Oil prices edged higher on Thursday after United States President Donald Trump stepped back from threats to impose tariffs linked to his push to acquire Greenland, easing fears of a U.S.-Europe trade war and supporting expectations for global economic growth and oil demand.

By 2:50 pm AEDT (3:50 am GMT), Brent crude was up 10 cents, or 0.2%, at US$65.34 per barrel, while U.S. West Texas Intermediate crude for March delivery rose 15 cents, or 0.3%, to $60.77 per barrel.

Prices had already gained momentum earlier in the week, climbing more than 1.5% on Tuesday and a further 0.4% on Wednesday, after OPEC+ producer Kazakhstan halted output at its Tengiz and Korolev oilfields on Sunday due to power distribution issues.

ANZ analysts commented in a note to clients: "Crude oil prices were steady as traders took stock of the geopolitical backdrop. Trump’s demands to acquire Greenland and calls for peace in the Ukraine continue to dominate discussions in the market.

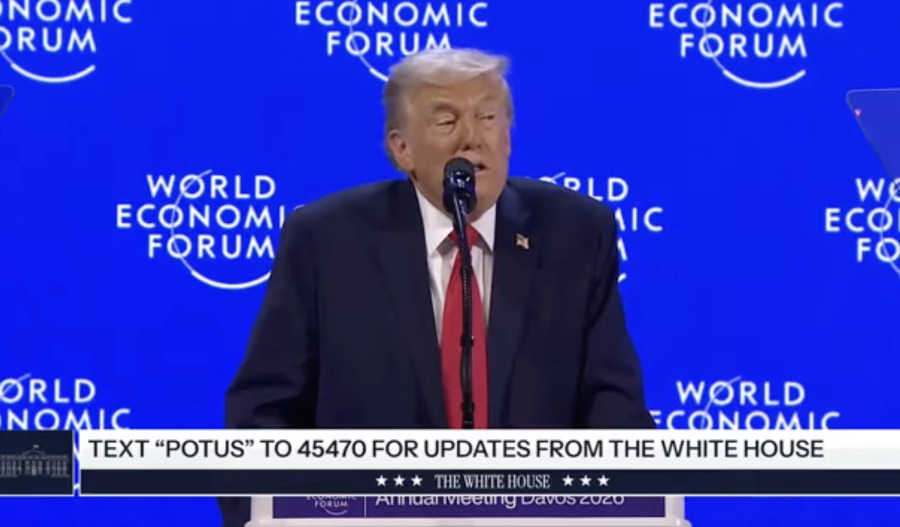

“In his Davos speech, Trump said that Russia and Ukraine are at a point now where they can come together and get a deal done. An end to the war would likely result in U.S. sanctions on Russia being removed, which would limit disruptions to supplies.

"However, sentiment was boosted by a slightly more positive outlook from the International Energy Agency. It increased its forecast for global oil demand growth in 2026 for a third consecutive month.

"World consumption will now grow by 930kb/d, the IEA stated in its latest monthly report. Stockpiles are theoretically on track to rise by 3.7mb/d this year, according to this assessment. However, IEA cautioned that the actual overhang may not reach these levels."

Meanwhile, U.S. crude and gasoline inventories rose last week, while distillate stocks edged lower, according to market sources citing data from the American Petroleum Institute.

Crude inventories rose by 3.04 million barrels in the week ended 16 January, the sources said, speaking to Reuters on condition of anonymity.

Gasoline stocks increased by 6.21 million barrels, while distillate inventories fell by 33,000 barrels.

The U.S. Energy Information Administration is due to release its official inventory data on Friday, with market expectations pointing to a draw of around 2.5 million barrels.