Superannuation funds may struggle this year to match the 10.25% return of 2025 after achieving only modest gains in January, according to SuperRatings.

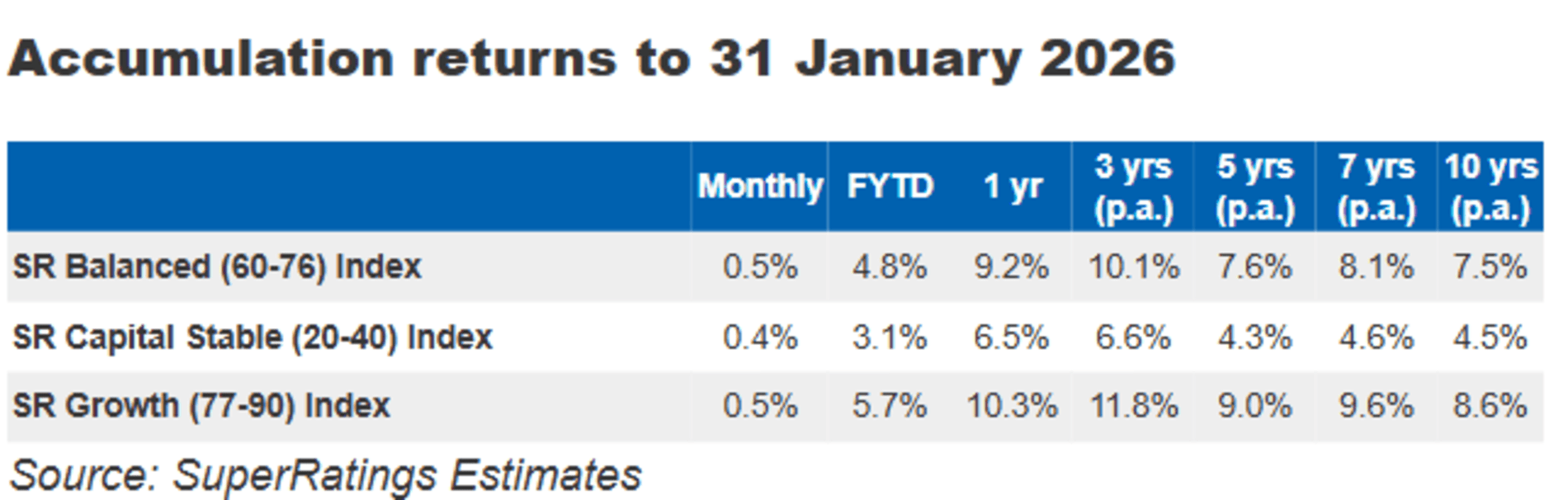

The super research house estimated that the median balanced option generated a return of 0.5% in January, which was the sixth positive return for members this financial year.

“However, returns are significantly more muted than this time last year, with the financial year to date (FYTD) return sitting at 4.8% compared to 8.0% at the same time in 2025,” SuperRatings said.

“The remainder of the financial year may see funds struggle to live up to the 2025 financial year return of 10.5%, with expectations around AI (artificial intelligence) turning into pressure on share prices for those being potentially disrupted or failing to live up to growth ambitions, coupled with ongoing geopolitical tensions and rising inflationary pressures in Australia.”

SuperRatings said the growth option also returned 0.5% while the capital stable option produced a return of 0.4%, in January, bringing the returns in the FYTD to 5.7% and 3.1% respectively.

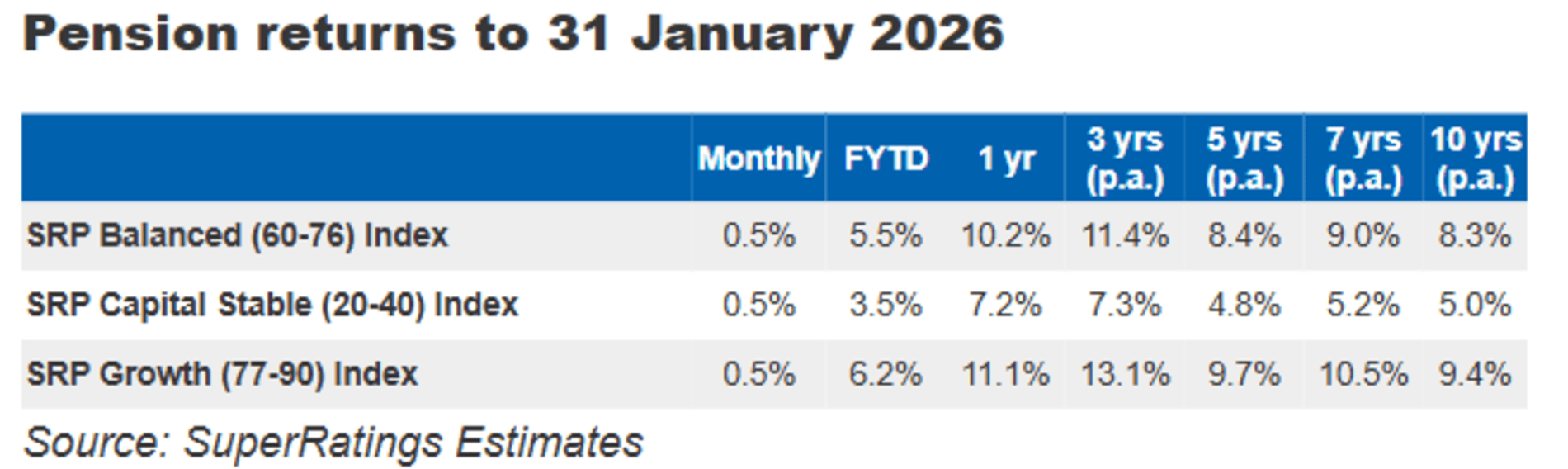

Pension members benefited from the tax concessions with the median, growth and capital stable options all returning 0.5% in January and lifting the FYTD returns to 5.5%, 6.2% and 3.3% respectively.

SuperRatings Director Kirby Rappell said super funds would be closely watching the trajectory of inflation and interest rates over the rest of the year.

“Members should remember that we have seen another positive return, and that this remains a strong result given uncertainties in the world,” he said.

“Over the long-term, funds have built a good track record of navigating market uncertainty, meaning that members should try and look through the noise.”