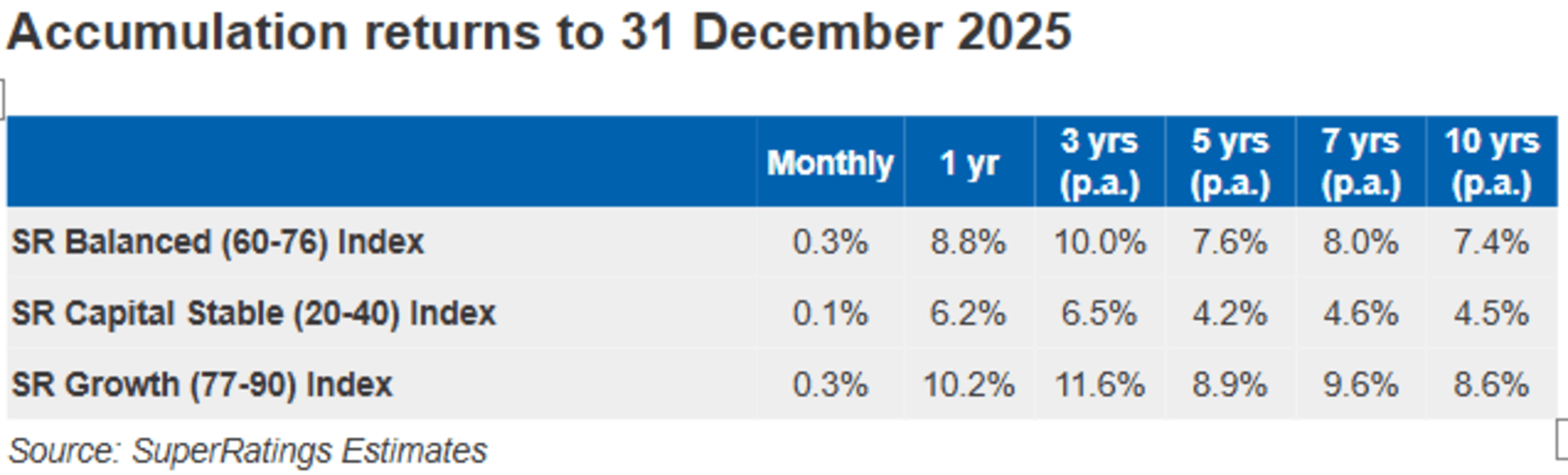

Australian superannuation funds generated an 8.8% return for median balanced options in the accumulation phase in 2025 but 2026 is expected to be challenging, according to SuperRatings.

The super research house estimated this option finished the year on a high note after a small stumble in November by generating a 0.3% return in December.

Although the full year outcome was below the 11.1% delivered in 2024, it comfortably exceeded the long-term average annual return of 6.5% since 2000.

“We have seen another strong year of superannuation returns. Funds continue to deliver above expected returns; however, there remain concerns over how long such growth can last,” SuperRatings Director Kirby Rappell said in a media release.

“A negative return in November meant the median Balanced option missed reaching double digits for 2025 and the outlook for 2026 is increasingly unclear.”

SuperRatings said the median growth option returned 10.2% last year, including 0.3% in December, while a smaller allocation to shares resulted in the median capital stable option returning 6.2% after 0.1% in the last month of the year.

International shares were the only asset class to reach double-digit returns for the year, while Australian shares just short of double digits and property and infrastructure assets added mid-single digit returns.

Fixed interest and cash delivered returns for median options of between 3.7% and 4.0%.

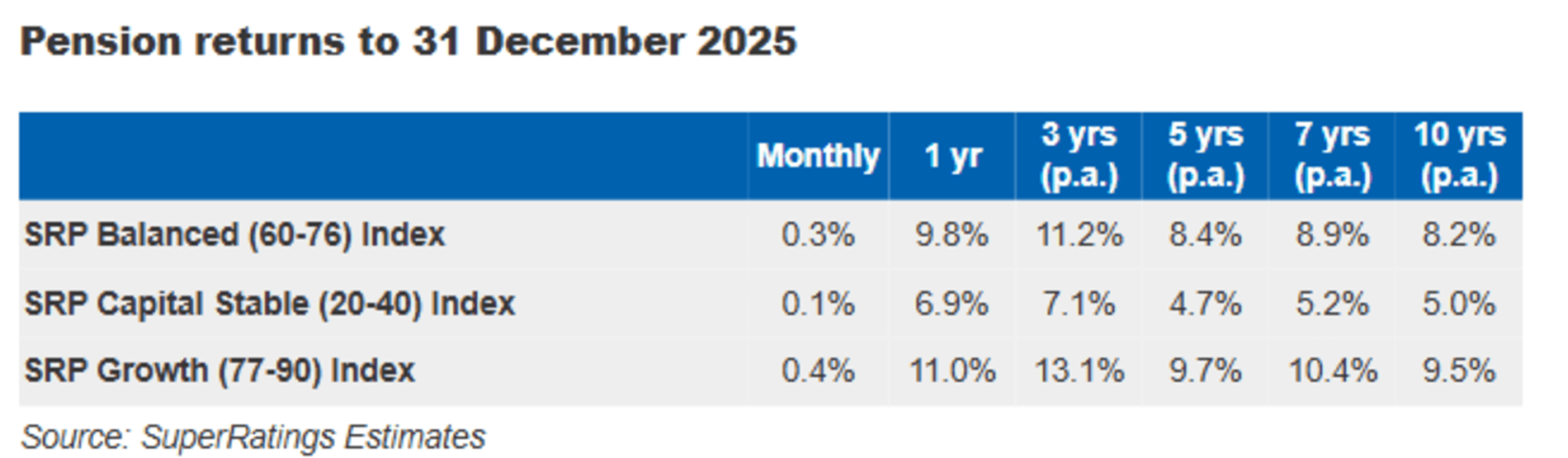

Pension members benefited from the tax concessions, with the median pension option matching the 0.3% accumulation return in December but outperforming accumulation options over the year with a 9.8% return.

“We expect 2026 to be a challenging environment for fund returns. Geo-political tensions are once again rising and the inflation outlook in Australia suggests there will be little opportunity for interest rate relief over the coming 12 months,” SuperRatings said.