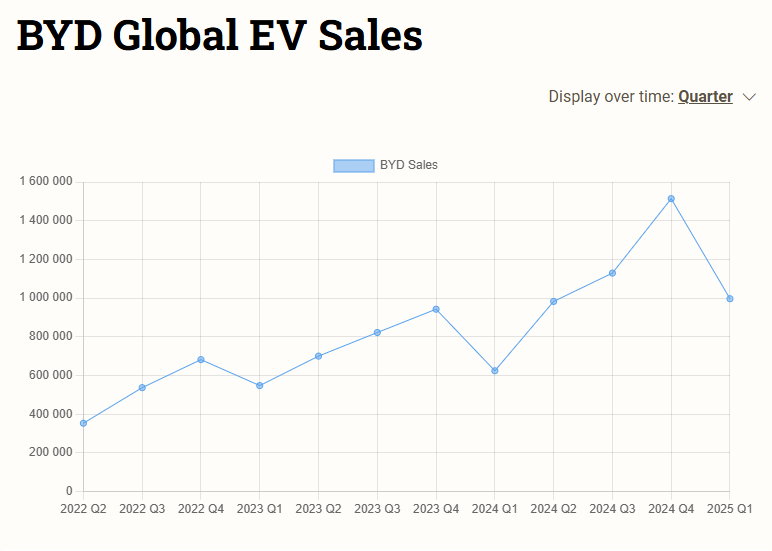

A Shenzhen-based car manufacturer that has seemingly popped up overnight has now beaten Tesla in Europe, posted US$115 billion (A$176.7 billion) in annual revenue and shipped 4.27 million vehicles in 2024, capturing 18% of the worldwide EV sector.

Here we look at how Chinese carmaker BYD catapulted itself from a battery manufacturer to the world's largest EV manufacturer; and how it's spearheading a plethora of Chinese automakers that are now simultaneously producing vehicles cheaper, higher in quality and more innovative than legacy brands.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

April 2025 caught some analysts by surprise as BYD's EU registrations jumped 359% year-over-year, while Tesla's volumes dropped 49%.

Yet with a commanding six of the world's top ten EV sellers, China now controls 70% of global EV production, and in developing nations such as Brazil and Thailand, they've locked up 85% of all EV deliveries.

Meanwhile, Volkswagen, BMW, and Mercedes-Benz are watching their market foothold evaporate in China, where German OEMs had been printing money for decades.

Porsche's China volumes fell 28% in 2024, and Ford and General Motors are both scrambling to match Middle Kingdom pricing without damaging their margins.

Borrowed money and chemistry smarts

BYD founder Wang Chuanfu grew up in rural Anhui Province, was orphaned as a teenager, and was raised by his siblings while persevering through a metallurgical chemistry degree.

After a brief stint as a government researcher, he borrowed $36,000 from his cousin in 1995 and started making batteries in Shenzhen with a clear vision.

"We want to use our technological innovations to help solve the world's energy problems," Wang remarked.

At that time, mobile phones were taking off globally, and BYD positioned itself to become the world's largest manufacturer of phone batteries, ending up supplying the likes of Motorola and Nokia.

Wang used that success as a springboard into the automotive sector, acquiring failing state-owned carmaker Xi'an Qinchuan Automobile in 2003 before launching China's first mass-produced plug-in hybrid five years later.

Berkshire Hathaway's $230 million bet

It was the late Charlie Munger who convinced Wall Street icon Warren Buffett to invest in BYD, describing Wang as "a combination of Thomas Edison and Jack Welch".

In 2008, Buffet's Berkshire Hathaway coughed up $230 million for 9.89% of the company at $8 per share.

BYD cars in 2008 were unremarkable - quality was questionable, design was derivative, and nobody was confusing them with BMWs.

What Munger saw was how the company was structured.

With legacy automakers having spent decades perfecting outsourcing and assembling motors from thousands of components made by hundreds of suppliers, Wang's operation was doing the opposite.

BYD was building batteries, motors, electronics, semiconductors - and software, all in-house.

Bill Russo of Shanghai-based consultancy Automobility puts it bluntly: Wang "is to the 21st century EV industry what Henry Ford was to the 20th century automotive industry: Both entrepreneurs leveraged vertical integration and economies of scale to democratise mobility".

Berkshire fully exited its stake earlier this year, ending a 17-year investment that grew over 20X in value.

An army of engineers

"We have 110,000 engineers, which is BYD's biggest asset," Wang told Chinese media recently.

The company's total headcount is almost an eye-whopping one million people, with that engineering army filing an average of 32 patents every single day.

Over the past three years, the Shenzhen manufacturer has recruited more than 50,000 fresh graduates - close to 70% of them holding master's or doctoral degrees and roughly 80% working in R&D roles.

That workforce manufactures batteries through FinDreams Battery, which became the world's second-largest EV battery producer in 2024 with a 17% worldwide sector share, along with producing electric motors, power electronics, semiconductors, and proprietary software systems.

BYD's in-house capability showed itself during COVID-19, when engineers designed and built mask-making machines in seven days and ramped up to producing five million masks daily.

Western automakers typically need four to five years to develop new vehicle models - whereas the Chinese carmakers like BYD can complete the same process in just 18 months.

"We were shocked at how fast BYD has caught up," Paul Gong, executive director of auto research at UBS, said at a Fortune conference last year.

When semiconductor shortages hammered global automotive output throughout 2021 and 2022, production kept rolling because Wang's company wasn't dependent on external suppliers.

The $10,000 Seagull

The Seagull electric hatchback retails for approximately US$10,000 in China, delivers 200km of range, has modern safety features and contemporary styling in a proper four-door package.

Ford CEO Jim Farley test-drove one and publicly called it "pretty damn good" before warning that Chinese EVs represent a real threat to established manufacturers.

In fact, the Seagull costs less than a third of the cheapest EV currently available in the States, yet BYD still makes a profit on each one.

That pricing capability comes from controlling the entire value chain: no supplier markups, no component shortages from third parties, no coordination across dozens of external partners.

“BYD only knows how to play offence,” Sino Auto Insights MD Tu Le said.

“Their consistent and frequent vehicle and feature launches keep their competitors on their heels, while their lowest in-class cost structure lets them price their products much more aggressively.”

Outsourcing tech

BYD has its patented Blade Battery tech, which uses lithium iron phosphate chemistry in a unique long, thin form factor.

During the nail penetration test - where engineers drive a metal spike directly through the battery cell to simulate a worst-case scenario - the Blade Battery doesn't catch fire or emit smoke, with surface temperatures staying below 60°C, as competing battery technologies can burn for 24 hours at dangerous temperatures during the same examination.

The blade design increases space utilisation by 50% compared to traditional battery pack configurations, and cells are rated for over 5,000 charge and discharge cycles.

With safety being a priority for car batteries, Ford, Tesla, and Toyota now use the technology in their own products.

In March 2025, the carmaker announced fast-charging technology that adds 250 miles of range in five minutes - compared to Tesla's Superchargers, which need 15 minutes for 200 miles.

Breaking ground

BYD is now establishing fabrication facilities in Hungary and Turkey to serve EU territories directly, as its Thailand plant, which opened in July 2024, started exporting motors to Europe two months later. sidestepping tariffs on China-manufactured units.

There's already a parts warehouse in the Netherlands stocking 22,000 components for after-sales service, addressing what's been a weak point for Chinese brands in foreign territories.

Its main brand for the EU is targeting affordable vehicle segments, though Denza - formerly a JV with Mercedes-Benz and now wholly owned by the company - which competes against BMW and Audi in the luxury bracket.

Yangwang offers automobiles priced above $140,000 for the ultra-luxury tier, whereas Fangchengbao focuses on off-road and specialty niches.

The carmaker now outsells established European nameplates, including Fiat, Dacia, and Seat, across multiple geographies.

"In the automotive industry, this means driving corporate growth and national industrial transformation and upgrading through innovative technologies and products," Wang told shareholders at the 2023 annual meeting, discussing how vertical integration drives the company's advantage.

Developing markets

BYD currently operates in more than 80 countries across six continents, with momentum coming from territories legacy automakers have historically underserved.

Chinese manufacturers accounted for 85% of electric vehicle shipments in Thailand during 2024, as Wang's operation is building three factories in Brazil that will employ more than 5,000 workers producing cars, buses, and processing lithium for battery fabrication.

In Australia, the EV maker became the second-largest EV marque in 2023 with 12,438 units sold.

The company exported ~232,800 units in Q3 2025, a 146% increase from the same period last year, though export volumes remain just a fraction of its domestic sales.

Bitten by its own tariffs

In September 2024, the Biden administration slapped a 100% tariff on Chinese-made electric vehicles, stacking on top of an existing 25% levy.

Analysts calculate that the Seagull would retail for approximately $25,000 in the United States after required safety modifications, even with the combined 125% tariff burden, still undercutting every domestically produced electric vehicle by thousands of dollars.

Wang's company hasn't announced any plans to enter the US passenger vehicle arena, instead focusing resources on the 95% of the worldwide automotive sector where it doesn't face political barriers.

The manufacturer operates a facility in Lancaster, California, for electric bus assembly, making it the largest battery-electric bus manufacturer in North America.

Addressing restrictive US and EU policies at a 2024 automotive conference, Wang remarked they "are abnormal and only serve to make Chinese car companies proud of their own brands".

Disruptor

BYD now leads Tesla in pure EV sales globally through Q3 this year by ~388,000 units, having now outsold the American carmaker for four consecutive quarters.

Ford and General Motors are trying to figure out how to match mainland manufacturers on both innovation speed and vehicle pricing without destroying their existing cost structures.

Yet BYD looks only to be solidifying its lead.

With 18-month development cycles, comprehensive vertical integration, and a 110,000-engineer workforce looks fundamentally different to the outsourced, just-in-time supply chain model that established carmakers have relied on for decades.

Whether legacy automakers can adapt their business models quickly enough to compete remains an open question.