The value of superannuation assets has increased by more than one-third over the last three years, according to Chant West.

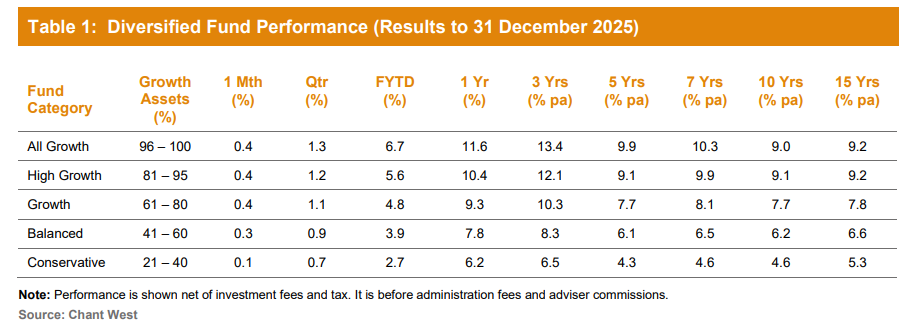

The research, data and analytics provider said median growth funds (those with 61% to 80% in growth assets) delivered a return of 9.3% in the 2025 calendar year.

“This follows impressive gains of 9.9% in 2023 and 11.4% in 2024, translating to nearly 35% growth over the past three years,” Chant West said in a media release.

“Super fund members invested in higher-risk portfolios enjoyed even stronger outcomes.”

Chant West Senior Investment Research Manager Mano Mohankumar said international share markets were the key driver of performance in 2025, returning 18.6% on a currency-hedged basis despite uncertainty about tariffs and geopolitical tensions.

He said the return from international shares in unhedged terms was lower at 12.5% due to the appreciation of the Australian dollar.

On average, growth funds have 31% invested in international shares and 25% in Australian shares, which returned 10.7%.

All major asset classes generated positive returns over the period.

Although Chant West was finalising the details for unlisted assets it estimated returns were 7-10% for unlisted infrastructure, the low double-digit percentages for private equity and 3-7% for unlisted property.

Returns from listed real assets were also up with Australian property at 9.7%, international property 7.5% and international infrastructure 11.6%.

In the defensive asset classes, cash, Australian bonds and international bonds returned 4%, 3.2% and 4.4% respectively.

“With share markets performing so well in 2025, particularly international shares, naturally the better performing super funds generally had higher allocations to those asset classes,” Mohankumar said.

“Funds that had lower allocations to unlisted property, cash and bonds would have also benefited, as did those with lower exposure to the U.S. dollar.”