The Trump administration unveiled a US$12 billion strategic minerals stockpile this week, combining $10 billion from the U.S. Export-Import Bank with $2 billion in private capital to warehouse rare earths, copper, and other materials Washington reckons it can't afford to run short on.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement, mergers & acquisitions and markets, to manufacturing and consumer products.

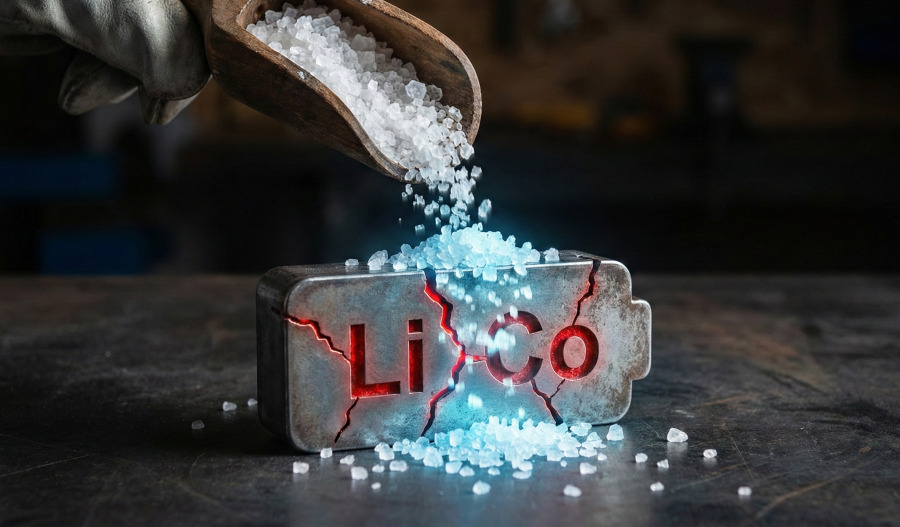

Project Vault represents the first civilian-focused strategic reserve of this type, modelled on the petroleum stockpile but aimed squarely at China's grip on feedstock that powers defence systems, EVs, and advanced manufacturing.

The administration's One Big Beautiful Bill Act set aside $7.5 billion for critical minerals, including $2 billion to expand the national defence stockpile by 2027 - add Project Vault's $12 billion and direct equity stakes in USA Rare Earth, MP Materials, Lithium Americas, and Trilogy Metals, and there's a reasonably coherent industrial policy taking shape.

The buffer itself solves a different problem by giving manufacturers inventory when supply chains get squeezed - companies like GM won't need to warehouse their own lithium or rare earths but can tap Project Vault when needed, keeping the volatility off their balance sheets.

Think nickel after Russia invaded Ukraine - the U.S. already runs a defence-focused minerals stockpile, but this civilian version targets automotive, aerospace, and energy sectors.

Whether it's enough to shift the balance with Beijing is debatable, particularly since building separation capacity is expensive and technically complex - many rare earth ores contain radioactive elements like uranium and thorium, which require specialised infrastructure most countries don't have.

The context matters here - Beijing controls nearly 60% of global rare earths extraction and over 90% of magnet production, and last year it tightened export controls on critical elements like gallium, germanium, and antimony, forcing some U.S. manufacturers to curtail output.

Trump referenced those disruptions when announcing the buffer from the Oval Office, with General Motors, Boeing, GE Vernova, and Google already signed on as participants.

Commodities traders Hartree Partners, Traxys North America, and Mercuria will handle the procurement side of the operation.

Price floors are on the table - sort of

By Wednesday, U.S. Trade Representative Jamieson Greer announced parallel talks with Mexico, the EU, and Japan on border-adjusted minimum pricing for critical minerals, aimed at stopping predatory dumping that floods markets with cheap supply to strangle competing projects before they get off the ground.

Mexico's involvement comes as part of a scheduled USMCA review due by July 1, while the EU and Japan frameworks involve coordinated trade policies to stabilise supply chains.

Vice President JD Vance pitched the arrangement at a 55-country summit in Washington, though the administration is stepping back from company-specific price floor guarantees like the one it gave MP Materials in July 2025 - $110 per kilogram for neodymium-praseodymium, roughly $50 above spot at the time.

That arrangement included a $400 million equity stake, making the Pentagon MP's largest shareholder - a commitment type that sent Australian rare earths explorers lower when the retreat became apparent.

Lynas Rare Earths, the biggest producer outside China, shed over 4%, though Australia's Resources Minister Madeleine King said Canberra would press ahead with its own A$1.2 billion strategic inventory regardless, targeting antimony, gallium, and rare earths by mid-2026.

Who's winning, who's not

U.S.-listed miners rallied initially, with USA Rare Earth up 11%, Critical Metals climbing 10%, and MP Materials tacking on 4%.

Energy Fuels, Idaho Strategic Resources, and NioCorp all posted gains Tuesday after Project Vault landed, but the minimum pricing retreat hit hard on Wednesday.

MP Materials and USA Rare Earth surrendered 10% and 12% respectively as the market worked out what the policy actually meant - the administration seems to favour multilateral structures over bilateral commitments, probably a mix of congressional funding constraints and the headache of pegging market values for dozens of minerals.