Shares in social media giant Meta Platforms jumped it announced an increase in net income for the fourth quarter (Q4) of 2025 and made profit forecasts that beat market expectations.

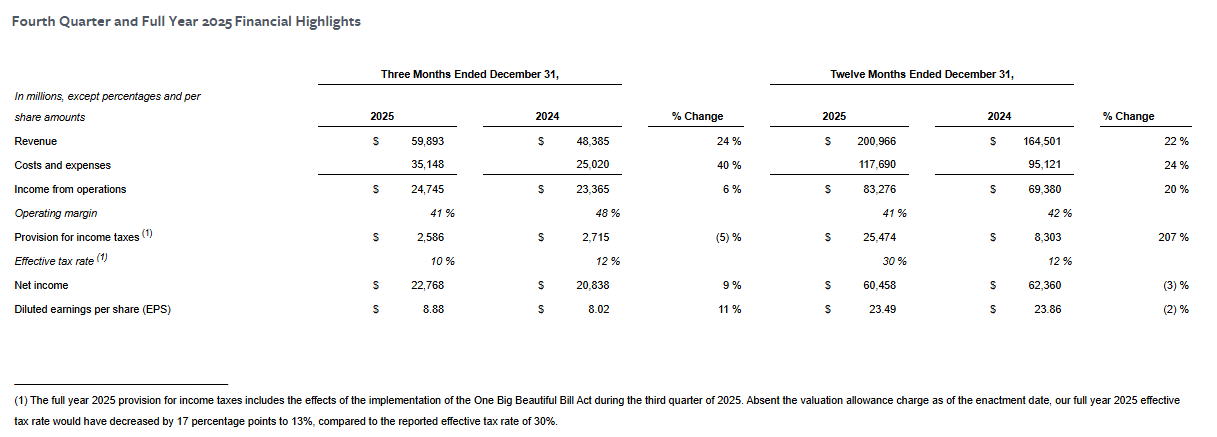

The parent of platforms including Facebook said net income rose 9% to $22.786 billion (A$32.57 billion) and diluted earnings per share (EPS) increased 11% to 8.88 cents on revenue which grew 24% to $59.893 billion in the three months ended 31 December.

For 2025, net income fell 3% to $60.458 billion and diluted EPS dipped 2% to 23.49 cents on revenue which rose 22% to $200.966 billion.

“We had a strong business performance in 2025,” Co-founder, Chairman and CEO Mark Zuckerberg said.

Chief Financial Officer Susan Li said the company expected Q1 2026 revenue to be $53.5 billion-56.5 billion.

Li said the company continued to monitor legal and regulatory headwinds that could significantly impact its business and financial results.

“For example, we continue to see scrutiny on youth-related issues and have a number of trials scheduled for this year in the U.S., which may ultimately result in a material loss,” Lit said in a press release.

Meta said family daily active people grew 7% year over year to 3.58 billion on average for December, advertising impressions delivered across its family of apps increased by 18% and 12% year-over-year for Q4 and 2025, respectively, and average price per advertisement rose 6% and 9% year-over-year for Q4 and 2025.

The company also lifted its capital spending plans for the new year by 73% in the pursuit of "superintelligence," an effort to offer deeply personalised artificial intelligence to its large social media user base.

The Q4 results and revenue estimates beat Wall Street estimates.

Before the announcement, Meta shares (NASDAQ: META) had closed $4.24 (0.63%) lower at $668.73, capitalising the company at $1.69 trillion, before rebounding 9.01% to $729.00 after the results.