Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Tesla sees first annual revenue decline on record

- Microsoft beats estimates, but cloud growth flags

- Meta revenue surges

- Starbucks issues guidance again as sales rise

- Samsung posts record operating profit

- AT&T fibre segment powers earnings beat

- Plus General Dynamics, Levi Strauss, ASML, IBM, Southwest Airlines, and more

_______________________________________________________________________________________

8:58 am (AEDT):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Kicking things off with Volvo (STO: VOLV-B), sales remained flat last quarter, with profits taking a significant hit from tariffs..

Net sales fell by 11% to SEK 123.8 billion (US$14.0 billion), the company said, but were largely unchanged when adjusted for currency movements and its divestment of China-based construction machinery maker SDLG. FactSet estimates were SEK 121.67 billion.

Its net profit was SEK 9.61 billion (US$1.1 billion), falling from SEK 10.74 billion one year ago but above estimates of SEK 8.89 billion.

The company saw a SEK 800 million hit to profit from tariffs, and has forecast a SEK 1 billion impact in 2026's first quarter. Adjusted operating income was SEK 12.77 billion, dropping from SEK 14.04 billion.

Volvo's new truck deliveries dropped by 3.4% last quarter. It has raised its guidance for both European and North American heavy duty truck markets, however, and expects 305,000 vehicles in Europe and 265,000 in North America during 2026.

Volvo's shares closed 2.6% higher.

9:22 am (AEDT):

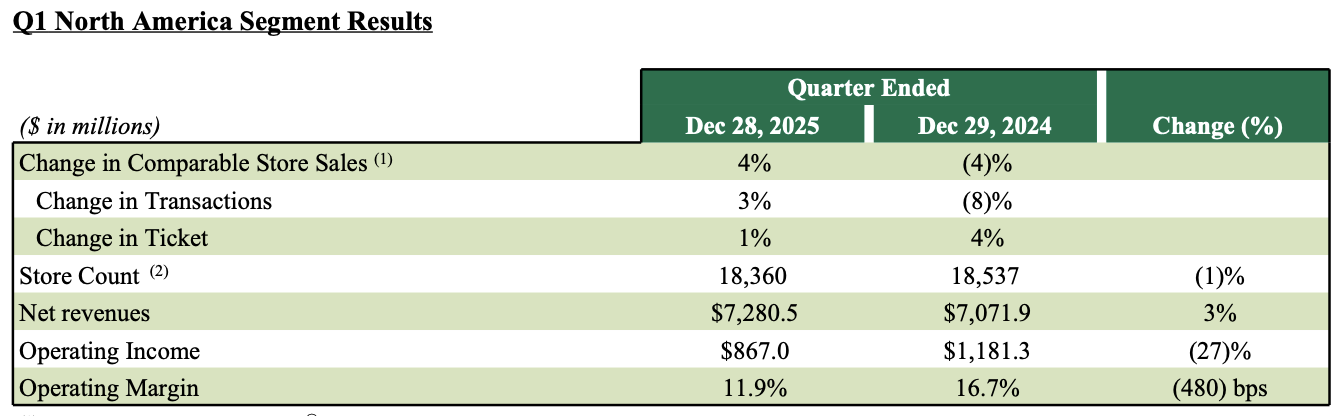

Moving to the Nasdaq, Starbucks (SBUX) posted mixed results, but has issued guidance for the first time since 2024 as sales increase.

Total revenue was US$9.92 billion, up 5.5% and passing LSEG estimates of $9.67 billion. Earnings per share dropped 19% to $0.56, below estimates of $0.59.

Comparable store sales increased 4% worldwide, with a 4% rise in North America and 5% growth internationally. North American operating income fell by 27%, which the company credited to labour investments and higher coffee prices amid U.S. tariffs.

Starbucks opened 128 net new locations during the quarter, with its store count rising 3% internationally. Location numbers declined by 1% in North America.

“Our Q1 results demonstrate our 'Back to Starbucks' strategy is working and we believe we're ahead of schedule,” said CEO Brian Niccol. “It's great to see the sales momentum driven by more customers choosing Starbucks more often, and this is just the beginning.”

The company projects earnings per share of $2.15-2.40 across fiscal 2026, compared with estimates of $2.35, and global sales growth of at least 3%. Starbucks had halted its forecasts in October 2024.

9:32 am (AEDT):

Over to the NYSE, Levi Strauss (LEVI) beat estimates last quarter, though shares fell on weaker-than-expected guidance.

Revenue was up 1% to US$1.77 billion, above LSEG estimates of $1.71 billion. Earnings per share were $0.41, down from $0.49 but beating estimates of $0.39.

“Over the past few years, we’ve taken bold steps toward becoming a DTC-first, head-to-toe denim lifestyle brand,” said CEO Michelle Gass. “We have narrowed our focus, improved operational execution and built greater agility across the organization. As a result, we’ve elevated the Levi’s® brand and delivered faster growth and higher profitability, as reflected by our Q4 and full year 2025 results.

Americas revenue declined 4% to $959 million. Europe revenue was up 8% to $469 million, while Asia revenue climbed 2% to $291 million. Its adjusted EBIT margin shrank from 13.9% to 12.1%, driven largely by U.S. tariffs.

Levi projects fiscal 2026 earnings per share of $1.40-1.46, under estimates of $1.48, and net revenue growth of 5-6%.

Shares closed 3.7% lower, and fell a further 1.2% after-hours.

Read Chloe Jaenicke's story here.

9:46 am (AEDT):

Back at the Nasdaq, Microsoft (MSFT) exceeded estimates, but shares dropped as cloud growth slowed.

The company's revenue was up 16.7% year-over-year to US$81.27 billion, passing LSEG estimates of $80.27 billion. Earnings per share climbed 24% to $4.14, besting estimates of $3.97.

Revenue for Azure and its other cloud services grew 39%. This is a decline form the 40% growth it reported in the prior quarter, though still in line with StreetAccount estimates of 39.4%.

Total Microsoft Cloud revenue rose 26% to $51.5 billion, with Intelligent Cloud revenue up 29% to $32.9 billion.

Its commercial remaining performance obligation increased by 110% to $625 billion at the end of its fiscal 2025. This was driven by the $250 billion cloud partnership Microsoft and OpenAI announced in November, with around 45% of Microsoft's backlog tied to OpenAI.

Operating income rose 21% to $38.28 billion. Total operating expenses climbed to $17.02 billion, from $16.18 billion.

Shares dropped by 2.1% in after-hours trading.

Oliver Gray has the full story.

10:05 am (AEDT):

And at the NYSE again, GE Vernova (GEV) beat estimates, driven by strong growth in Power and Electrification.

Earnings per share were US$13.39, up from $1.73, due to a $2.57 billion income tax benefit. Revenue grew 3.8% to $10.96 billion, passing FactSet estimates of $10.21 billion.

“We delivered strong financial performance in 2025 with continued momentum in Power and Electrification while focusing on what we can control in Wind. We increased our backlog to $150 billion, with better equipment margins, and are entering 2026 with significant momentum,” said CEO Scott Strazik.

Power revenues were up 6% to $5.75 billion, with orders rising 78%. Electrification revenues increased 36% to $2.96 billion, while Wind revenues dropped 24%.

Its operating income climbed 2% to $602 million.

10:35 am (AEDT):

Still with the NYSE, Danaher (DHR) beat estimates on revenue and earnings per share following sales growth across segments.

Earnings per share were US$2.23, rising 4% and above Zacks estimates of $2.22. Sales were up 4.5% to $6.84 billion, passing estimates of $6.79 billion.

Life Sciences revenue increased 2.5% to $2.09 billion, while Diagnostics revenue climbed 3% to $2.72 billion. Biotechnology revenue grew 9% to @2.03 billion.

“We delivered a strong finish to the year with better-than-expected performance across our portfolio. We were particularly encouraged by continued strength in our bioprocessing business, along with improved momentum in Diagnostics and Life Sciences. Our teams' disciplined execution also enabled us to exceed our fourth quarter margin, earnings, and cash flow expectations,” said CEO Rainer Blair.

The company expects non-GAAP revenue growth in the low single digit percentages in 2026's first quarter. Across 2026, it projects revenue growth of 3-6% and earnings per share of $8.35-8.50.

10:59 am (AEDT):

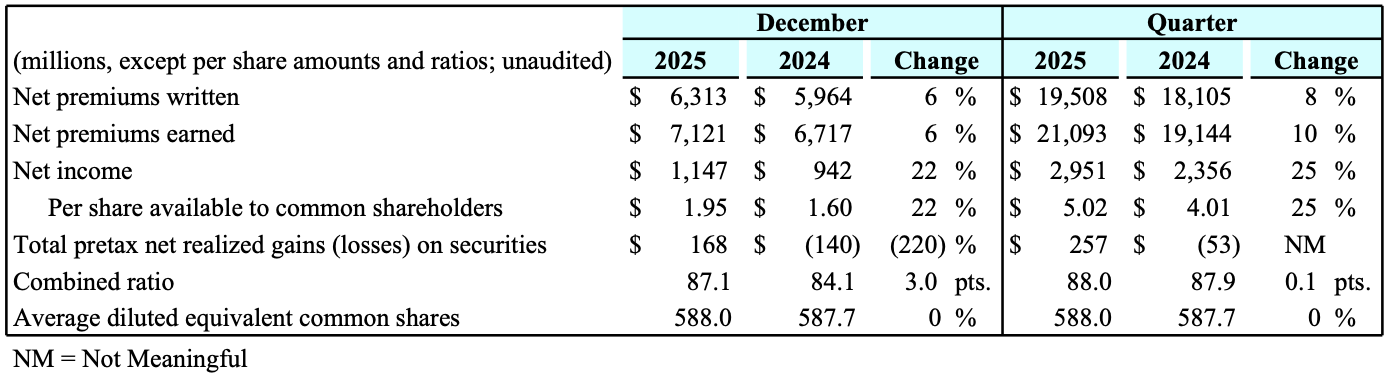

And continuing with the NYSE, Progressive (PGR) solidly surpassed estimates last quarter, and has named a new chief financial officer.

Adjusted earnings per share were US$4.67, up from $4.08 one year ago and beating Zacks estimates of $4.44. Revenue was $22.49 billion, rising from $20.33 billion and passing estimates by 2.5%.

Net premiums written rose 8% to $19.51 billion, while net premiums earned increased 10% to $21.09 billion.

Total policies in force grew by 10% to 38.62 million by the end of 2025, with 11% growth in personal lines and 4% growth across commercial lines.

CFO John Sauerland will retire from the company in July after 10 years in the role, Progressive said. The company's chief strategy officer Andrew Quigg will succeed Sauerland.

Shares closed 2.2% higher.

11:16 am (AEDT):

AT&T (NYSE: T) beat estimates as its fibre segment surged, sending shares up 4.7%.

Revenue climbed 3.6% year-over-year to US$33.5 billion, above FactSet estimates of $32.9 billion. Adjusted earnings per share were $0.52, up from $0.43 and besting estimates of $0.46.

“We achieved or surpassed all of our consolidated full-year guidance for 2025,” said CEO John Stankey. “With new investments in spectrum and fiber, we’re set to win more customers in more categories and geographies across the U.S."

AT&T reported a 283,000 net increase in fibre customers, beating estimates of 265,000. According to AT&T, 42% of its fibre customers also use its wireless network. consumer Wireline fibre revenues were up 13.6%.

It also added net 421,000 postpaid phone customers, below estimates of 425,000.

Adjusted operating income was $6.1 billion, rising from $5.4 billion. Its adjusted EBITDA increased from $10.8 billion to $11.2 billion.

The company's outlook for 2026 includes earnings per share of $2.25-2.35.

11:41 am (AEDT):

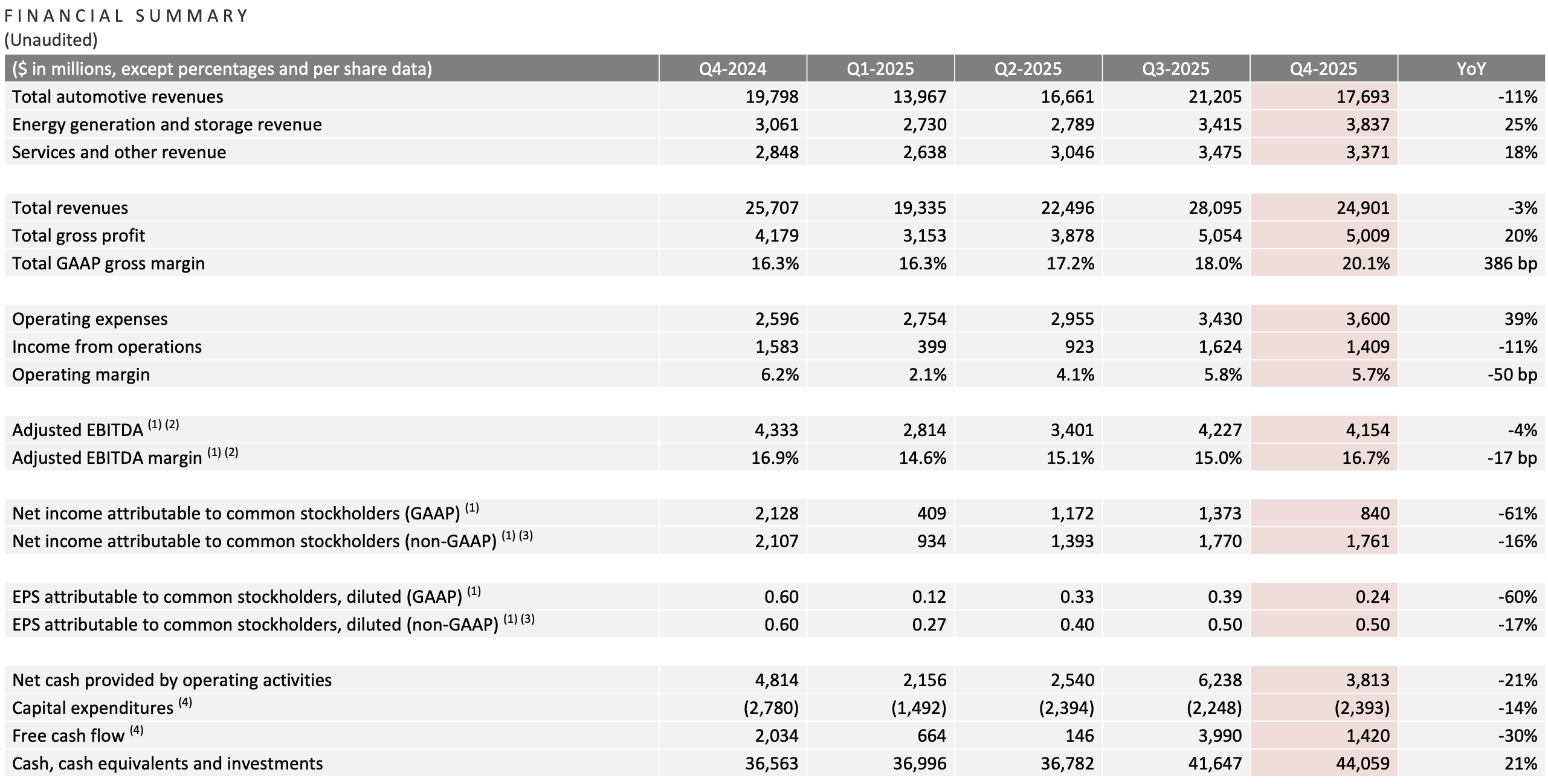

On the Nasdaq, Tesla (TSLA) has reported its first annual drop in revenue, and will discontinue its Model S and X vehicles.

Revenue slid 3% year-over-year last quarter, reaching US$24.90 billion. This was above LSEG estimates of $24.79 billion. Its revenue also declined by 3% across 2025, Tesla's first annual decline on record.

Automotive revenues were down 11% to $17.69 billion. Energy generation and storage revenue continued to grow, climbing 25% to3.84 billion.

Earnings per share were $0.50, passing estimates of $0.45 but falling 17%. Income from operations dropped 11% to $1.41 billion, while operating expenses were up 39% to $3.60 billion.

Tesla previously said vehicle deliveries fell by 16% last quarter and by 8.6% across 2025.

The company's deliveries faltered last year amid consumer backlash to CEO Elon Musk's on-and-off alliance with U.S. President Donald Trump and endorsements of far-right parties internationally, and the end of the U.S.' tax credit for electric vehicle purchases. China-based BYD overtook Tesla as the world's top-selling EV maker in 2025.

Its Model S sedan and Model X SUV will wind down production next quarter, said Musk. These vehicles were originally released in 2012 and 2015.

The company also plans to reveal its third generation Optimus robot in 2026's first quarter, which it claims will be its first Optimus model for mass production. Musk said earlier this month that Optimus robots would be sold to other companies in the second half of 2026, and to the public by the end of 2027.

According to Musk, Tesla will eventually derive 80% of its value from Optimus. Tesla has said Optimus will be an autonomous bipedal robot capable of a wide variety of tasks, though it has been remotely operated by Tesla employees at several previous public demonstrations.

Tesla shares closed 0.1% lower, but jumped 1.6% after-hours.

12:10 pm (AEDT):

Over at Euronext Amsterdam, semiconductor supplier ASML (ASML) saw record bookings last quarter and beat estimates on sales.

Sales were EU€9.72 billion, up from €9.26 billion one year ago and above LSEG estimates of €9.6 billion. Net income was €2.84 billion, rising from €2.69 billion but missing estimates of €3.01 billion.

Net bookings were a record €13.16 billion at the end of the quarter, growing from €7.09 billion last year.

The company sold 94 new lithography systems last quarter, up from 66 units the prior quarter, as well as eight used units.

“In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand. This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake,” said CEO Christophe Fouquet.

ASML expects sales in 2026's first quarter to be €8.2-8.9 billion, and sales of €34-39 billion across the year.

12:27 pm (AEDT):

Turning to the TYO, semiconductor testing equipment company Advantest (6857) bested earnings estimates and lifted its forecast, with shares up 8.9%.

Net income was JP¥248.53 billion (US$1.62 billion) for the nine months ending 31 December, up 105% year-over-year. Operating income last quarter was ¥114 billion, above estimates of ¥72 billion.

Sales for the past three quarters were up 46.3% to ¥800.54 billion, which the company credited to surging demand for testing equipment for artificial intelligence-related chips.

Its full-year guidance projects operating profit of ¥454 billion, raised from its previous forecast of ¥374 billion and well above estimates of ¥385 billion. Shares were up 8.9% to ¥27,800 at time of writing, having reached a new high of ¥29,250 earlier in the trading session.

12:49 pm (AEDT):

Good afternoon everyone, Chloe Jaenicke here to take over the blog for a bit.

Starting off, Meta (NASDAQ: META) announced an increase in net income for Q4 2025.

The Facebook parent company saw net income rise by 9% to US$22.786 billion, and diluted earnings per share rose 11% to $8.88.

Revenue also jumped 24% to US$59.893.

However, net income for the full year fell 2% to US$60.458, and diluted earnings per share decreased to $23.49. Full-year revenue rose 22% to $200.966 billion.

These results beat Wall Street estimates.

“We had a strong business performance in 2025,” Co-founder, Chairman and CEO Mark Zuckerberg said.

Chief Financial Officer Susan Lu said the company expected Q1 2026 revenue of between US$53.5 billion and US$56.5 billion.

Read Garry West's full story here.

1:05 pm (AEDT):

Samsung (KRX: 005930) has reached record operating profits that are triple the amount of last year's.

Operating profits surged to KR₩20.1 trillion (US$14.1 billion), climbing over 200% year-over-year. This also surpasses its previous record of ₩17.6 trillion achieved in the third quarter of 2018.

Revenue also rose 24% year-over-year to ₩20.1 trillion, surpassing analysts' expectations of ₩20.018 trillion.

In its earnings report, the company said its memory business helped drive earnings, setting all-time highs for quarterly revenue and operating profit, driven by an overall market price surge, sales of high-bandwidth memory and other high-value-added products.

The company also said it will continue to focus on AI as the industry is expected to continue driving favourable market conditions.

“Looking ahead to Q1 2026, the DS Division expects AI and server demand to continue increasing, leading to more opportunities for structural growth,” the company said.

“In response, the Division will continue to focus on profitability via a strong emphasis on high-performance products.”

1:30 pm (AEDT):

Moving to the NYSE, IBM (IBM) earnings beat Wall Street expectations for its fourth quarter revenues, with the adoption of AI boosting demand for its software services.

During the fourth quarter, the company’s revenue rose 12% year-over-year to US$19.7 billion. This beat analysts' expectations of US$19.23 billion, according to data compiled by LSEG.

This was driven by infrastructure revenue, which jumped 21% and software revenue that increased by 14%.

“Infrastructure continued its double-digit revenue growth with the robust adoption of the next generation of our mainframe platform. Our generative AI book of business now stands at more than $12.5 billion,” IBM chairman, president and CEO Arvind Krishna said.

Adjusted earnings per share came in at $4.52, also beating estimates of $4.32.

For the full year, revenue was up 8% to $67.5 billion.

Krishna said the company expects a strong 2026.

"We enter 2026 with momentum and in a position of strength, giving us confidence in our full-year expectations of more than 5% constant currency revenue growth and an increase of about $1 billion in year-over-year free cash flow,” he said.

1:59 pm (AEDT):

Thank you, Chloe! Harlan Ockey back with you now.

Sticking with the NYSE, General Dynamics (GD) beat estimates last quarter as revenue for its Marine Systems segment surged.

Total revenue was US$14.38 billion, up from $13.34 billion one year ago and passing FactSet estimates of $13.8 billion. Earnings per share were $4.17 per share, rising from $4.15 and above estimates of $4.15.

Marine Systems revenue increased by 21.7% to $4.82 billion, with its operating earnings also growing by 72.5%.

Aerospace revenue climbed 1.2% to $3.79 billion and Combat Systems revenue was up 5.8% to $2.54 billion.

The company's orders reached $22.4 billion during the quarter, with a backlog of $118 billion at the year's end.

"We had a solid fourth quarter, capping off a year that saw growth in revenue and earnings in all four segments coupled with an impressive 30% growth in company-wide backlog," said CEO Phebe Novakovic. “As we focus on execution of programs for our customers, we are also preparing aggressively for future growth, investing nearly $1.2 billion in capital expenditures in 2025 – with even more investments planned in the year ahead.”

2:35 pm (AEDT):

Still at the NYSE, electronic cable manufacturer Amphenol (APH) beat estimates on revenue, earnings per share, and guidance, but shares sank amid concerns that organic sales could slow.

Revenue was up 49% to US$6.44 billion, above FactSet estimates of $6.2 billion. Earnings per share increased by 76% to $0.97, passing estimates of $0.93.

“We are pleased to have closed 2025 with record fourth quarter and full-year sales and Adjusted Diluted EPS, both significantly exceeding the high end of our guidance,” said Amphenol CEO R. Adam Norwitt.

Operating income was $1.72 billion, up from $953.7 million year-over-year.

The company also completed its acquisition of cable assembly company Trexon during the quarter, and its purchase of CommScope's connectivity and cable solutions arm will close in January.

Its guidance projects first quarter sales of $6.9-7.0 billion, besting estimates of $6.55 billion.

Amphenol's shares closed 12.2% lower, however. The company had dipped in pre-market trading after its earnings release “on what we believe are concerns of an implied deceleration in organic sales in Q1 and perhaps lower contribution than expected from AI data centre sales where most investors are focused,” according to BNP Paribas analysts.

3:00 pm (AEDT):

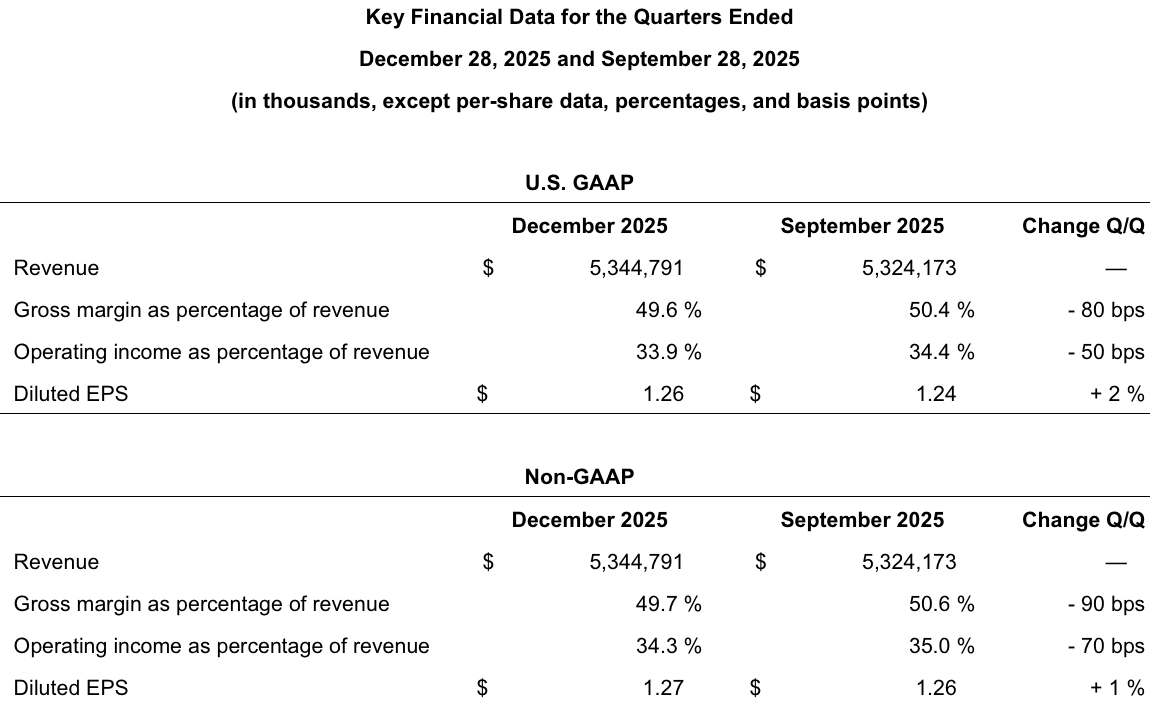

Back to the Nasdaq, semiconductor supplier Lam Research (LRCX) issued stronger-than-expected guidance, sending shares up 5.2% after-hours.

Revenue was up 22% to US$5.34 billion, above FactSet estimates of $5.23 billion. Earnings per share rose 40% to $1.27, beating estimates of $1.17.

"Lam delivered another strong quarter to cap a record year," said CEO Tim Archer. "Entering 2026, our expanding product and services portfolio is enabling the market's transition to smaller, more complex three-dimensional devices and packages. With AI accelerating, we are ramping execution velocity across the company to support our customers' growth and realize our vision for multi-year outperformance."

China represented 35% of the company's revenue, while Taiwan and South Korea each accounted for 20%.

Total deferred revenue was $2.25 billion at the end of the quarter, down from $2.77 billion in the September quarter.

Operating income was $1.81 billion, up from $1.33 billion last year.

Its March quarter guidance includes revenue of $5.70 billion, plus or minus $300 million, and earnings per share of $1.35, plus or minus $0.10. This surpassed estimates of $5.33 billion in sales and $1.20 in earnings per share.

3:31 pm (AEDT):

Back at the NYSE, Southwest Airlines (LUV) missed revenue estimates, but shares rose 5.7% after-hours due to its strong guidance.

Revenue was a record US$7.44 billion, climbing 7.4% but below LSEG estimates of $7.51 billion. Earnings per share were $0.58, up from $0.58 and matching estimates.

“Southwest closed 2025 with strong momentum. Last year we implemented the most ambitious transformation in Company history, including bag fees, basic economy fares, assigned and extra legroom seating, Rapid Rewards® program optimisation, online distribution expansion, and free Wi-Fi for loyalty members,” per CEO Bob Jordan.

“We also outperformed our cost reduction goals, strengthened operational reliability through new technology, and returned $2.9 billion to our Shareholders through share repurchases and dividends.”

Its capacity was up 5.8% year-over-year last quarter. Southwest received 19 Boeing 737-8 aircraft and retired 18 other aircraft, ending 2025 with 803 aircraft.

Passenger revenue rose 7.6% to $6.79 billion, while freight revenue dropped 4.4% to $43 million. Other revenue climbed 6% to $614 million.

Southwest expects earnings per share of $0.45 for the first quarter, above estimates of $0.33. Across 2026, it forecast earnings per share of at least $4.00, passing estimates of $3.19.

It also projects capacity growth of 2-3% across 2026, well above the 1.6% increase it reported in 2025.

More than 22,000 U.S. flights were cancelled across airlines over the weekend amid Winter Storm Fern. Southwest said ahead of the storm that passengers with flights during this period could rebook with no change in airfare.

4:06 pm (AEDT):

And finishing at the NYSE, enterprise cloud computing company ServiceNow (NOW) surpassed estimates, though shares fell as the company steps up its spending.

Earnings per share were US$0.92, growing from $0.73 one year ago and beating LSEG estimates of $0.88. Revenue was up 20.5% to $3.57 billion, above estimates of $3.53 billion.

Subscription revenues rose by 21% to $3.47 billion last quarter. Professional services and other revenues increased 13% to $102 million.

Income from operations was $443 million, climbing from $374 million. Operating expenses grew from $1.95 billion to $2.29 billion, driven by increases across categories.

ServiceNow has also been spending heavily on acquisitions, saying last quarter that it would buy enterprise cybersecurity company Armis for $7.75 billion and identity security company Veza for an undisclosed amount. It closed its $2.85 billion acquisition of agentic AI company Moveworks in December.

“Our acquisitions are 100% not a pivot away from organic growth,” according to CFO Gina Mastantuono. “They represent an acceleration of it.”

Current remaining performance obligations were $12.85 billion at the end of the quarter, up 25% year-over-year.

For 2026's first quarter, it projects subscription revenues of $3.650-3.655 billion. The company's shares closed 1.7% lower, and fell another 5.3% after-hours.

Thank you for joining us today. We'll see you again tomorrow for more live coverage of earnings season!