Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Nintendo reports strong Switch 2 sales

- Uber trips surge, though operating income falls short

- AMD beats estimates with Client and Gaming strength

- Spotify sees major growth in paying subscribers

- Super Micro, Pinterest, Live Nation fall below earnings estimates

- Marriott profit rises on international demand

- Pfizer beats estimates despite decline in income

_______________________________________________________________________________________

8:50 am (AEDT):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Starting off on the TYO with Nintendo (7974), the company has raised its sales forecast for its Switch 2 console after it drove a major surge in revenue.

Nintendo's net sales for the six months ended 30 September were JP¥1.10 trillion, up 110.1% year-over-year, with ¥874.3 billion of this from outside Japan. Its profit per share was ¥170.87, up from ¥93.33.

Operating profit rose by 19.5% to ¥145.18 billion. Ordinary profit increased 60.5% to ¥236.04 billion.

Switch 2 sales reached 10.36 million units following its launch in June. Sales of Nintendo's Switch 2 software were 20.62 million units.

Nintendo expects to sell 19 million Switch 2 consoles by March 2026, up from its prior forecast of 15 million.

“For Nintendo Switch 2, following the release of Pokémon Legends: Z-A – Nintendo Switch 2 Edition, as well as a Nintendo Switch 2 hardware bundle that includes this title in October, we plan to release Kirby Air Riders in November and Metroid Prime 4: Beyond – Nintendo Switch 2 Edition in December. Other software publishers also plan to release a range of titles,” wrote Nintendo. “We will aim to keep the momentum of released titles and continuously introduce new titles to expand the platform's user base.”

It projects net sales will be ¥2.25 trillion across the fiscal year to March, with profit per share of ¥300.62.

Shares were down 0.77% yesterday, with trading set to open today at 11 am AEDT.

Frankie Reid has the full story.

9:15 am (AEDT):

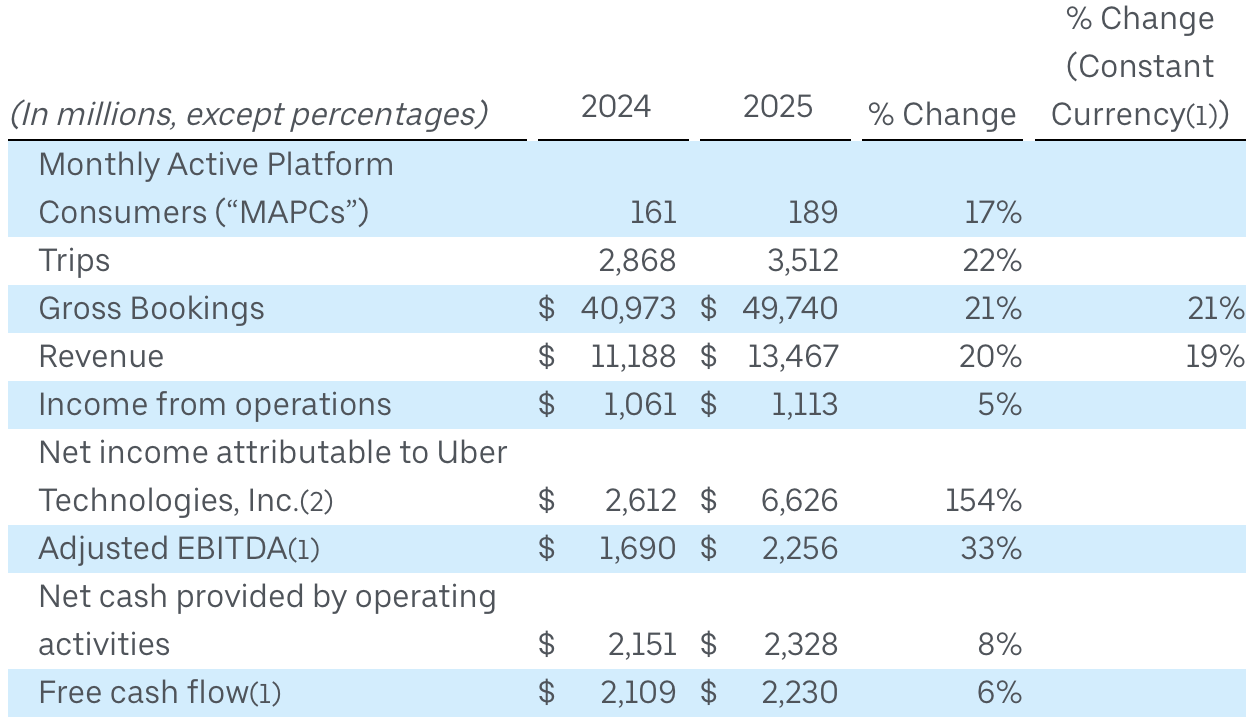

Over to the NYSE, Uber (UBER) beat revenue estimates last quarter, though shares dropped 5.1% on weaker-than-expected operating income.

Revenue was US$13.47 billion, up 20% year-over-year and above LSEG estimates of $13.28 billion. Earnings per share were $3.11, up from $1.20.

Gross bookings rose 21% to $49.74 billion, also passing StreetAccount estimates of $48.95 billion.

Income from operations was up 5% to $1.11 billion, below VisibleAlpha estimates of $1.61 billion.

Trip numbers were up 22% to 3.5 billion. Monthly Active Platform Consumers increased by 17% to 189 million, and trips per monthly active user grew by 4%.

“Uber’s growth kicked into high gear in Q3, marking one of the largest trip-volume increases in the company’s history,” said CEO Dara Khosrowshahi. “We’re building on that momentum by investing in lifelong customer relationships, leaning into our local commerce strategy, and harnessing the transformative potential of AI and autonomy.”

The company expects gross bookings of $52.25-53.75 billion for the fourth quarter.

9:35 am (AEDT):

Moving to the NASDAQ, Advanced Micro Devices (AMD) surpassed earnings per share and revenue estimates after a major surge in its Client and Gaming segment.

Earnings per share were up 30% to US$1.20, above LSEG estimates of $1.16. Revenue increased 36% to $9.25 billion, beating estimates of $8.74 billion.

Client and Gaming segment revenue grew by 73% to $4 billion, which the company credited to greater sales of Ryzen processors and Radeon gaming GPUs. Client revenue was up 46% to a record $2.8 billion, while Gaming revenue rose 181% to $1.3 billion.

Data Center segment revenue increased by 22% to $4.3 billion on strong demand for fifth generation EPYC processors and Instinct MI350 Series GPUs. Embedded segment revenue dropped 8% to $857 million.

AMD will power OpenAI's next-generation artificial intelligence infrastructure with its Instinct GPUs, the companies said last month, which is set to begin in the second half of 2026.

AMD projects Q4 revenue will be $9.6 billion, plus or minus $300 million.

Shares fell 3.7% during the day, and a further 2.7% in after-hours trading.

9:47 am (AEDT):

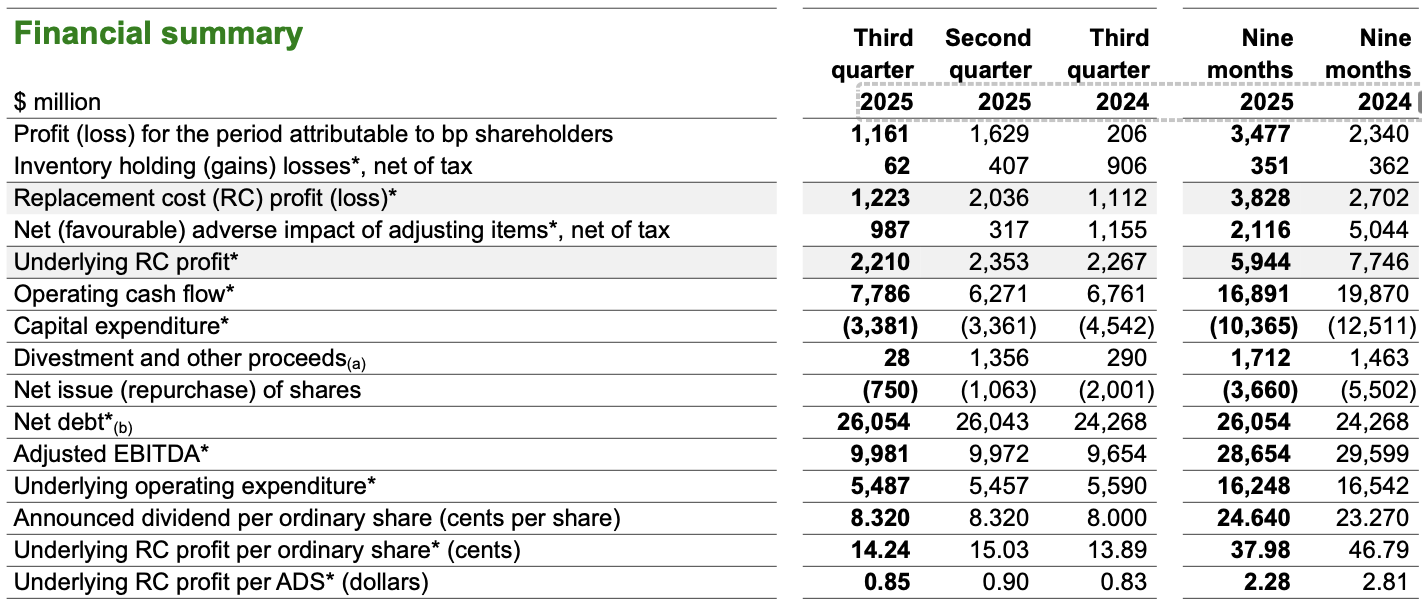

At the LSE, BP (BP) posted better-than-expected profit last quarter, with high production balancing the period's lower oil prices.

Underlying replacement cost profit was US$2.21 billion, down from $2.27 billion one year ago but above LSEG estimates of $2.03 billion.

Earnings per share were $0.85, up from $0.83 and passing Zacks estimates of $0.72. Revenue was $49.3 billion, increasing from $48.3 billion but below Zacks estimates of $63 billion.

Total production was 1.556 million barrels of oil equivalent per day, rising from 1.488 million barrels one year ago. Prices were $59.58 per barrel, falling from $70.22.

"We continue to make good progress to cut costs, strengthen our balance sheet and increase cash flow and returns. We are looking to accelerate delivery of our plans, including undertaking a thorough review of our portfolio to drive simplification and targeting further improvements in cost performance and efficiency," said CEO Murray Auchincloss.

10:12 am (AEDT):

Back to the NYSE, Spotify (SPOT) beat estimates on revenue and earnings per share after strong paying subscriber growth.

Revenue was EU€4.27 billion, up from €3.99 billion year-over-year and passing Bloomberg estimates of €4.23 billion. Earnings per share were €3.28, rising from €1.45 and above estimates of €1.98.

Paying subscribers rose 12% to 281 million, with growth across all regions. Monthly active users were up 11% to 713 million.

Operating income increased 28% to €582 million.

"The business is healthy. We’re shipping faster than ever. And we have the tools we need – pricing, product innovation, operational leverage, and eventually the ads turnaround – to deliver both revenue growth and profit expansion," said outgoing CEO Daniel Ek. Ek will step down as CEO at the end of the year, but remain as executive chair.

Its fourth quarter outlook expects 745 million monthly active users with 289 million paying subscribers, and revenue of €4.5 billion.

Shares closed 2.3% lower.

Read Chloe Jaenicke's full story here.

10:48 am (AEDT):

And on the NASDAQ, Shopify (SHOP) reported major growth in revenue and gross merchandising volume last quarter.

Revenue was US$2.84 billion, up from $2.16 billion year-over-year. Gross profit was $1.39 billion, rising from $1.12 billion.

Merchant solutions revenue grew from $1.55 billion to $2.15 billion. Subscription solutions revenue increased from $610 million to $699 million.

Gross merchandising volume was $92.01 billion, growing from $69.72 billion.

Operating income was $343 million, increasing from $283 million. Operating expenses rose from $835 million to $1.05 billion.

"We build. We ship. We grow. That’s the model - and it’s running at full speed. From entrepreneurs making their very first sale on Shopify every 26 seconds, to global icons like Estée Lauder, we’re powering growth across the full spectrum of commerce," said president Harley Finkelstein.

For Q4, it projects revenue percentage growth in the mid to high twenties, and gross profit percentage growth in the low to mid twenties.

Shopify shares dropped 6.9% across the day.

11:12 am (AEDT):

Over to Milan, Ferrari (RACE) saw a 7.4% jump in revenue despite a decline in shipments in the Americas, with shares rising 3.2%.

Revenue was EU€1.77 billion. Net profit was up 2% to €382 million, beating LSEG estimates of €367.33 million.

Sponsorship, commercial, and brand revenue also rose 21% to €211 million.

EBITDA increased 5% to €670 million. Operating profit increased 7.6% to €503 million.

Total shipments were up 1% to 3,401 units, with Europe, the Middle East, and Africa shipments growing 2% to 1,449 units.

The Americas, its second-largest market, posted a 2% drop in shipments to 1,045 units. The U.S. agreed in September to lower tariffs on European Union-made automotives from 25% to 15%, effective retroactively from August.

Shipments to Mainland China, Hong Kong, and Taiwan fell by 12% to 248. APAC shipments were up 9% to 659.

“We continue to advance with conviction and strong visibility on our development path. At our Capital Markets Day, we have defined a clear trajectory in the long-term interests of our brand, setting the floor for sustainable growth toward 2030,” said CEO Benedetto Vigna.

Its full-year guidance expects at least €7.1 billion in revenue and at least €2.72 billion in EBITDA.

11:32 am (AEDT):

Back to the NASDAQ, Thomson Reuters (TRI) beat estimates on earnings per share and revenue, and a large increase in operating profit.

Earnings per share were US$0.85, up from $0.80 year-over-year and passing Zacks estimates of $0.81. Revenue grew 3% to $1.78 billion, above Zacks estimates by 0.76%.

Operating profit soared 43% to $593 million. The company credited this to a gain on the sale of its remaining stake in financial practice management business Elite, as well as higher revenues.

Adjusted EBITDA increased by 10% to $672 million.

Revenues from its Legal Professionals segment dropped 2% to $728 million. Corporates revenue rose 10% to $478 million, while Tax & Accounting Professionals were up 13% to $251 million.

Its full-year outlook expects revenue growth of 3.0-3.5%. Thomson Reuters shares dropped 5.8%.

11:41 am (AEDT):

In a U.S. futures trading update, Pinterest (NYSE: PINS) dropped 20.2% after missing earnings per share estimates. Super Micro Computer (NASDAQ: SMCI) also fell 9.0% after falling short of earnings expectations.

Arista Networks shares declined 11.3% on weaker-than-expected guidance.

Rivian Automotive (NASDAQ: RIVN) shares increased 3.5%, as losses were smaller than projected.

Read Oliver Gray's full trading update here.

11:57 am (AEDT):

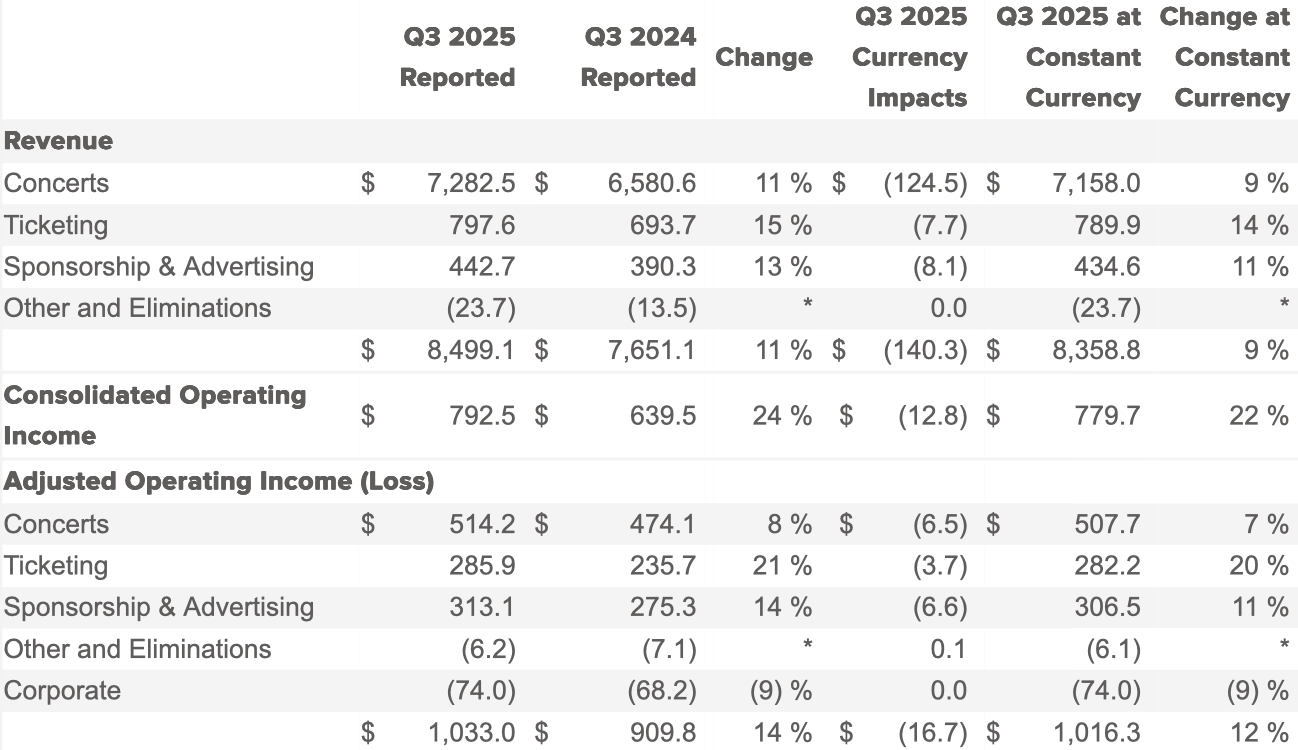

And back to the NYSE, Live Nation (LYV) missed estimates on both revenue and earnings per share, sending shares down 5.5% after-hours.

Earnings per share were US$0.73, down from $1.66 and below Zacks estimates of $1.21. Revenue was up 11% to $8.50 billion, under estimates by 0.59%.

Operating income was $792.45 million, up from $639.53 million.

Concerts revenue was up 9% to $15.71 billion. Ticketing revenue increased 4% to $2.23 billion, and Sponsorship & Advertising revenue climbed 9% to $999.3 million.

The company said its stadium show numbers were up 60% globally.

“Strong fan demand drove another record quarter, as we continue to attract more fans to more shows globally. With these tailwinds, 2026 is off to a strong start with a double-digit increase in our large venue show pipeline and increased sell-through levels for these shows,” said CEO Michael Rapino.

The U.S. Federal Trade Commission sued Live Nation and subsidiary Ticketmaster in September, alleging it had collaborated with ticket scalpers to resell tickets at high markups. Live Nation has denied this.

12:19 pm (AEDT):

Sticking with the NYSE, Pinterest (PINS) missed estimates on earnings per share and issued lower-than-expected guidance.

Earnings per share were US$0.38, up from $0.32 but below LSEG estimates of $0.42. Revenue was $1.05 billion, in line with estimates and rising from $898.37 million.

Income from operations was $58.52 million, compared with a loss of $5.92 million one year ago. Adjusted EBITDA grew 24% to $306.05 million.

Global monthly active users were 600 million, up 12%. U.S. and Canada active users increased 4%, while European users rose by 8%. Users from other regions, which represented the majority, were up 16%.

Average revenue per user was $1.78, rising 5% but below StreetAccount estimates of $1.79.

Costs and expenses increased from $904.29 million to $990.69 million.

Its guidance next quarter expects revenue of $1.313-1.338 million, with a midpoint below revenue guidance estimates of $1.34 billion.

Pinterest shares dropped 2.4% during the day, and have now plummeted 20.2% in after-hours trading.

12:53 pm (AEDT):

Good afternoon, Chloe Jaenicke here to take care of the blog for a bit.

On the NASDAQ, Marriott International (MAR) reported a rise in third-quarter profit as international demand countered softness in its budget.

Adjusted net income totalled US$674 million, increasing from US$638 million in the third quarter of 2024.

Adjusted earnings per share also rose from US$2.26 to US$2.47.

Worldwide revenue per available room (RevPAR) increased by 0.5% worldwide, driven by a 2.6% increase in international markets and pushed down by a 0.4% decline in the U.S. and Canada due to “calendar shifts and ongoing macroeconomic uncertainty”.

“International RevPAR increased 2.6%, led by APEC, which delivered nearly 5% growth fuelled by strong performance in key markets like Japan, Australia and Vietnam.” President and CEO, Anthony Capuano said.

“In the U.S. & Canada, RevPAR declined 0.4% due to weaker demand in the lower chain scales, largely reflecting reduced government travel.”

Capuano also said the company’s new travel rewards program, Marriott Bonvoy, continued to grow throughout the quarter.

“During the third quarter, we added another 12 million members, bringing total global membership to nearly 260 million.” he said.

“Member penetration remained strong at 75% in the U.S. & Canada and 68% globally, reflecting deep engagement with our expanding global member base.”

The company returned around US$3.1 billion to its shareholders year-to-date through 30 October through share repurchases and dividends and expects to return about US$4 billion to shareholders in 2025.

1:26 pm (AEDT):

Owner of Pizza Hut, Taco Belland KFC, Yum! Brands (NYSE: YUM) reported earnings and revenues that beat analysts' estimates.

Worldwide system sales for the company grew by 5%, with the growth being led by Taco Bell at 6% and KFC at 6%.

Third quarter EPS also grew by 15% from the same time last year to US$1.58. This also beat the Zacks Consensus Estimate of US$1.47.

Quarterly revenues for the company also increased by 8% year-over-year to US$1.98 billion, surpassing expectations of US$1.96 billion.

This comes as the company announced the initiation of a strategic review for its Pizza Hut Brand to improve longevity and completed plans to acquire 128 Taco Bell restaurants across the Southeast of the U.S..

“Going forward, my three priorities for driving growth will be staying relevant with the next generation of consumers, leveraging our global scale to strengthen franchisees’ store-level economics, and expanding Byte across more restaurants worldwide,” CEO Chris Turner said.

1:59 pm (AEDT):

Thanks so much, Chloe! Harlan Ockey back with you again.

Still with the NYSE, Pfizer (PFE) has raised its guidance after beating estimates, though revenue and income declined.

Revenue was down 6% to US$16.65 billion, above LSEG estimates of $16.58 billion.

Earnings per share were down 18% to $0.87, passing estimates of $0.63. The company took an $0.20 hit to its earnings per share from a one-off charge related to its in-licensing agreement with Chinese pharmaceuticals producer 3SBio.

Its Global Pharmaceuticals segment, its largest, saw revenue drop 6% to $16.31 billion.

Pfizer's adjusted cost of sales fell 18% to $3.98 billion, while research and development expenses decreased 3% to $2.49 billion.

Its full-year guidance projects revenue of $61-64 billion, with earnings per share of $3.00-3.15. Its prior earnings per share forecast was $2.90-3.10.

While U.S. President Donald Trump has repeatedly threatened to impose tariffs on pharmaceuticals, Pfizer will be exempt for three years under a deal struck in September.

“I am proud of Pfizer’s leadership as the first in our industry to reach an agreement with the U.S. Government, which we believe provides greater clarity for our business. Additionally, our recent strategic actions have strengthened opportunities to advance innovation that could address significant medical needs in high growth markets, helping us deliver value for patients and shareholders,” said CEO Albert Bourla.

2:30 pm (AEDT):

And at the NYSE, Arista Networks (ANET) shares dropped after offering middling guidance, despite beating revenue and earnings per share estimates.

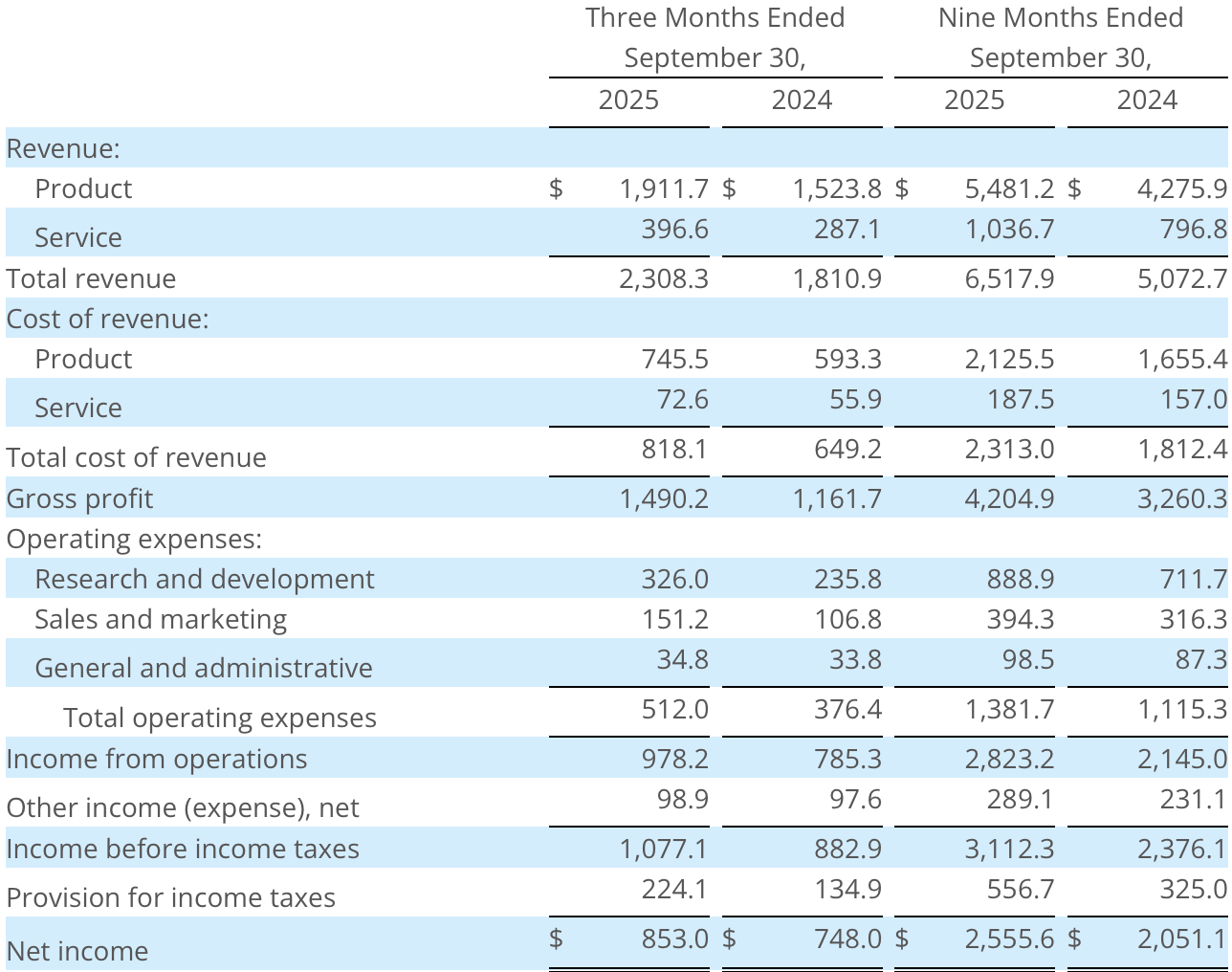

Earnings per share were US$0.75, up from $0.60 year-over-year and above FactSet estimates of $0.72. Revenue was $2.31 billion, growing from $1.81 billion and passing estimates of $2.26 billion.

Product revenue was $1.91 billion, rising from $1.52 billion. Service revenue increased from $287.1 million to $396.6 million.

Income from operations was $978.2 million, compared with $785.3 million one year ago. Its gross margin was 65.2%, up from 64.6%.

"Our centres of data strategy is resonating well across customers and analysts because it delivers a superior client to campus to cloud/data and AI centers experience," said CEO Jayshree Ullal. “After yet another strong performance in Q3 2025, Arista is well-positioned as a strategic networking provider with continued durable execution.”

Arista's Q4 guidance includes revenue of $2.3-2.4 billion and a gross margin of 62-63%. FactSet estimates projected $2.33 billion in revenue and a 62.9% gross margin.

Shares fell by 12.7% across after-hours trading.

2:56 pm (AEDT):

Over to São Paulo, Itaú (ITUB4) met net recurring profit estimates, and has revised its guidance upwards.

Recurring profit was BR$11.88 billion (A$3.4 billion), up from R$10.68 billion year-over-year and in line with LSEG estimates.

Operating revenue was R$46.57 billion, rising from $42.69 billion. Net income per share was R$1.07, climbing from R$0.95.

Net interest income was R$31.38 billion, compared with R$28.51 billion one year ago. Return on equity was 23.3%, up from 22.7%.

Itaú's total credit portfolio grew from R$1.32 trillion to R$1.40 trillion.

The company's full-year forecast expects total credit portfolio growth of 4.5-8.5%. It has revised its financial margin with the market to R$3.0-3.5 billion, increasing from its prior guidance of R$1.0-3.0 billion, and it projects its financial margin with clients will grow 11-14%.

3:36 pm (AEDT):

Back at the NYSE, Anywhere Real Estate (HOUS) swung to a loss ahead of its merger with Compass, Inc.

Its loss per share was US$0.12, down from earnings of $0.06 one year ago. Revenue increased by 6% to $1.63 billion.

Gross commission income revenues were $1.32 billion, up from $1.24 billion. Service revenue rose from $156 million to $165 million.

Anywhere posted a net loss of $13 million, falling from income of $7 million. Operating EBITDA was $100 million, dropping 7%.

Total expenses climbed from $1.53 billion to $1.64 billion.

Anywhere said in September that it would merge with real estate broker Compass, Inc, with the transaction set to close in the second half of 2026. The new combined company will have an enterprise value of roughly $10 billion.

"Our proposed merger with Compass will create the premier platform where agents, franchisees, and employees can thrive as we drive meaningful innovation across the real estate experience," said Anywhere CEO Ryan Schneider.

4:19 pm (AEDT):

And back to the NASDAQ, Super Micro Computer (SMCI) missed estimates on both earnings per share and revenue, with shares dropping by 9.5% in extended trading.

Earnings per share were US$0.35, down from $0.73 year-over-year and below LSEG estimates of $0.40. Revenue was $5.02 billion, falling from $5.94 billion.

Gross profit fell to $467.37 million, from $775.58 million.

Income from operations collapsed to $285.12 million, compared to $266.38 million one year ago.

Operating expenses increased from $266.38 million to $285.12 million, driven by a surge in research and development costs.

“Powered by DCBBS, Supermicro is expanding/transforming into a leading AI and datacenter infrastructure company, delivering total solutions that simplify deployment, accelerate time-to-market, and reduce TCO," said CEO Charles Liang.

“With a rapidly expanding order book, including more than $13B in Blackwell Ultra orders, we expect at least $36 billion in revenue for fiscal year 2026,” he said. It also projects earnings per share of $0.46-0.54.

Super Micro shares were down 6.4% during the day, and fell a further 9.5% in extended trading.

Thank you for joining us today. Later tonight, we'll see earnings from Toyota, and tomorrow we'll have earnings from companies like McDonald's and Qualcomm. See you next time!