Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

____________________________________________________________________________________________

Summary

- Walt Disney Company reports 31% surge in net operating income

- Ford Motors beats Wall Street top and bottom line expectations

- Uber shares closed down more than 7% on Wednesday as the company missed on EPS expectations.

- News Corp reports EPS of $0.33 surpassing the expected $0.31, while revenues rose 5% year-over-year to US$2.24 billion, exceeding estimates of $2.19 billion.

- REA Group boss Owen Wilson steps down after delivering excellent earnings results

- Mattel stocks are up 15.33% after the company reported big fourth-quarter earnings

- Toyota raised its full-year operating profit forecast by 9%

____________________________________________________________________________________________

8:45 am (AEDT):

Good morning, it's Sienna Martyn here to get us started with today's Azzet live earnings blog. We have a big day today, with some industry heavyweights releasing their Q4 earnings overnight, along with plenty more to unpack throughout the day.

Let's kick things off with entertainment giant Walt Disney Company (NYSE: DIS) which posted a 31% surge in net operating income to US$5.1 billion in the first quarter (Q1) of the 2025 financial year (FY25).

Disney revealed that diluted earnings per share (EPS) soared 35% to $1.40 on revenues which increased 5% to $24.7 billion in Q1.

The company forecasted high-single-digit adjusted EPS growth for FY25 compared to fiscal 2024, with double-digit percentage segment operating income growth from the entertainment segment, 13% growth from sports, and 6% to 8 growth from the experiences segment.

The entertainment segment's operating income was said to have skyrocketed 89% to $1.7 billion with sports operating improved to $247 million from a $10.3 million loss, and ‘experiences’ operating income barely changed at $3.1 billion.

Walt Disney (NYSE: DIS) shares closed at US$110.54, down $2.76 (2.44%), after trading between $110.23 and $118.59, capitalising the California-based company at $199.91 billion, and by 8.20 am AEDT (9.20 pm GMT) had slipped to $10.26.

8:56 am (AEDT):

Moving along we have Ford Motor Co. (NYSE: F) beating Wall Street’s top- and bottom-line expectations for the fourth quarter.

“Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford’s history,” said the company's president and CEO Jim Farley.

The major car manufacturer recorded a fourth-quarter revenue increase to US$48.2 billion, a net income of $1.8 billion and an adjusted EBIT of $2.1 billion.

Earnings per share was reported at 39 cents adjusted compared to 33 cents expected.

Additionally, automotive revenue was $44.9 billion compared to the expected $43.02 billion.

9:15 am (AEDT):

Another one to watch is Uber Technologies Inc (NYSE: UBER) who reported mixed fourth-quarter results and issued soft guidance for the first quarter of 2025.

Uber shares closed down more than 7% on Wednesday as the company missed on EPS expectations.

Gross bookings grew 18% year-on-year (YoY) to US$44.2 billion, split between $22.8 billion in mobility, $20.1 billion for deliveries and US$3.1 billion for trips - that’s about 33 million trips a day on average.

The revenue beat analyst's expectations and grew 20% YoY to $12.0 billion and combined mobility and delivery revenue grew 23% YoY to $10.7 billion on the back of record demand from office travel and an uptick in deliveries during the Christmas period.

Net income was $6.9 billion, which includes a $6.4 billion benefit from a tax valuation release and a $556 million benefit (pre-tax) due to net unrealised gains.

Adjusted EBITDA grew 44% YoY to $1.8 billion and the percentage of gross bookings was 4.2% - up from 3.4% in Q4 2023.

Cash and equivalents were $7 billion at the end of the fourth quarter, with Uber redeeming $2 billion of its outstanding debt during the quarter.

9:28 am (AEDT):

The Australian sharemarket is expected to open higher at 10 am AEDT with futures trading point to an 0.7% increase in the S&P / ASX 200 index.

The market is supported by a positive night on Wall Street as concerns over a possible global trade war eased. Eyes will be on REA Group which delivered better-than-expected half-year results.

Shares in gold producers and other miners are tipped to be particularly strong.

9:36 am (AEDT):

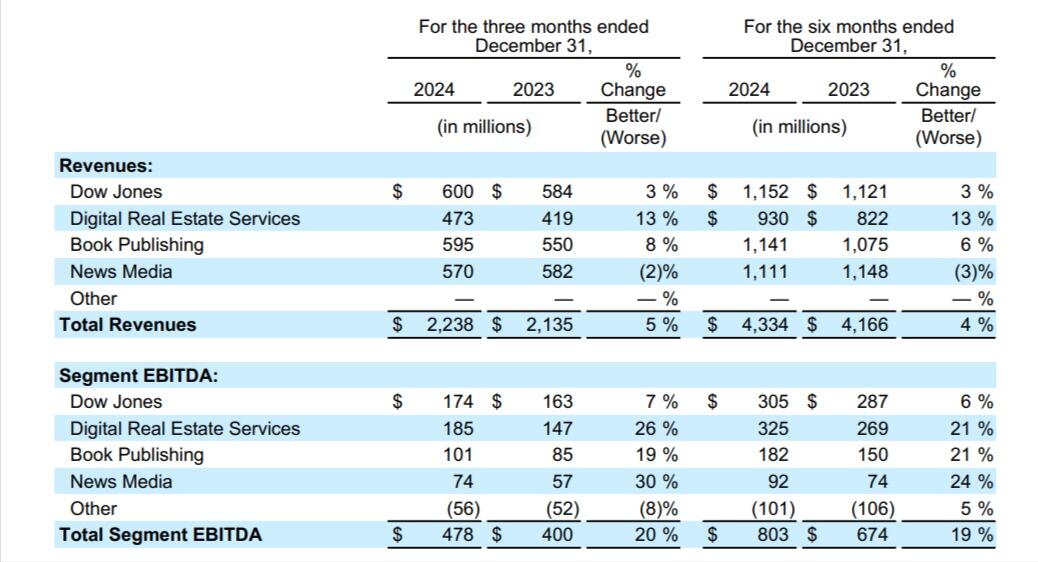

International media giant News Corporation (ASX: NWS) has also reported its earnings and exceeded expectations.

Growth for the business was primarily driven by higher Australian residential revenues at REA Group, increased book sales in the Book Publishing segment, and higher circulation and subscription revenues at Dow Jones.

News Corp reported EPS of $0.33 surpassing the expected $0.31, while revenues rose 5% year-over-year to US$2.24 billion, exceeding estimates of $2.19 billion.

Despite these gains, news media revenue in the quarter declined by $12 million, or 2%, due to lower third-party printing revenue and decreased advertising revenue.

Advertising revenue fell by $4 million, or 2%, primarily due to a decline in print and digital advertising at News U.K., which was attributed to algorithm changes affecting traffic at some mastheads.

“News Corp had a fruitful quarter, qualitatively and quantitatively,” said Chief Executive Robert Thomson, “Revenues on a continuing operations basis, which excludes Foxtel, grew 5% to $2.24 billion, net income from continuing operations surged 58% to $306 million and Total Segment EBITDA rose 20% to $478 million.”

9:49 am (AEDT):

REA Group Ltd (ASX: REA) reports that Chief Executive Officer (CEO) Owen Wilson has informed the Board of his intention to retire from full-time executive roles in the second half of 2025 after 10 years with REA, and 6 years as CEO.

“It has been a privilege to lead REA Group for the past six years and I am proud of all our team has accomplished,” Wilson said.

The company is the largest property listing platform in Australia and is controlled by News Corp.

Rea Group reported a 20% jump in revenue to $873 million and a 26% rise in profit to $314 million.

Earnings per share were up 26% to $2.38.

“REA’s exceptional first half result was driven by strong yield growth in a healthy listings environment.

Vendors remained confident during the half with sales volumes consistently higher than the prior year, demonstrating the depth of demand, while buyers benefitted from more choice and some moderation in price growth,” said Wilson.

REA shares last traded at $251.85, having risen almost 40 per cent over the past 12 months, giving the company a market value of $33 billion.

10:47 am (AEDT):

Heading around the world now to Japan where Toyota Motor Corp (TYO: 7203) has raised its full-year operating profit forecast by 9%.

The top-selling automaker raised its profit forecast for the current year through March 2025 to 4.7 trillion yen (US$30.7 billion) versus 4.3 trillion yen expected previously.

11:05 am (AEDT):

MicroStrategy Inc (NASDAQ: MSTR), the largest corporate holder of bitcoin, has reported since the end of the third quarter it has secured 218,887 bitcoins for US$20.5 billion.

Now known as Strategy, the company currently holds 471,107 bitcoins on its balance sheet - about 2% of the total supply.

Shares of Strategy were little changed in extended trading after it unveiled its new name and logo, which it said was aimed at highlighting its focus on Bitcoin.

11:12 am (AEDT):

PEXA Group (ASX: PXA) shares fell more than 3% after the digital property settlement platform provided an update on non-operating items that will affect its half-year results.

PEXA also announced the resignation of senior executive Les Vance.

11:22 am (AEDT):

United States stock futures were largely unchanged on Wednesday night, stabilising after the major indices recorded back-to-back gains.

In extended deals, Ford Motors fell 5.3% despite surpassing earnings and revenue expectations, as its 2025 EBIT guidance came in below estimates.

Qualcomm dropped 4.7% following its quarterly results and guidance.

The chipmaker reported Q1 EPS of $3.41, beating estimates of $2.97. Revenue reached $11.67 billion, exceeding the consensus estimate of $10.93 billion.

Align Technology declined 5.9% after missing EPS estimates and issuing weaker-than-expected guidance.

Coherent surged 12.1% after exceeding quarterly EPS estimates and raising guidance.

Looking ahead, key earnings reports from Eli Lilly, Yum Brands, and Amazon are set for release on Thursday. Traders will also monitor the latest weekly jobless claims for further economic insights.

11:32 am (AEDT):

Stocks for major toy and game manufacturer Mattel Inc. (NASDAQ: MAT) are up 15.33% at the time of writing this after the company reported a big fourth-quarter earnings.

Mattel's stock is trading at $20.84 up from $18.07 from the previous close. The company's market cap is $7.02 billion.

Mattel reported earnings per share (EPS) of $0.35 beating estimates of $0.23 by 52.2%.

EPS also improved from the same period last year at $0.29.

Net sales for the toy company in the quarter amounted to US$1.64 billion, only just missing the consensus estimate of $1.66 billion by 0.5%.

While net sales in 2024 amounted to $5.38 billion dropping slightly compared with $5.44 billion in 2023.

11:57 am (AEDT):

The New York Times (NYSE:NYT) stocks fell 11.9% after the company reported overall weak fourth-quarter results.

Q1 2025 forecasts double-digit digital subscription revenue growth, but total advertising revenue could range from a slight decline to a small increase, indicating some uncertainty in ad performance.

However, this quarter advertising supported revenue growth as digital advertising revenues increased 9.5% and print advertising revenues decreased 16.4%.

Total revenue went up by 7.5 % while subscriber count fell below Wall Street's expectations.

12:04 pm (AEDT):

Equinor ASA (NYSE: EQNR) announced a lower-than-anticipated decline in fourth-quarter profits on Wednesday and, like many competitors, committed to increasing oil and gas production while reducing its focus on renewables.

However, its shares dropped 5.3% due to some disappointment over shareholder returns.

12:15 pm (AEDT):

Asia-Pacific markets mirrored Wall Street’s gains this Thursday morning as investors shrugged off trade concerns and focused on corporate earnings.

By 11:20 am AEDT (12:20 am GMT) Australia’s ASX 200 rose 0.9% while the Dow Jones Industrial Average climbed 0.7%, the S&P 500 added 0.4% and the Nasdaq Composite gained 0.2%.

Overnight, major U.S. indices posted gains for the second consecutive session, even as tech giants Alphabet and AMD faced sell-offs after earnings.

Nvidia surged over 5% after Super Micro Computer reported full-scale production availability of its AI data centre using Nvidia’s Blackwell platform.

Super Micro Computer rose around 8% on the news.

12:30 pm (AEDT):

Now we look to Banco Santander Brasil SA ADR (BSBR) on the New York Stock Exchange (NYSE) as the bank reported a 75% jump in fourth-quarter net profit.

Shares jumped 4.9% as the bank surpassed market expectations as a result of stronger margins and increased fees.

The lender - a unit of Spain's Banco Santander (BME: SAN) - said net profit totalled 3.85 billion reais (US$668.62 million) in the October-December quarter, above the 3.72 billion forecast by analysts.

12:46 pm (AEDT):

Arm Holdings PLC - ADR (NASDAQ: ARM) has beat analyst estimates but offered in-line guidance in their Q4 earnings results.

The British semiconductor and software design company earned $0.39 per share beating analyst expectations of $0.34 a share.

On a year-over-year basis, Arm Holdings earnings increased 34% while sales climbed 19%.

The company’s stocks popped up 6.82% at close today but dropped 6.3% in after-hours trading.

"With our high-performance, energy-efficient, flexible technology, Arm is a key enabler in advancing AI innovation and transforming the user experience, from the edge to the cloud," said Chief Executive Officer Rene Haas.

That's all from me today, has been a pleasure doing business with you! Chloe will be here for the afternoon!

1:12 pm (AEDT):

Good afternoon, it’s Chloe Jaenicke here to take you through the rest of the day!

At the time of writing, PEXA Group (ASX: PXA) stock was trading at A$12.42, down 3.27% from the previous close of $12.48. They had a day high of $12.71 and a low of $11.58. The market cap is $2.20 billion.

2:08 pm (AEDT):

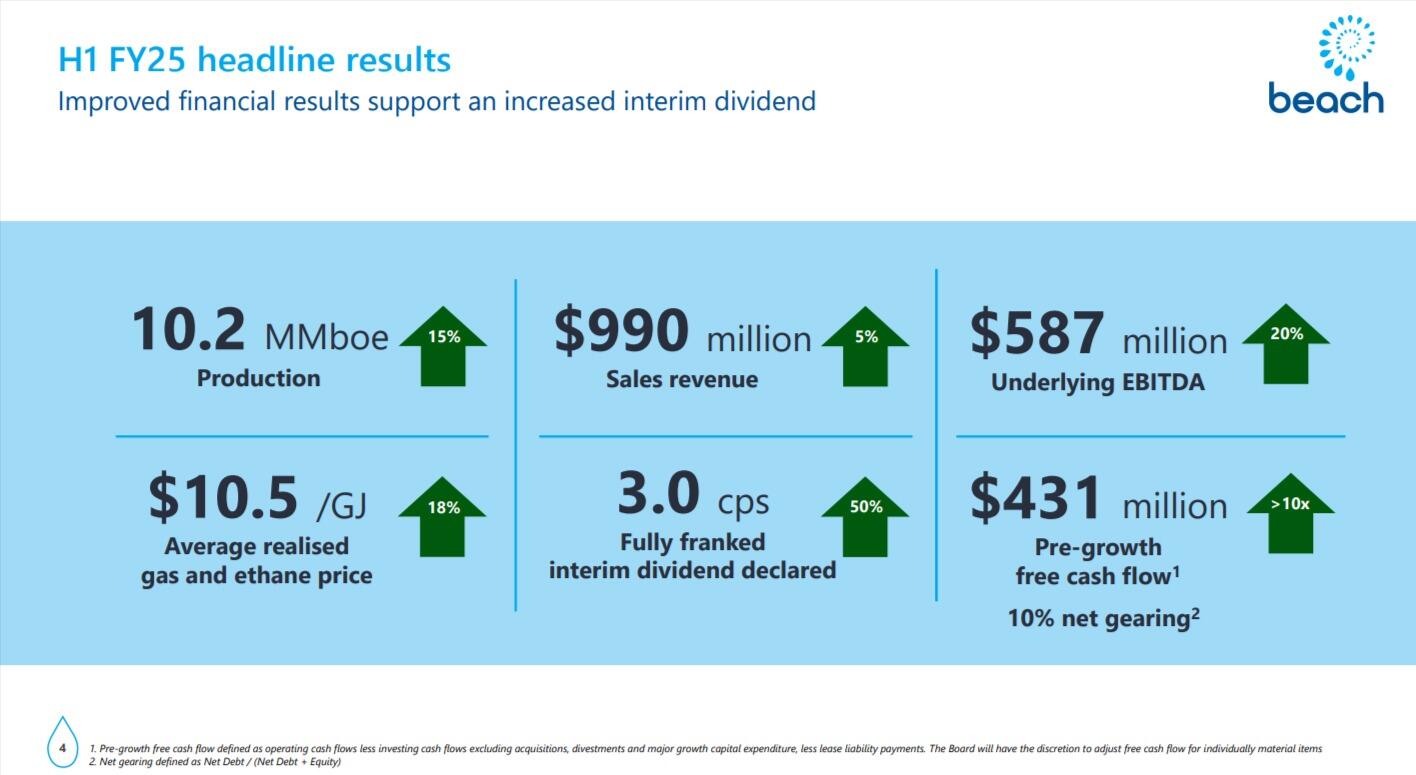

Beach Energy (ASX: BPT) earnings were in line with expectations, with net profit up 37% to $237 million, due to higher production and Waitsia LNG swap cargoes while operating cash was up 88% to $659 million.

Shares for Beach Energy Ltd, an Australian oil and gas exploration and production company based in Adelaide, South Australia, were down 0.055 cents at 3:03 pm (AEDT) - a 3.63% drop.

2:25 pm (AEDT):

Renesas Electronics Corporation (TSE: 6723) announced that their overall revenue for 2024 was 1,348.5 billion yen and Renesas' revenue for Q4 2024 was 292.6 billion yen.

At the time of writing, their stock price is 2,298 yen (A$24.09) and up 13.23% from yesterday’s close.

2:41 pm (AEDT):

TotalEngeries (EPA: TTE) generated USD$4.4 billion, which is an 8% increase for the fourth quarter.

“During the fourth quarter, TotalEnergies leveraged its multi-energy integrated model, benefiting notably from strong performance in Integrated LNG and Integrated Power, with $4.4 billion of adjusted net income, up 8% compared to the third quarter, and $7.2 billion of CFFO, up 5%,” CEO of TotalEnergies, Patrick Pouyanné, said.

Despite the increase in the final quarter, TotalEnergies reported a net income of $18.3 billion in 2024, down 23% from 2023’s $23.2 billion.

2:58 pm (AEDT):

U-Haul Holding Company (NYSE: UHAL, UHAL.B) reported net earnings of US$67.2 million, compared with net earnings of $99.2 million for the same period last year.

They also reported $0.35 earnings per share (EPS), which is 0.02 better than analyst estimates.

At the time of writing, U-Haul Holding Co (NYSE: UHAL) stocks were trading at $71.57, up 0.72% from the previous close of 71.06. Its market cap is currently $12.62 billion.

3:30 pm (AEDT):

Thomson Reuters (NYSE: TRI) is expected to announce its earnings at 12am AEDT.

Analysts expect that the company will post earnings of US$0.96, reflecting a year-over-year decline of 2% per share and revenue of $1.91 billion, an increase of 4.9% compared to the year-ago quarter.

At the time of writing, Thomson Reuters (NYSE: TRI) stocks were trading at $169.23. Up $0.70 from the previous close of $169.23. It reached a day high of $170.57 and low of $167.76. The market cap is $76.35 billion.

3:50pm (AEDT):

Looking ahead to tomorrow, there are many companies who will be posting their earnings.

Zacks Research analyst R. Department anticipate that AstraZeneca (NASDAQ: AZN) will post earnings per share of US$4.59 for the year, while the consensus for the company's full-year earnings is $4.13 per share.

This quarter, analysts are expecting revenue from Warner Music Group (NASDAQ: WMG) by 4.8% to $1.66 billion. This would be a reversal from the 17.5% jump it recorded in the same quarter last year.

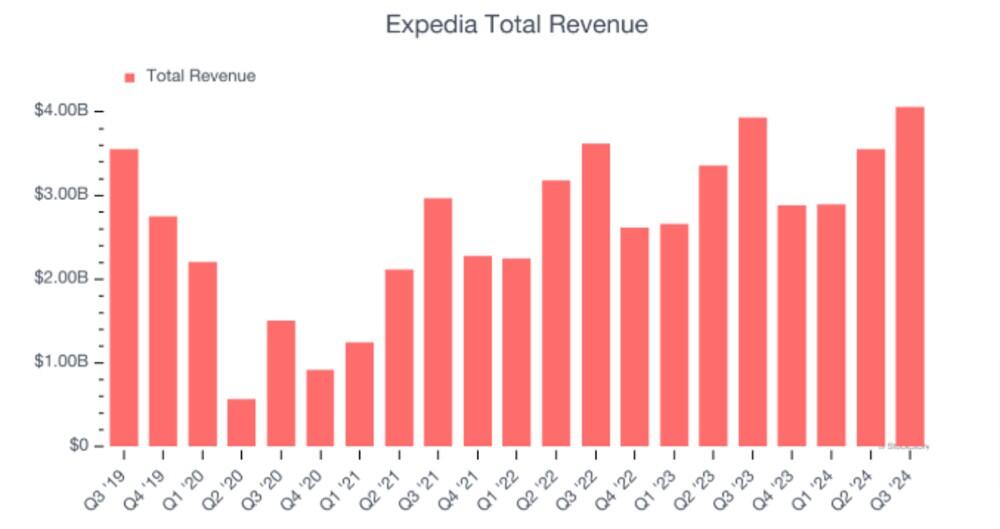

For online travel agency Expedia (NASDAQ: EXPE), analysts expect their earnings to grow 6.5% year on year to $3.08 billion, slowing from the 10.3% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $2.09 per share.

Equifax's (NYSE: EFX) total international revenues are expected to increase 8.5% from the year-ago’s quarter actual to $368.2 million.

Analysts expect Hershy’s (NYSE: HSY) to grow 6.9% year-on-year to $2.84 billion and adjusted earnings are expected to come in at $2.38 per share.

Revenue for Phillip Morris (NYSE: PM) is expected to grow 4.4% year on year to $9.44 billion, slowing from the 11% increase it experienced in the same quarter last year. Adjusted earnings are expected to come in at $1.50.

The Zacks Consensus Estimate for Honeywell International (NASDAQ: HON) is that revenues will grow 5.1% to $9.9 billion from the previous quarters figure. They predict that earnings per share will be at $2.31.

Nippon Steel Corp (TSE: 5401) is estimated to report a revenue of $2.09 billion and earnings per share to come in at $85.55 per share for the quarter. The full-year revenue is expected to be $8.06 billion with earnings per share predicted to be $320.77 per share.

That's all for today! Thanks for following along and please join us tomorrow for more earnings coverage.