For decades, the West happily outsourced critical parts of its industrial future to Beijing in exchange for cheap flat-screens and a quiet life. While Western governments were chasing phantom "end of history" dividends, China was methodically cornering key metal supply chains required to build a 21st-century economy.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around the critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

Let's call this what it is: a direct, painful, and highly profitable consequence of a 20-year lapse in strategic thinking. Now, the bill has finally come due.

China's export restrictions on gallium, germanium, antimony, and graphite are a calculated act of economic warfare. And since a ‘truce’ has been called by the United States and China over rare earths supply, market tension is now in the supporting cast: antimony, cobalt, graphite, and other strategic metals.

This is the consequence of letting a primary geopolitical rival become the sole dealer for materials that run the entire Western economy and military.

The problem has worsened. The IEA's Global Critical Minerals Outlook 2025 confirms that between 2020 and 2024, the top three refiners' market share climbed from 82% to a concerning 86%. China alone produces 98% of the world's gallium and controls over 90% of battery-grade graphite refining. Now, they are tugging on the leash.

Anatomy of a supply shock

2025 is the year the gloves came off. The strategic dominoes fell with remarkable speed:

- December 2024: China bans exports of gallium, germanium, and antimony to the U.S.

- February 2025: The Democratic Republic of Congo (DRC), which produces 74% of global cobalt, implements a full export ban as prices hit a nine-year low.

- October 9, 2025: China doubles down, announcing fresh export controls on graphite anode equipment, materials, and technology.

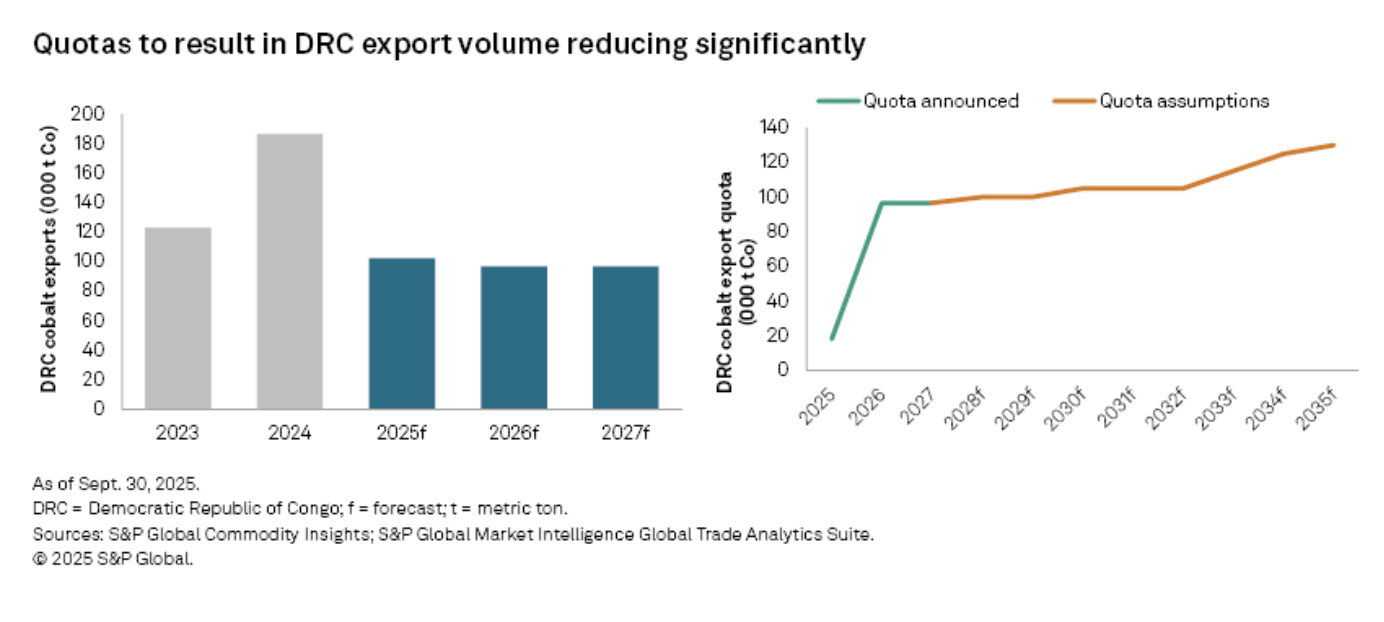

- October 16, 2025: The DRC replaces its ban with a strict quota system, capping 2026-2027 exports at roughly half of pre-ban volumes.

- Washington's Retaliation: The U.S. responds with the only tool it has left, slapping a 93.5% anti-dumping tariff on Chinese graphite, raising the total effective tariff to a high 160%.

The great misdirection: a one-year truce

Just as the market tension hit its peak, the politicians stepped in. In early November 2025, the U.S. and China announced a temporary trade pact - a one-year “pause”.

On paper, it's a significant de-escalation. China has agreed to issue "general export licenses" for rare earths, gallium, germanium, antimony, and graphite, effectively rolling back the very bans and curbs that started this crisis.

The announcement provided a reprieve for markets, particularly for those focused on rare earth elements.

However, this "truce" is a tactical pause, not a structural resolution. It doesn't solve the fundamental problem; it just puts a one-year timer on it. As analysts have noted, this "buys time, not security." Even the U.S. Treasury Secretary himself stated China remains an "unreliable partner.”

The on-the-ground realities remain unchanged:

- Concentration is unchanged: China still controls >90% of graphite and gallium refining.

- The quota is real: The DRC's cobalt quota system is independent of this pact and remains in full effect.

- The threat is proven: China has shown its willingness to weaponise these supply chains. The West now knows where the gun is pointed.

The underlying vulnerability is not only still there - it's been given a one-year expiration date.

The scorecard: where the market actually is

The initial shock sent prices parabolic. But now that the dust is settling, the real picture is emerging. Here is the data-driven scorecard for each key commodity as of November 2025.

Antimony (Sb)

- Latest Price: The $51,500/t spike was a fever dream. The market has settled at a new, permanently high floor. Standard ingots are trading at ~$19,160/t, but high-grade (99.5% Trioxide FOB) for defence use is holding firm at $30,950/t.

- Price History: This is a significant leap from the ~$12,600/t price seen in early 2024. The market rocketed in Q1 2025 before the spike, establishing a new structural baseline.

- Supply: A significant supply-side squeeze. China (controlling ~60% of production) slashed exports by 97%. This has tightened the market considerably; Chinese smelters are reportedly running at less than 55% capacity.

- Demand: Purely strategic. The Pentagon is on a $1 billion stockpiling spree for ammunition. This is a defence-driven market, not an industrial one. Key Western projects, like Perpetua Resources' (PPTA) Stibnite asset, are now viewed as national security infrastructure.

Cobalt (Co)

- Latest Price: The rebound is holding. After the DRC's quota was announced, prices spiked to ~$48,500/t in late October and are forecast to hold near $49,000/t through Q4.

- Price History: This is an entirely policy-driven recovery from the 9-year low of ~$21,500/t seen in February 2025.

- Supply: This market is politically captive. The DRC (~74% of global supply) flipped the market from a significant surplus to a deficit overnight with its export quota, capping 2026-27 exports at 96,600t. This political volatility has major producers like Glencore and CMOC managing operations under immense pressure, while developers like Cobalt Blue Holdings (COB) race to build ex-DRC refining capacity.

- Demand: A tug-of-war. Defence and aerospace must have it for superalloys. EV battery makers are desperately trying to engineer this volatile metal out of their products.

Graphite (C)

- Latest Price: A tale of two markets. Inside China, a massive domestic glut has prices at their lowest point since 2018. Outside China, prices are climbing, forced up by the 160% effective U.S. tariff on Chinese anodes.

- Price History: Prices fell 10-20% in 2024 due to the Chinese oversupply. The 2025 story is this price divergence.

- Supply: China controls ~70% of mining and, importantly, >90% of all battery-grade refining. You either buy from China and pay the tariff, or you don't build batteries.

- Demand: The entire EV anode market. Global demand is set to surge by 140% to 600% by 2030, which will require ~30 new mines that don't yet exist. This places high strategic value on the few integrated ex-China producers, chiefly Syrah Resources (SYR) with its Vidalia facility, and near-term developers like Sovereign Metals (SVM).

Gallium (Ga) & Germanium (Ge)

- Latest Price: The panic spike has cooled, but the "West vs. East" price gap is sizable.

- Gallium: Sits at ~$400/kg (FOB China), but Western buyers are paying a premium of ~$1,245/kg for non-Chinese material.

- Germanium: Sits at ~$2,765/kg (FOB China), while Western premium material is trading at ~$5,800/kg.

- Price History: The Dec 2024 ban created a new, permanent floor. Gallium started 2024 at ~$755/kg and Germanium at ~$2,840/kg.

- Supply: China controls an eye-whopping 98% of primary gallium. Supply is “inelastic” - it's a by-product of alumina and zinc refining and cannot be ramped up easily.

- Demand: Pure high-tech. Gallium is for semiconductors, in 5G and defence radar. Germanium is for fibre optics (34%) and military infrared (22%). The U.S. has zero strategic stockpile of gallium. This reliance keeps all eyes on producers like Teck Resources and developers like Rio Tinto who are exploring by-product recovery circuits.

So, who stands to gain?

Western governments are now throwing cash at the problem. Defence Production Act (DPA) grants, massive government loans, and fast-tracked permits for exploration and development are de-risking projects globally. Here are the frontrunners for each commodity.

Antimony: the ammunition metal

- Global Producers: Outside of China, the key producer is Tajikistan, which supplies 25% of global antimony (and 54% of EU imports) via the Talco Gold (a China-Tajik JV) - so if you think about it, it’s just China anyway.

- U.S. Strategic Frontrunners:

- Perpetua Resources (TSX: PPTA, NASDAQ: PPTA): The U.S. government's key domestic project. Its Stibnite asset in Idaho is positioned to be the only domestically mined source. Backed by a $59.2M DPA grant, it could supply 35% of U.S. demand.

- Alaska Range Resources: A $43.4M DPA grant winner, fast-tracking military-grade antimony trisulphide from its Estelle development.

- United States Antimony Corp: Already cashing in, with a $245 million contract for the National Defence Stockpile.

- Key Developers (ASX/TSX):

- Mandalay Resources (TSX: MND): Operates Australia's only producing antimony mine at Costerfield, set to produce over 1,000t in 2025.

- Larvotto Resources (ASX: LRV): Advancing the Hillgrove operation, with a $157M NPV8 at a conservative $24,500/t.

- Felix Gold (ASX: FXG): Evaluating near-term production in Alaska after hitting high-grade 28% Sb near-surface.

- Lode Resources (ASX: LDR): Exploring the historical Magwood mine, where past grades hit up to 62% Sb.

Cobalt: battery metal under quota

- The Majors (DRC-Reliant): The market is dominated by giants, all reliant on the DRC: Glencore (Switzerland), China Molybdenum (CMOC) (China), Huayou Cobalt (China), and Eurasian Resources Group (ERG) (Luxembourg).

- Key Non-DRC/Russia Producers:

- Glencore: Operates the crucial Murrin Murrin nickel-cobalt mine in Western Australia.

- Vale (Canada): Produces cobalt as a by-product from its Voisey's Bay mine.

- Sherritt International (Canada): Operates the Moa Bay JV in Cuba.

- Next-Generation Developers (ASX/TSX):

- Coda Minerals (ASX: COD): Progressing Elizabeth Creek in South Australia (1,300tpa Co potential).

- Cobalt Blue Holdings (ASX: COB): Building a $60M refinery at Broken Hill (3,000tpa cobalt sulphate).

- Kuniko (ASX: KNI): Advancing its Ertelien prospect in Norway.

Graphite: the anode war

- Key Non-China Producers:

- Syrah Resources (ASX: SYR): One of the most important ex-China players. Operates the large Balama mine in Mozambique and, crucially, the Vidalia anode facility in Louisiana - the first integrated processor outside China.

- Vianode (Norway/Canada): A key player in the synthetic graphite space, building large-scale, low-emission plants in Norway and Canada.

- Key Developer Pipeline:

- Sovereign Metals (ASX: SVM): Developing the large-scale Kasiya project in Malawi. Aims to be the world's largest, lowest-cost non-Chinese producer. Rio Tinto is a 19.99% partner.

- Renascor Resources (ASX: RNU): Backed by an A$185 million Australian government loan for its Siviour project.

- Talga Group (ASX: TLG): Fully permitted in Sweden for its Vittangi-Lulea anode project, designated strategic by the EU.

The inelastic by-products: Ga, Ge, Mo & Ta

The supply of these metals is "inelastic" - it can't respond to price signals because they are almost exclusively by-products of other mining.

- Gallium & Germanium: The global response is focused on building recovery circuits at existing plants.

- Producers: Teck Resources (TSX: TECK) (from its Red Dog zinc mine) and Neo Performance Materials (Canada - recycling).

- Developers: Rio Tinto (Quebec), South32/Alcoa (Australia), Metlen (Greece), and the Stade refinery (Germany) are all advancing plans.

- Molybdenum:

- Producers: This market is dominated by copper giants like Grupo Mexico, Codelco (Chile), and projects like the Antamina mine (Peru).

- Key Developers: Almonty Industries (NASDAQ: ALM) is a key pure-play developer, with an exclusive offtake for its Sangdong project with a SpaceX contractor. The Ann Mason project (Nevada, U.S.) is another key development.

- Tantalum:

- Producers: Outside the DRC/Rwanda, the key primary producer is Advanced Metallurgical Group (AMG) from its Mibra mine in Brazil.

- By-Product: A major source is a by-product from lithium spodumene, primarily from the Greenbushes mine (Talison Lithium).

The final word

Critical minerals have now decoupled from traditional industrial price ebbs and flows. It's become a game of export controls, defence stockpiling and national security.

Cascading export bans, strong Western policy support (DPA grants, gov loans), and high supply concentration means prices will remain structurally high.

For companies with assets in stable jurisdictions, the policy tailwinds have rarely been stronger. Government-backed capital is de-risking projects that would have been stalled for a decade under normal circumstances.

The race is on - and the companies that deliver critical tonnage to allied nations won't just capture pricing power, they'll lock in strategic partnerships that outlast the current commodity cycle.