A powerful new bull cycle could be on its way (it might already be here) and copper's role in our energy transition, defence systems, and technological infrastructure have shifted it from a cyclical industrial metal into a strategic commodity. Today, increasingly apparent variables such as cascading supply disruptions and resilient demand are currently colliding with production cuts across major mines to strain global supply chains.

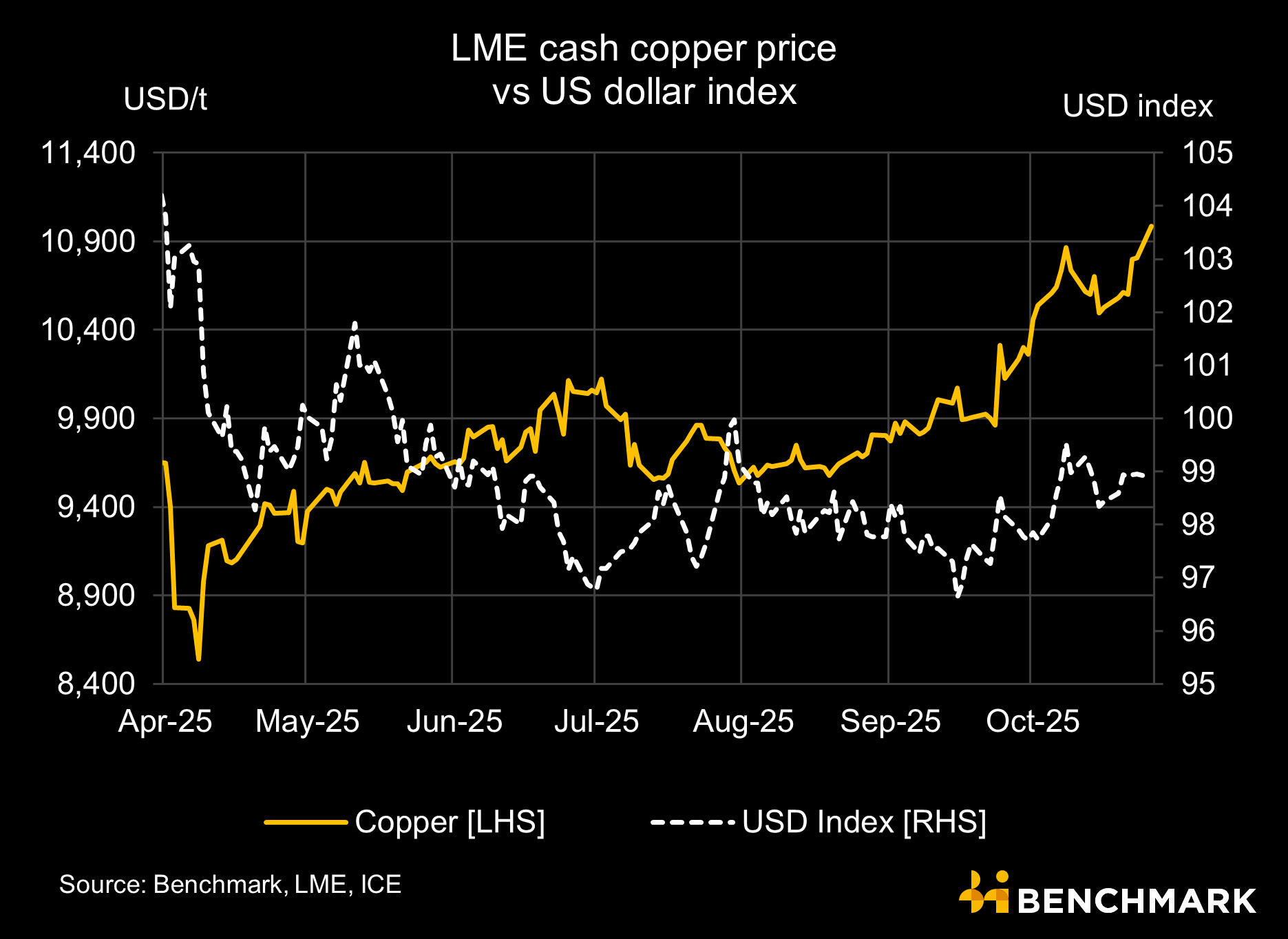

That's spurred investors and analysts alike to turn bullish on the red metal, as three-month copper prices closed at $10,987/t in late October, up 3.8% week-on-week on the London Metal Exchange and just short of the record set in May 2024.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

Supply shocks trigger deficit

2025 is tracking as the weakest year for mined copper growth since 2011, pushing the market into deficit territory despite smelter capacity coming online.

Freeport-McMoRan's force majeure declaration at Indonesia's Grasberg mine drove the latest price movement.

An 800,000t mud inrush shut down the facility, removing 591,000t of expected production through December 2026 - equivalent to Chile's entire Collahuasi mine annual output.

Ivanhoe Mines' Kamoa-Kakula complex in the Democratic Republic of Congo suffered flooding that cut output by an estimated 300,000t.

Teck Resources revised Chilean production guidance downward by 60,000t, while Codelco's El Teniente trimmed forecasts by 33,000t following an accident.

First Quantum's Cobre Panama remains shuttered after government-ordered closure in late 2023, eliminating over 300,000t annually.

BHP reported 493,600t in Q3 - a 4.4% decline quarter-on-quarter.

Output at its Escondida operation held steady, as higher concentrate production offset reduced cathode volumes.

Freeport's copper production totalled 414,000t in Q3 - a 13% decline from Q3 2024, reflecting a 41,000t reduction due to the Grasberg suspension.

And Zijin's Q3 production of 263,000t was 5.8% lower than Q2, driven by the Kamoa-Kakula contraction.

Consensus

No wonder investment banks have upgraded copper price targets.

Goldman Sachs forecasts copper averaging $10,160/t across 2025, anticipating a supply deficit driven by electrification demand and constrained mining output and projects prices climbing above $10,500/t by end-2026 as the deficit deepens.

The GS forecast also accounts for 3.5% annual demand growth through 2026, while supply growth is capped at just 1.2% annually due to declining ore grades at existing operations.

Meanwhile, ANZ Research expects copper and base metals to benefit from de-escalating trade tensions, noting any deal should reduce the risk of a full trade war detrimental to metal markets.

Yet J.P. Morgan projects prices sliding toward $9,100/t in Q3 2025 before stabilising around $9,350/t in Q4.

The bank cites front-loaded U.S. copper imports that surged 129% year-over-year through May, leading to an inventory build-up that will unwind in the second half.

Broader analyst consensus places copper trading between $8,800/t and $9,500/t by the end of the year.

In terms of production, Chile's mining association forecasts production of 5.4-5.6Mt in 2025, while expansions at Kamoa-Kakula, QB2, and Oyu Tolgoi contribute 80,000-150,000t each of additional supply.

The Democratic Republic of Congo is responsible for the most additional tonnage this year, as it has been for four out of the past five years.

Tailwinds

The copper market received a boost from U.S.-China trade talks at October's Asia tour, where Presidents Xi and Trump made historic deals on tariffs, rare earths and illegal fentanyl trade.

The development pushed Wall Street futures higher and lifted copper prices on improved macro sentiment.

Concentrate treatment charges remain depressed, with MySteel's latest smelter buying level at US$42.5/t, reflecting the shortage of copper ore available for processing.

Arbitrage between the Chicago Mercantile Exchange and LME copper continues at $383/t, while the cash-to-three-month spread on the LME remains narrow at $22/t - indicating limited immediate supply availability.

M&A & Policy

Major miners are pivoting toward copper in record deals. Anglo American and Teck Resources' recently proposed $53 billion merger would create the world's sixth-largest copper producer, with a 17% premium paid over Teck's closing price.

The deal follows Teck's spin-off of its coal business, reflecting industry recognition that legacy fossil fuel commodities face structural decline.

Beyond M&A, copper stands apart as the largest and most liquid critical mineral, with market capitalisation and trading volumes that exceed lithium, cobalt, or rare earths.

The Trump administration's direct equity stakes in domestic copper miners signal a shift toward supply security.

Its $35.6 million investment in Trilogy Metals for 10% equity plus warrants, coupled with approval for Alaska's Ambler Access Road, drove triple-digit share price gains and reinforced policy support for domestic production.

These moves parallel interventions in lithium and rare earths, establishing a pattern where federal capital, infrastructure approval, and offtake guarantees de-risk mining projects while securing mineral supply chains.

For US-focused copper producers, particularly juniors, the implications include accelerated permitting and enhanced likelihood of production milestones.

Forward macro

The copper market deficit is projected to intensify through 2026, with refined copper shortfalls driven by prolonged capital constraints and repeated supply disruptions that have depleted inventories.

While scrap copper increasingly supplements primary supplies, technical limitations prevent full substitution for mined concentrate.

Copper's decoupling from oil and iron ore reflects its diminishing reliance on Chinese construction demand and growing importance to Western infrastructure, defence, and technology sectors.

The shift positions copper as a building block for energy security and technological sovereignty, driving investor flows and policy attention independent of traditional industrial cycles.

The convergence of supply constraints, policy support, and demand suggests copper prices will test and exceed previous highs as the deficit deepens through 2026.