Azzet reports on three ASX stocks with notable trading updates today

REA’s strong 1H result is overshadowed by news of CEO’s exit

Shares in REA Group (ASX: REA) traded lower despite the realestate.com.au operator posting a strong underlying first half FY25 result.

While strong revenue and profits were in line with market expectations, they were offset somewhat by higher operating costs guidance.

Revelations that REA posted a 20% rise in revenue to $873 million for the six months to 31 December also coincided with news that CEO Owen Wilson will retire later this year. It’s this bombshell that may have derailed today’s robust trading update.

Due in part to strong growth in both Australia and India, net profit after tax was up 257% to $437.3 million.

Other milestones with today’s results include:

• Operating expenses up 18% to $338 million

• Earnings up 22% to $535 million

• Fully-franked interim dividend up 26% to $1.10 per share

• Earnings per share were $2.38, up 26%.

Here in Australia, residential revenue increased 21% to $614 million; with Buy revenue growth driven up by a 14% increase in Buy yield and a 5% increase in national listings.

In India the group delivered strong revenue growth, up 46% to $64 million, while revenue from adjacent services on Housing Edge increased 153%, due to increased customer acquisition and usage.

While total losses from equity accounted investments increased from $13 million in the prior period to $15 million, the sale of the Group’s 17.2% stake in PropertyGuru Group Limited which was finalised in December, resulted in a total gain of $151 million.

Outlook

Looking forward, management expects strong employment, high immigration levels and expectations for interest rate cuts in the first half of 2025 to continue to support buyer demand and vendor confidence to list.

While the magnitude of growth may be impacted if the negative drag from the geographical mix continues, the group’s expected double-digit FY25 residential buy yield growth remains unchanged.

Commenting on today’s update, outgoing CEO Owen Wilson noted that after sustained listings growth, the Australian property market has reached a more balanced level of supply and demand.

“Continued strength in underlying fundamentals and the expectation of at least one interest rate cut before the end of FY25 should further support the health of the market,” said Wilson.

“REA continues to invest in the next generation of consumer experiences and the delivery of further value to our customers.”

The group will pay a lower than expected interim dividend of $1.10 per share fully franked, up 26%.

It’s worth noting that REA is trading at its most expensive level in nearly four years, with a price-to-earnings ratio of 109.

While earnings were solid, valuation remains a key concern; based on Morningstar’s fair value of $141.25 the stock looks overvalued.

REA Group is majority-owned by New Corp.

REA Group’s market cap is $33 billion making it the 18th largest stock on the ASX. The stock's share price is up around 40% over one year and up 10% year to date.

REA's 200-day moving average trends upwards and highlights long-term investor interest in the stock.

Consensus is Moderate Buy.

Beach Energy dives after interim dividend slashed

Shares in Beach Energy (ASX: BPT) were trading around 4% lower heading into lunch following revelations the board was trimming its interim dividend from the expected 4 cents per share (CPS) to 3 CPS.

However, market sentiment appears to be undermining what was an otherwise strong 1H FY25 set of numbers.

In line with expectations, net profit was up 37% to $237 million due to higher production and Waitsia LNG swap cargoes, while operating cash, up 88% to $659 million, was a major beat against consensus.

Management guided to FY25 production of 18.5 – 20.5 MMboe (previously 17.5 – 21.5 MMboe) and capital expenditure unchanged at between $700 million to $800 million.

Commenting on the 1H result, managing director and CEO Brett Woods highlighted:

• A 15% increase in production to 10.2 MMBe.

• Sales revenue increased 5% to $990 million.

• Earnings increased 20% to $587 million.

• Net debt reduced by 33% to $389 million.

• Successfully commissioned the Moomba CCS project.

“Commissioning of the Waitsia Gas Plant is now well underway and we continue to target first sales of gas in Q4 FY25. In the Otway Basin, we expect activity for the Offshore Gas Victoria program to commence, including drilling the Hercules gas exploration prospect,” Woods said.

“In the Western Flank, we are readying to commence the next phase of oil development and appraisal drilling, with a focus on the McKinlay reservoir across several fields.”

Beach has a market cap of $3.3 billion making it an ASX200 stock; the share price is up 11.5% over one year and 4.5% year to date.

The stock appears to be in a medium-term rally confirmed by multiple indicators.

Consensus on Beach is Hold.

PEXA drifts lower on guidance update

PEXA Group’s (ASX: PXA) share price was trading around 3% lower this afternoon after its 1H FY25 guidance update revealed A) that the CEO is exiting and B) that it expects to recognise a non-cash impairment charge of approximately $15 million in its results.

In light of this, the impairment which relates to a minority investment, specified items are now expected to impact its profits by $35 milion to $40 million instead of $15 million to $20 million.

PEXA also expects tax expenses of $40 million to $45 million, up from its guidance of $13 million to $18 million.

The group also plans to de-recognise $19 million of deferred tax assets due to new revenue streams, increasing their effective tax rate.

PEXA is also reviewing the $14.1 million carrying value of its interoperability assets following a regulatory pause, which suggests there’s potential for future asset impairment. Financial adjustments are subject to final auditor processes and Board approval.

Today’s update coincides with the announced exit of CEO Les Vance on 21 February 2025.

Meanwhile, PEXA has announced the appointment of two senior hires, James Foster as director of lender sales and Paul Davies as head of conveyancer relationships.

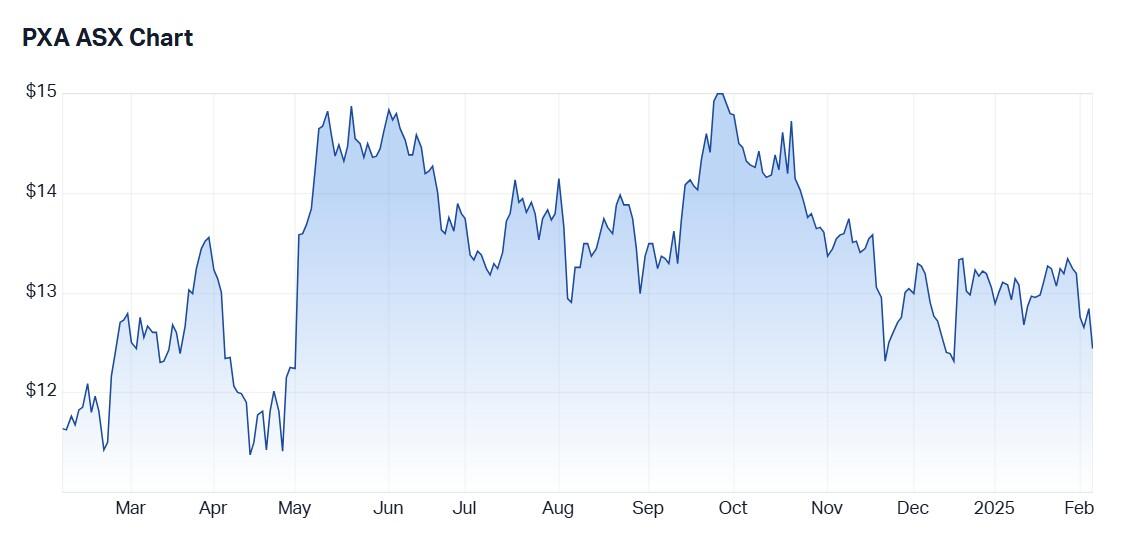

PEXA has a market cap of $2.2 billion making it an ASX200 stock; the share price is up around 7% over one year.

PEXA shares appear to be in a near-term uptrend confirmed by its 20-day moving average.

Consensus is Moderate Buy.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.