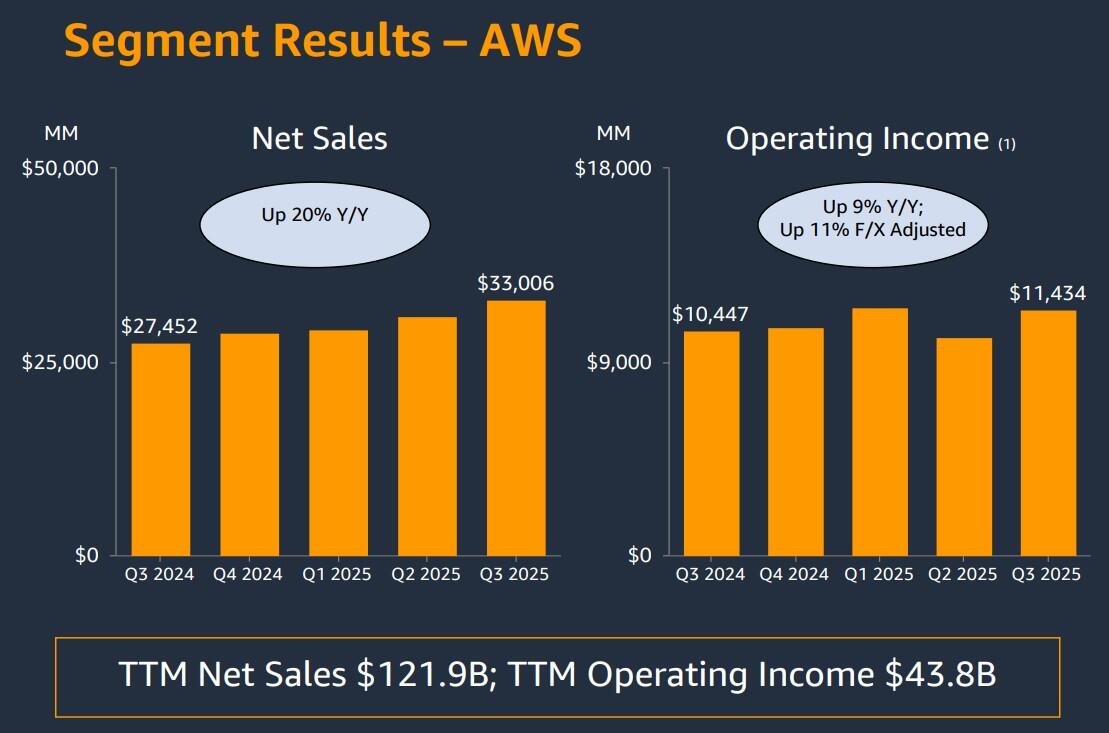

AWS delivered 20.2% revenue growth to $33 billion after several quarters of deceleration, marking the fastest pace since 2022 but still trailing Microsoft Azure's 40% expansion and Google Cloud's 34% growth reported days earlier.

Advertising climbed 24% to $17.7 billion, maintaining its position alongside AWS as the company's most profitable business and its continued momentum in Amazon's high-margin revenue streams.

Operating income landed at $17.4 billion, missing the $19.7 billion consensus - yet stripping out the $2.5 billion FTC penalty for Prime subscription practices and $1.8 billion in severance expenses revealed to the market an adjusted operating income of $21.7 billion.

Net income of $21.2 billion included a $9.5 billion gain from Amazon's Anthropic investment as the AI startup's valuation surged following its updated Claude model releases.

Amazon CEO Andy Jassy highlighted the 3.8 gigawatts of capacity additions that exceeded every other cloud competitor's own infrastructure buildout.

"AWS is growing at a pace we haven't seen since 2022, re-accelerating to 20.2% year-over-year," Jsssy said.

The report came ten days after AWS suffered a 15-hour outage that took down services from Snapchat to Disney+ and triggered 50,000 distress reports on Downdetector, raising questions about infrastructure reliability ahead of the critical holiday quarter.

Two days before earnings, Amazon announced the elimination of 14,000 corporate positions across cloud, logistics and video game divisions, with Jassy stating AI would "change the way our work is done" and require “fewer people doing some of the jobs”.

Free cash flow dropped to $14.8 billion over twelve months from $47.7 billion previously as infrastructure spending jumped $50.9 billion year-over-year, reflecting the company's aggressive push into AI data centre capacity.

Project Rainier, Amazon's 500,000-chip Trainium2 cluster, went live this quarter with the proprietary silicon business growing 150% sequentially and reaching full subscription status.

Outlook into Christmas

Fourth-quarter guidance targeted $206-213 billion in revenue against Street estimates of $208.5 billion, with operating income projected at $21-26 billion, essentially matching analyst models at the midpoint.

The forecast includes a 190 basis point tailwind from foreign exchange, putting organic growth closer to 11% year-over-year heading into the holiday shopping season.

Across Magnificent Seven earnings this week, Amazon and Google captured investor enthusiasm while Microsoft fell 3% on Azure margin concerns, and Meta absorbed a $15.9 billion tax charge hit that overshadowed otherwise solid fundamentals.