Wall Street tech giant AMD's market capitalisation jumped US$100 billion in a single session Monday after announcing a major chip supply deal with OpenAI, continuing the pattern of major tech stocks putting their hands in each other's pockets.

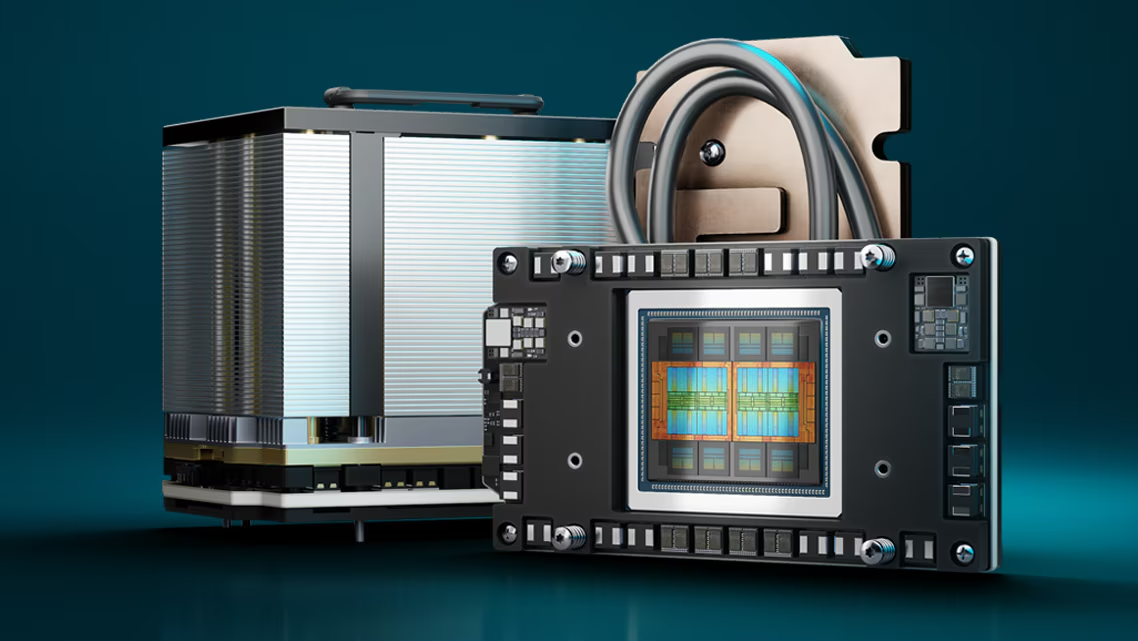

Under the agreement, OpenAI will deploy 6 gigawatts of AMD Instinct MI450 GPUs starting in the second half of 2026, with the deployment scaling across multiple chip generations.

AMD has issued OpenAI warrants for up to 160 million shares - around 10% of the company - that vest as deployment milestones are reached.

"Our partnership with OpenAI is expected to deliver tens of billions of dollars in revenue for AMD while accelerating OpenAI's AI infrastructure buildout," AMD CFO Jean Hu said.

The deal positions the chipmaker as a core compute partner to OpenAI and helps the latter diversify from its single-vendor supply from Nvidia.

Investors poured in as the news broke, and at one stage, AMD had risen a whopping 38% during a trade where AI tech stocks also rallied higher.

AI's circular economy

The deal follows a series of interconnected AI infrastructure agreements announced in recent weeks, with OpenAI committing roughly $1 trillion in infrastructure buildout spending across tech giants AMD, Nvidia and Oracle.

It started a fortnight ago when Nvidia committed $100 billion to invest in OpenAI, with OpenAI using those funds to buy Nvidia's chips.

Then last month, OpenAI signed a $300 billion deal with Oracle for cloud services, and Oracle ordered $40 billion in GPUs from Nvidia.

AMD also gave OpenAI $26 billion in equity at last Friday's close, which OpenAI will use to buy AMD chips.

The structure has Nvidia supplying capital to buy its own chips, Oracle building sites with OpenAI money then buying Nvidia chips, and AMD issuing shares so OpenAI can buy AMD chips.

That positions OpenAI at the centre, anchoring AI infrastructure and compute demand.

What the analysts say…

CNBC described it as “a tightly wound circular economy, and one that analysts fear could face real strain if any link in the chain starts to weaken”.

"If a significant share of turnover derives from transactions fuelled by capital that the companies themselves have injected into the circuit, the risk is that these revenues arise from non-real demand and are not fully sustainable over time," Italian financial outlet Il Sole 24 ORE stated.

Goldman Sachs said circular deals make up less than 15% of 2027 revenue estimates.

"People are out on the risk curve because they're excited," GS CEO David Solomon said last week, predicting “a lot of capital that's deployed will turn out to not deliver returns”.

"The market's immediate reaction appears excessive, pricing in years of perfect execution and future cash flows," Seeking Alpha analysts said, noting that revenue won't arrive until late 2026 at the earliest.

They advised holding AMD but not adding at current levels.

Others were more bullish. "This is a major win for AMD and shows that it has been putting the right strategy in place to take advantage of the AI mega-wave with its advanced GPUs," infrastructure analyst Jack Gold said.

“It's also an endorsement that AMD has become competitive with Nvidia processing power.”