Superannuation funds have performed solidly, with median growth funds returning 7.8% so far in 2025, according to Chant West.

The research, data and analytics provider said median growth funds (those with 61% to 80% in growth assets) delivered a return of 1.2% in October, which was the seventh positive month in a row.

“While we’ve seen some share market jitters in November so far, Chant West estimates that with only 6 weeks of CY25 (calendar year 2025) remaining, the median growth fund return is still sitting at a solid 7.8%,” the firm said.

Head of Superannuation Investment Research Mano Mohankumar said this would be a good outcome, particularly given the uncertain economic and geopolitical backdrop throughout the year, putting it ahead of the typical long-term return objective of 6%.

“Super fund members should also remember that this year’s result follows two exceptional years, with returns of 9.9% in CY23 and 11.4% in CY24,” he said in a media release.

The returns in October were: 1.6% for all growth funds (96%-100% in growth assets), 1.3% from high growth (81%-95%), 1.0% from balanced (41-60%) and 0.8% from conservative (21-40%).

The drivers were returns from: developed international share markets of 2.6% and 3.3% in hedged and unhedged terms; emerging markets of 5.5%; Australian shares of 0.4%; and Australian and international bonds of 0.4% and 0.7% respectively.

This brought the returns in the calendar year to 31 October to: 12.0% from all growth funds, 10.3% from high growth, 7.9% from balanced and 6.2% from conservative.

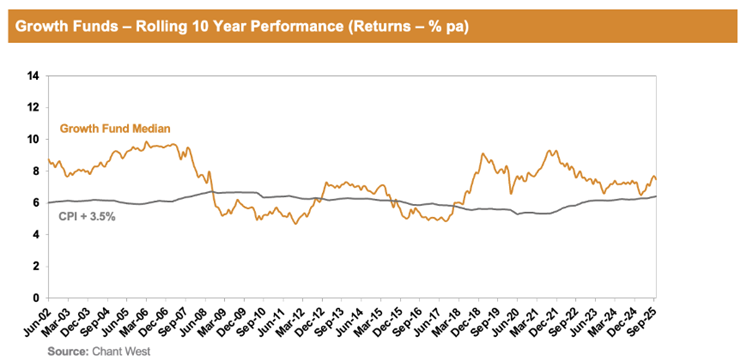

The chart below showed the median growth fund exceeded its return objective over rolling 10-year periods most of the time.

The exceptions were between mid-2008 and late-2017 when it fell behind because of the devastating impact of the global financial crisis when growth funds lost about 26% on average.