AMD posted a record third-quarter revenue of US$9.25 billion, climbing 36% year-over-year on surging demand for its EPYC server processors and Instinct AI accelerators.

The chipmaker reported diluted earnings per share of $1.20 on a GAAP basis, a beat of 3 cents, while revenue also comprehensively exceeded the $8.74 billion expected by Wall Street.

GAAP net income jumped 61% to $1.24 billion compared to Q3 last year, as gross margin reached 52%.

Operating expenses expectedly climbed 30% to $3.5 billion as the company ramps up investment in AI product development.

AMD CFO Jean Hu highlighted record free cash flow generation, reflecting what she called "disciplined execution" of the company's AI and high-performance computing investments.

“Our continued investments in AI and high-performance computing are driving significant growth and position AMD to deliver long-term value creation.”

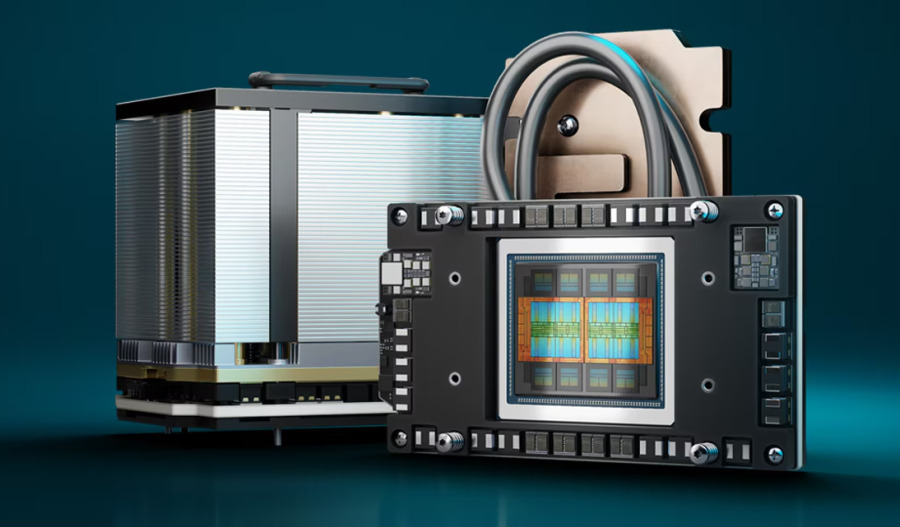

The data centre division pulled in $4.34 billion, gaining 22% year-over-year and beating consensus of $4.13 billion, fuelled by strong uptake of 5th Gen EPYC processors and the MI350 Series GPUs.

Worth noting - Q3 results didn't include any revenue from Instinct MI308 GPU shipments to China due to U.S. export restrictions.

That same constraint hammered Q2 with $800 million in inventory charges.

But it's the client and gaming units that really turned heads.

Client revenue reached a record $2.75 billion, advancing 46% and topping the $2.61 billion consensus, while gaming turnover surged 181% to $1.30 billion, easily clearing the $1.05 billion estimate - on the back of higher semi-custom sales and Radeon GPU demand.

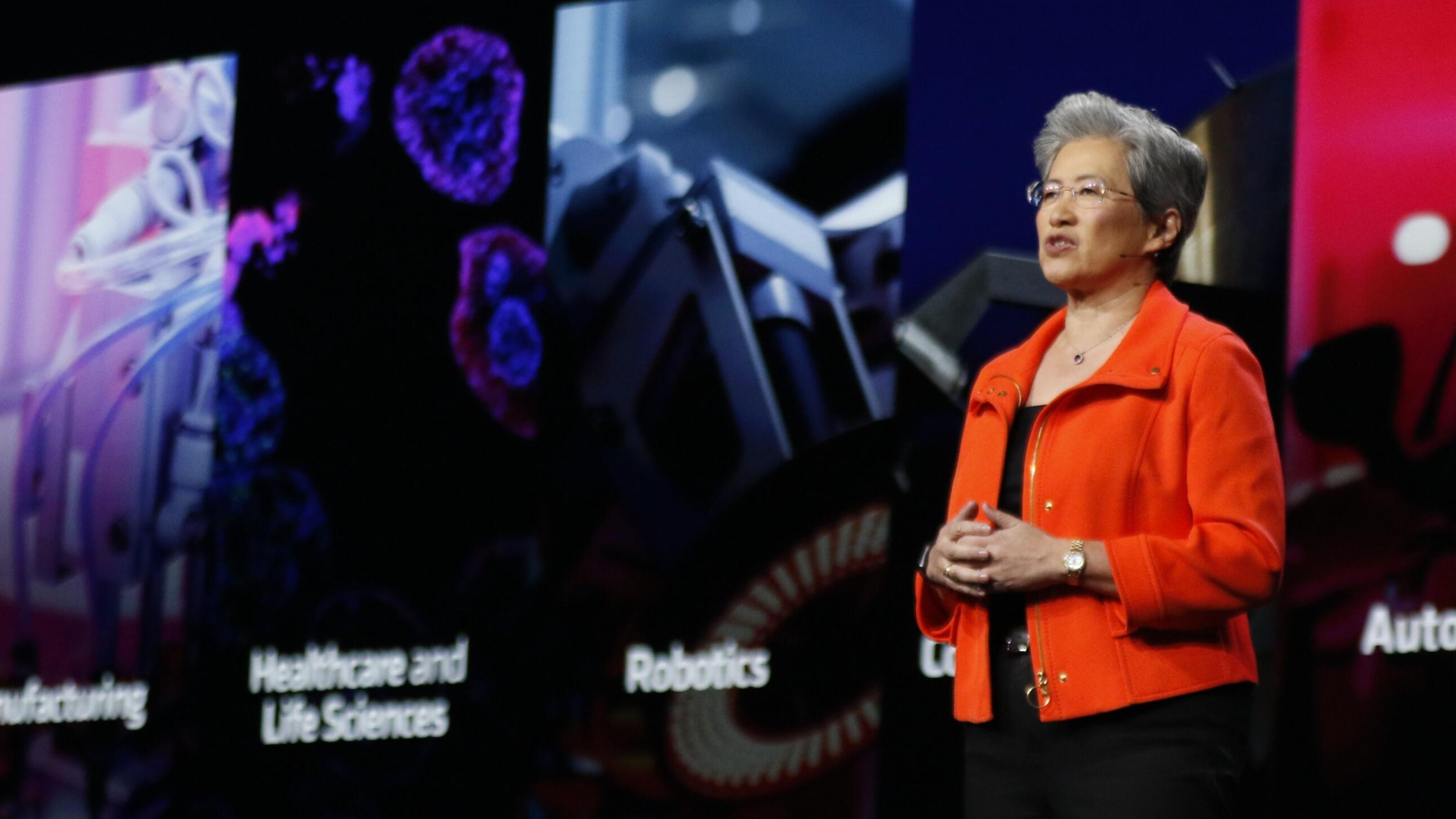

AMD CEO Lisa Su said the results marked "a clear step up" in the company's growth trajectory as its data centre AI business scales rapidly.

“We delivered an outstanding quarter, with record revenue and profitability reflecting broad based demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators,” Su said.

Guidance

For Q4, AMD expects sales around $9.6 billion (plus or minus $300 million), representing 25% year-on-year growth and 4% sequential expansion - above LSEG’s $9.15 billion consensus.

The company’s non-GAAP gross margin forecast of ~54.5% met analyst expectations.

Q4 guidance notably excludes any potential takings from MI308 shipments to China, suggesting AMD is taking a conservative stance on export control uncertainties.

On the horizon

In business deals, AMD's AI momentum continues to build, with the company announcing a strategic partnership with OpenAI that could see the AI startup take a 10% stake in the chipmaker.

OpenAI will deploy 6 gigawatts of AMD GPUs—the first 1-gigawatt deployment of Instinct MI450 GPUs set to begin in H2 2026. And Oracle will launch an AI supercluster with 50,000 GPUs starting Q3 2026.

In a separate development, Amazon, a key cloud customer for AMD, disclosed in a Tuesday filing that it had sold all 822,234 of its AMD shares as of 30 September.

Despite the strong top-and-bottom-line beats, the stock slipped in extended trading.

It could be that the market reacted to an adjusted gross margin guidance of 54.5% that was only in line with consensus estimates, rather than exceeding them.

At the time of writing, Advanced Micro Devices (NASDAQ: AMD) stock was trading at US$250.05, easing 3.7% from Monday's close of $259.65, before falling 3% after-hours to $241.95. AMD's market cap stands at $405.79 billion.