The G7’s proposed price floor for critical minerals effectively marks the end of the free market in the resources sector. For three decades, the global economy treated commodities as neutral inputs that traded efficiently based on price and availability, but that structure collapsed in Washington this week.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

Western governments have now conceded that private capital cannot compete against state-sponsored monopolies that prioritise strategic control over profit - as has played out with China.

The consequential policy shifts for resources extraction are profound in the sense that they represent a formal split in the global commodities market.

The market is now dividing into two distinct tiers: a "Red Price" driven by Chinese internal demand and a "Blue Price" set by Western security needs.

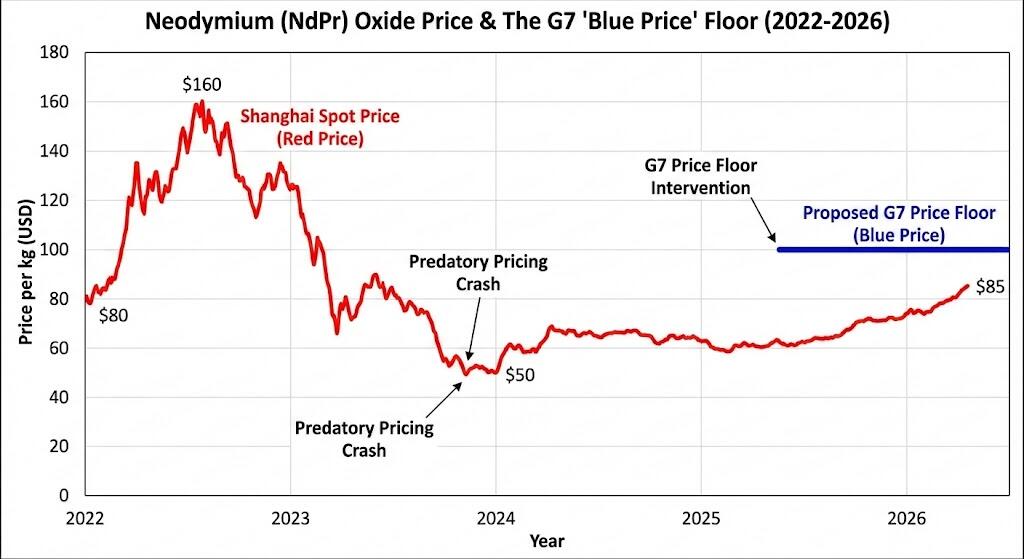

Take the elements neodymium and praseodymium - magnet rare earths in high demand into the future.

For critical minerals stocks, the G7-subsidised "Blue Price" becomes the only relevant valuation metric.

The idea is that company valuations will decouple from the Shanghai spot market and tether instead to Western industrial policy, making the "Security Premium" the primary asset.

The geopolitical trigger: Taiwan

The immediate catalyst for this intervention was a sharp escalation in the Indo-Pacific.

In early January, Beijing enforced strict export controls on dual-use items to Japan following Prime Minister Sanae Takaichi’s remarks regarding Taiwan.

This event confirmed that the long-feared "weaponisation" of supply chains is no longer theoretical.

While China has previously restricted gallium and germanium - controls that sent prices soaring—this targeted move against a specific G7 member forced the bloc to abandon passive monitoring.

Japan’s demand for G7 market intervention successfully pushed the alliance from rhetoric to active defence.

Inflation vs security

A critical component of this shift is the Trump administration’s trade policy adjustment.

By pausing planned tariffs in favour of a price floor mechanism, the White House signals a clear intent to avoid "Greenflation".

While tariffs on Chinese minerals increase costs for U.S. manufacturers like Ford and GM, a price floor shifts the financial burden to the taxpayer via the Treasury.

This effectively creates a "buyers’ club" to stimulate non-Chinese production without causing an immediate inflationary spike for consumers.

Subsidised survival?

This policy is a formal acknowledgement of market failure.

Western miners like Lynas Rare Earths and MP Materials have long struggled against predatory pricing from Chinese state-backed entities, which dominate 60-90% of global processing.

When Western competitors emerge, prices often drop below the cost of production to bankrupt the new entrants, but the "price floor" eliminates this volatility.

If the market price falls below the break-even cost of Western production (e.g., US$100/kg for NdPr), G7 governments will cover the deficit.

This transforms commodity equities into infrastructure assets secured by sovereign credit, mimicking Japan’s JOGMEC model which has treated mineral supply chains as strategic infrastructure for over a decade.