Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- Spotify reports first full year of profitability

- Alphabet posts increase in net revenue, but falling short in cloud revenue

- Palantir revenue surges well above analyst predictions

- Pfizer earnings still soaring even as Covid-19 vaccine revenues decline

- Snap beats expectations with strong user numbers

- Plus the best of the ASX, a tough quarter in gaming, and more

-----------------------------------------------------------------------------------------------------------------------------------------------------

8:45 am (AEDT):

Frankie Reid here to kick off the live blog for you today, with several heavyweights releasing their fourth-quarter (Q4) earnings overnight and more to come throughout the day.

Kicking us off from the NASDAQ, we have Spotify (SPOT) with its first-ever year of full profitability, a strong performance which saw shares at pre-market trading leaping to a record high of 9%.

The music streaming giant released its fourth-quarter earnings overnight (AEDT), with revenue, profit and user growth all coming in above investor expectations.

8:56 am (AEDT):

Heading over to the New York Stock Exchange (NYSE), Ferrari (RACE) was another to drop its Q4 earnings since yesterday, reporting strong full-year growth, coming in at 21%.

The luxury car maker also saw earnings per share (EPS) beaten by 13.71%, with CEO Benedetto Vigna saying that the “outstanding financial results in 2024” were best explained as “quality of revenues over volumes”.

This positive report stands in contrast with many of Ferrari's automotive peers, who are facing the difficulty of a slump in the Chinese market.

9:07 am (AEDT):

Back on the NASDAQ, Alphabet Inc (GOOG, GOOGL), parent company to Google, announced a 28% increase in net income to the tune of US$26.536 billion in the fourth-quarter.

Earnings per share also rose 31% to $2.15 in Q4 as revenue rose 12% year to $96.5 billion, reflecting robust momentum across the business.

Annual net income was reported by the company to have also risen, at 36% or $110.118 billion for FY24 and diluted EPS jumped 39% to $8.04.

“We had another strong quarter in Q4 with robust momentum across the business,” Chief Financial Officer Anat Ashkenazi said on the earnings call webcast.

9:30 am (AEDT):

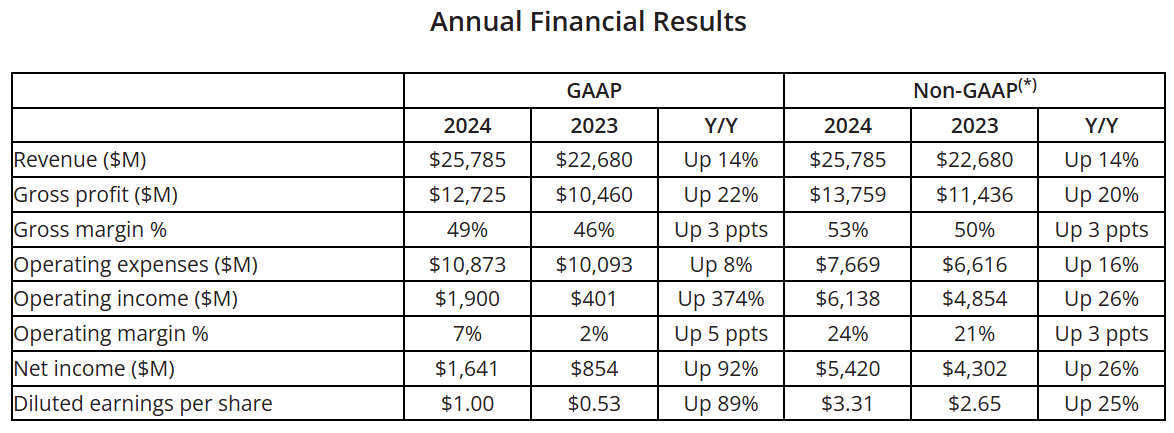

Still on the NASDAQ, Advanced Micro Devices (AMD) Q4 earnings also delivered better-than-expected results overnight (Wednesday AEDT), with revenue outpacing projections at US$7.66 billion.

Adjusted EPS at $1.09 matched market expectations, however, mixed forward guidance saw stock in after-hours trading fall.

“We closed 2024 with a strong fourth quarter, delivering record revenue up 24% year-over-year, and accelerated earnings expansion while investing aggressively in AI and innovation to position us for long-term growth and value creation,” said AMD's CFO and Treasurer Jean Hu.

10:00 am (AEDT):

It was a busy time overnight for the NASDAQ, with PayPal (PYPL) seeing a drop in stock despite a strong Q4 report.

Analysts over at Investors Business Daily say this fall was due to investor focus shifting to Braintree, a subsidiary that processes transactions for Uber (UBER), Airbnb (ABNB), DoorDash (DASH), Spotify (SPOT) and more.

Despite this, the earnings report still came in with better than expected results, as revenue rose 4% to US$8.37 billion, above estimates of US$8.26 billion.

CEO Alex Chriss said it was a “strong finish to a successful 2024” for PayPal.

11:10 am (AEDT):

Heading back to NYSE, Estee Lauder (EL) has taken a tumble in its Q4, with operating income reported at a loss of US$580 million, and sales on all products, bar fragrances, saw a decline.

Sales had fallen $4.28 billion from the the same time the year before, but revenue came in slightly above the anticipated $3.977 billion.

The beauty company, parent to MAC, La Mer and Aveda, also announced it would be cutting 11% of its workforce by FY26, or 7000 jobs.

11:32 am (AEDT):

And once again back to NASDAQ! Fox Corp's (FOX) earnings report saw stocks hit their highest point in nearly six years, after its numbers came out ahead of forecasts.

The jump in second-quarter profit was up more than triple the same period last year.

It also announced a plan to launch a new, currently unnamed, streaming service before the end of the year, with CEO Lachlan Murdoch saying it will look to offer “existing content and existing brands” at a “relatively low” price point.

11:55 am (AEDT):

Merck & Co. (NYSE: MRK) reported overnight local time (Wednesday AEDT) with an adjusted forward guidance causing shares to fall.

This was despite the pharmaceutical company coming in with an adjusted EPS of $1.72, above estimates from some analysts and revenues rising 7% year over year.

The 2025 guidance came under initial analyst expectations and combined with the announcement it was pausing shipments to China of its Gardasil vaccine, stock for Merck took a hit.

“Our business remains well positioned thanks to the dedication of our talented global team, and I am more confident than ever in our long-term growth potential,” said chairman and CEO, Robert M. Davis.

12:15 pm (AEDT):

Coming back to home territory with a look at the ASX, Amcor (AMC) and Pinnacle Investment (PNI) released overnight.

Amcor (also NYSE: AMCR) fell mostly in line with estimates, and expects $650 million in synergies from its soon-to-be-completed merger with rival Berry. Pinnacle Investment's net profit after tax (NPAT) blew estimates from Macquarie out of the water, coming out 60% ahead.

Sticking with the ASX, BWP Trust (BWP) and New Zealand-based Tower (NZT) also released their earnings reports today.

The portfolio value for BWP, the nations country's largest owner of Bunnings Warehouse sites, increased in the six months to December following the acquisition of NPR Property REIT in March.

Meanwhile, the Kiwi insurer Tower revised its guidance for the full year underlying NPAT from between $50 to $60 million up to $60 to $70 million. Its share price has risen by 115% over the past year, and by 2.48% in 2025.

That's all from me today — Harlan will take over from here. Till next time!

1:33 pm (AEDT):

Hello everyone, Harlan Ockey here to cover this afternoon's earnings.

Over on the NASDAQ, PepsiCo (PEP) posted mixed results for Q4. Earnings per share were US$1.96, beating LSEG analyst expectations. However, revenue fell short at $27.78 billion, compared to analysts' $27.89 billion projection.

The company said demand had weakened in North America, but “we’re very confident that our North American business will accelerate this year," said CEO Ramon Laguarta on a conference call.

Its Frito-Lay and beverage divisions each saw a 3% decline in volume over the quarter.

PepsiCo projects a low single digit increase in organic revenue in 2025, and hopes to expand further into the protein drinks sector.

2:06 pm (AEDT):

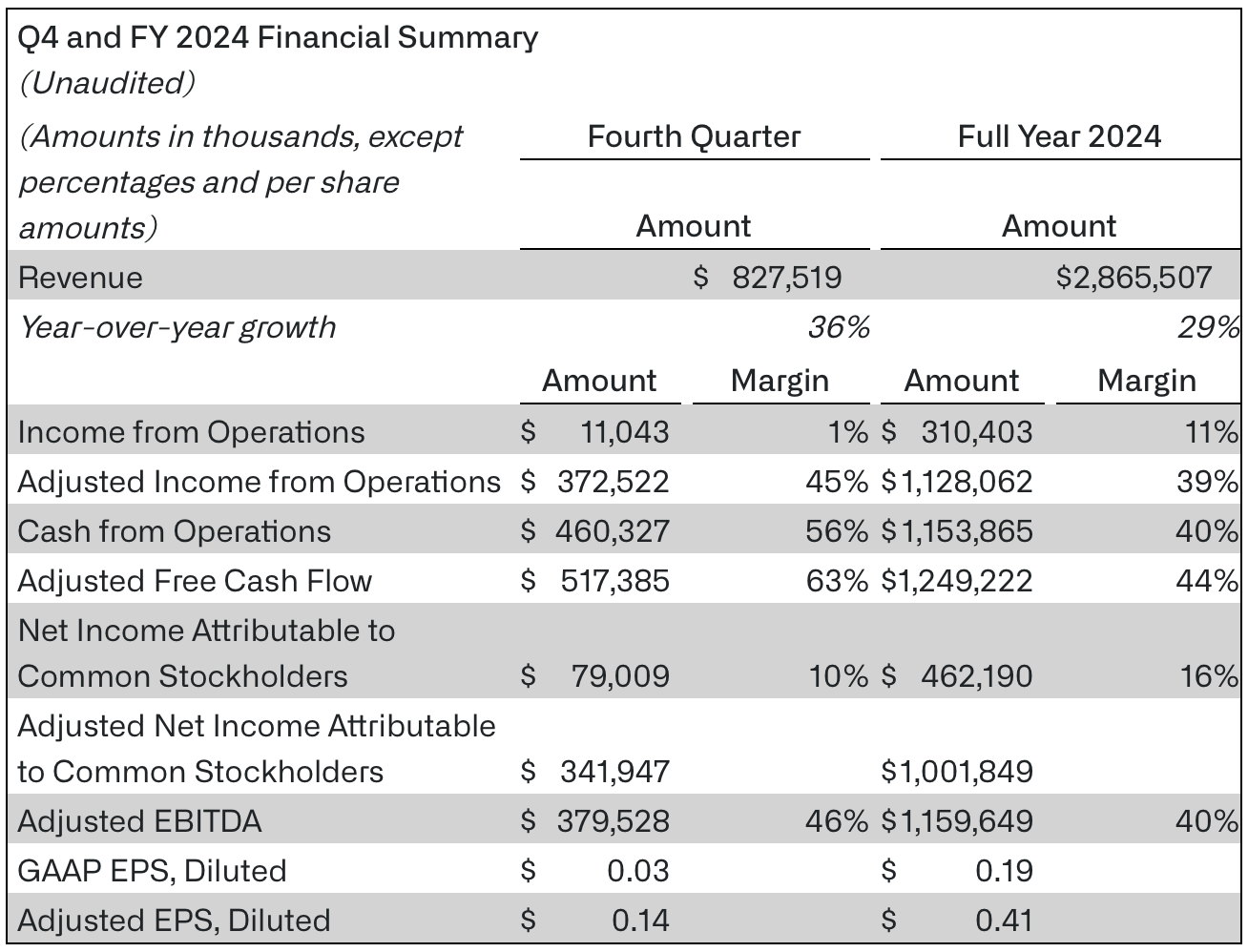

It's tech sector time on the NASDAQ: Palantir (PLTR) reported strong results, with revenue up by 36% year-over-year to reach US$828 million. This is well above LSEG analysts' estimate of $776 million.

“Our business results continue to astound, demonstrating our deepening position at the centre of the AI revolution. Our early insights surrounding the commoditisation of large language models have evolved from theory to fact,” said CEO Alex Karp. Palantir's stocks surged by 21% in extended trading after its results were released.

Its U.S. commercial revenue grew by 64% year-over-year to US$214 million, while its government revenues rose by 45%.to $343 million. Palantir projects U.S. commercial sales will reach around $1.08 billion in 2025.

Moving into the gaming world, Nintendo (TYO: 7974) saw earnings fall short this quarter, with net profit declining by 6% year-over-year to JP¥128.53 billion. Nintendo lowered its full-year profit forecast to ¥270 billion, below its prior guidance of ¥300 billion.

The company posted JP¥432.92 billion in revenue, below LSEG analysts' projection of ¥498.22 billion.

Nintendo's highly-anticipated Switch 2 console is set to release later this year. It has cut sales forecasts for its current-generation Nintendo Switch, with the company now expecting it will sell 11 million units by the end of its fiscal year on March 31. Nintendo's previous projection was 12.5 million units.

Back on the NASDAQ, Electronic Arts (EA) reported lower-than-expected revenue, after it said last month that net bookings had slowed. Revenue was US$2.22 billion, below Zacks Consensus estimates of $2.25 billion and down 6.4% year-over-year. Its earnings per share was $2.83, down from last year's $2.96.

EA expects net bookings between US$1.4 billion and $1.6 billion in its next quarter, with net revenue estimates at $1.4-1.6 billion.

EA also announced a US$1 billion accelerated stock repurchase. “This reflects both our confidence in EA’s long-term strategy and our ability to balance investment in growth with capital returns," said CFO Stuart Canfield.

2:22 pm (AEDT):

Looking to the NYSE, Pfizer (PFE) saw results well above estimates, with revenue up 22% year-over-year to reach US$17.76 billion. This surpassed FactSet projections of $17.35 billion.

Its adjusted earnings per share was US$0.63, above $0.10 in 2023's Q4. While Covid-19 vaccine Comirnaty's revenue declined by 37% to $3.38 billion, Covid-19 treatment Paxlovid's sales were $727 million, compared to a $3.14 billion loss in 2023's Q4. The company's oncology division grew by 27% following Pfizer's acqusition of Seagen.

Research and development spending grew by 8%, although cost reduction measures brought Pfizer's adjusted net income to US$3.59 billion.

The company expects revenues will be between US$61-64 billion in 2025, with earnings per share from $2.80 to $3.00.

2:46 pm (AEDT):

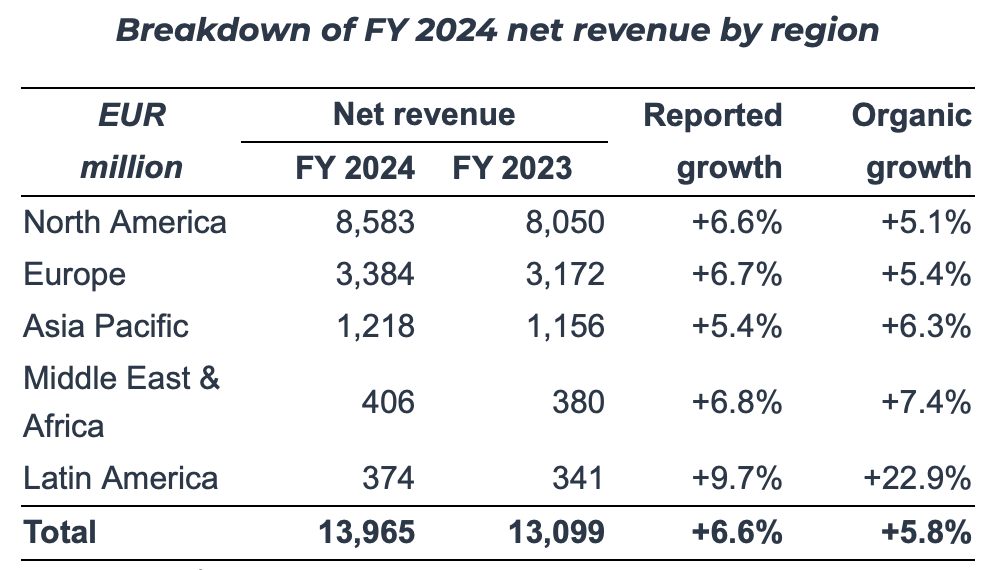

Turning to Euronext Paris, Publicis Groupe (PUB) has said it ended 2024 as the world's largest advertising group, with net revenue at EU€3.85 billion in Q4. Its full-year revenue in 2024 was €16 billion, up 8.3% over 2023.

“We are ending the year in the number one position across the board, growing three times faster than our holding company peers, and five times faster than the IT consultancies. We delivered industry-high financial ratios while stepping up the pace of our investments in AI and talent,” said CEO Arthur Sadoun.

Its free cash flow across 2024 was EU€1.84 billion. Publicis' operating income was $2.21 billion last year, an increase of 27% over 2023.

Net revenue was up in all regions. Latin America saw the largest increase, at 9.7% reported growth and 22.9% organic growth.

Publicis' acquisitions included Singapore-based AKA Asia and France's Downtown Paris in 2024. Last month, it said it would acquire Australia's Atomic 212. The company projects 4-5% organic growth in 2025.

3:17 pm (AEDT):

In Japan's auto sector, Mitsubishi Motors (TYO: 7211) saw results slip year-over-year. It reported net sales of JP¥1.99 trillion this quarter, down 3.6% year-over-year.

Operating income also fell by 34.7% to reach JP¥104.6 billion. Its basic earnings per share were ¥22.80, compared with ¥69.04 in the same quarter in 2023.

Mitsubishi's full-year earnings forecast includes ¥2.76 trillion in net sales, down 1.1% over fiscal year 2023, and ¥26.16 in earnings per share.

While Mitsubishi was initially expected to join the proposed merger between Honda and Nissan, Japanese outlet Yomiuri reported last week that it will instead stay independent. Nissan and Honda are now considering calling off the merger, Reuters reported today.

Rival Toyota is expected to post its earnings in the coming hours. Analysts have projected Toyota will report its second consecutive quarterly drop in profits, but will still see over US$9 billion in net income.

3:45 pm (AEDT):

In the NYSE's social media sector, Snap (SNAP) has beaten estimates with strong revenue and user numbers. Its revenue reached US$1.56 billion, up 14% year-over-year, and above LSEG estimates of $1.55 billion.

Global daily active users rose to 453 million, compared to StreetAccount's projection of 451.1 million. Free cash flow was $182 million, up from $111 million in 2023.

“In 2024 we made significant progress on our core priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, while building toward our long-term vision for augmented reality," said CEO Evan Spiegel.

Snap also donated US$5 million to support communities affected by January's Los Angeles wildfires.

Meanwhile, the NASDAQ's Match Group (MTCH) — which owns online dating services like Tinder, Hinge, and OkCupid — reported mixed results.

Its revenue was US$860 million, down 0.7% year-over-year. This was above Zacks Consensus estimates of $856 million. According to the company, this was driven by a 4% decline in paying subscribers.

Match's earnings per share were $0.82, up from $0.81 year-over-year, but below Zacks estimates of $0.84.

Tinder saw its direct revenue and paying subscribers decline by 3% and 5%, respectively. However, Hinge's direct revenue grew by 39% to reach US$550 million, and payers grew by 23% to 1.5 million.

And that's all from me today. Tomorrow, we expect to see earnings from companies like Uber, Disney, and Toyota. Thank you for following along — please join us next time!