Azzet reports on three ASX stocks with notable trading updates today

Amcor nears completion of Berry merger; reaffirms FY25 guidance

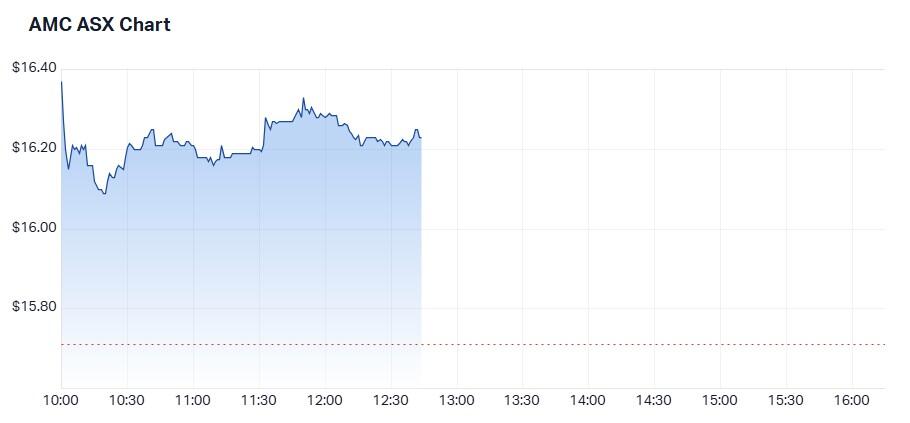

Shares in Amcor (ASX: AMC) were 3% higher at the open after the global packaging giant reassured the market that despite flat sales, and the stronger US$ negatively impacting the company's US earnings, it was still on track to reach FY25 guidance, in line with expectations.

Analysts expect the company earnings to be between 72c and 76c per share, with free cash flow of between US$900 million and US$1 billion.

While lower than expected sales for the quarter saw net sales for H1 (US$6.59 billion), down 1.5% year on year, adjusted earnings for the half-year of US$728 million were up 4% year on year, due to higher volumes and strong cost performance.

Amcor also reported that the adjusted earnings margin for H1 was up by 0.4% on the previous period to 11%.

Meanwhile, the near-completed multibillion-dollar merger with rival Berry also delivered a solid result, which according to Wilson Asset Management bodes well for Amcor’s future returns and stock volumes.

The broker expects portfolio optimisation resulting from the merger with Berry to drive cash flow upside and earnings accretion for shareholders.

Commenting on the recent merger, Amcor’s CEO Peter Konieczny noted: “With faster growth and $650m of identified synergies, this combination will drive significant near and long term value for all shareholders.”

“The path to completion is well advanced and we remain on track to close in mid-calendar year 2025.”

The company’s dividend of US12.8c will be paid on 13 March.

Amcor’s market cap is $10.3 billion, which puts it well inside the ASX200; the stock is up 8% year to date.

Consensus is Moderate Buy.

Amcor's share price appears unable to make a substantial move up or down. Its 20- and 200-day moving averages are relatively flat and imply a lack of interest from both buyers and sellers.

Tower lift FY earnings guidance

Shares in Tower (ASX: TWR) were up around 6% heading into lunch after the midcap Kiwi-based insurer revised its earnings guidance for the year ending 30 September 2025 to a range of between $60-$70 million, up from the previously advised range of between $50-$60 million.

Management attributes the upward revision in underlying net profit guidance to strong business performance and favourable conditions such as benign weather and easing inflation.

While customer growth has been strong, the company has tweaked its guidance for gross written premiums due to lower average premiums from new house and motor policies. This resulted in revised growth of between 7% and 12%.

However, the combined operating ratio has improved which suggests enhanced operational efficiency.

Tower is expected to update its performance at its AGM on 11 February.

Tower’s market cap is $470 million which makes it the ASX’s 505th largest company; the stock is up 115% over one year and 2.48% year to date.

While Tower’s 200-day moving average is trending higher, there is significant evidence that the bullish trend is near an end.

Consensus is Strong Buy.

BWP Trust boosts profit, raises portfolio value

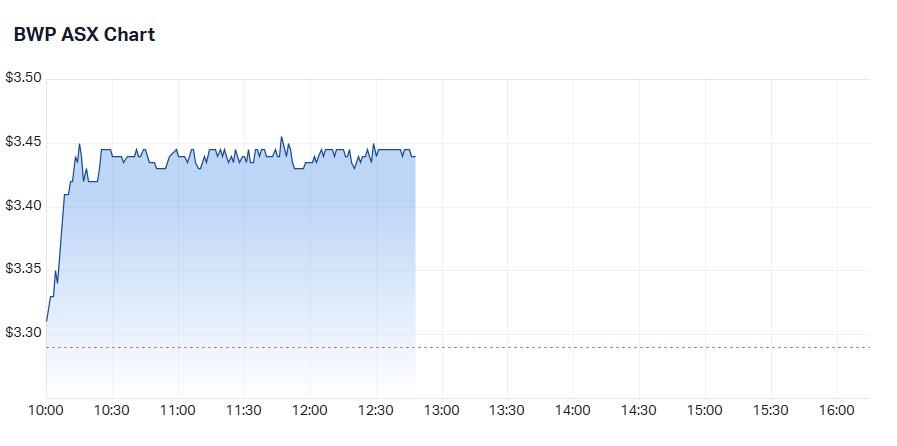

Shares in BWP Trust (ASX: BWP) were up around 5% a midday after the REIT increased its first-half profit and raised its portfolio value in the six months to December. In the half year to 31 December 2024, the REIT posted a net profit of $157.1 million, up from $53.2 million a year earlier.

Supporting the result was $91m in net gains on the fair value of investment properties and derivatives.

Profit excluding fair value movements grew 15% to $66.1 million.

Boosted by the acquisition of NPR Property REIT in March last year and annual rental increases, total income for the period was $100.6 million, up 22.2% from last year.

However, a 58% increase in borrowing, due to debt assumed as part of the NPR acquisition, meant finance costs of $17.2 million were 63.7% higher year on year.

After spending $572m on acquisitions and $41.9m on capex during the year, the REIT ended the half year with total assets valued at $3.7bn, compared to $3bn a year earlier.

Looking forward, the REIT’s managing director Mark Scatena told investors the core focus for the remainder of FY25 is optimising the portfolio while actively assessing opportunities to grow the portfolio that create value.

“This activity will focus on reinvesting in the core retail portfolio to support tenant optimisation plans, acquiring accretively to grow the core portfolio and partnering with tenants to potentially, over time, participate in adjacent parts of the retail value chain,” Scatena said.

BWP Trust also reported an interim distribution of 9.2 cents per unit, up 2% year on year.

The REIT’s market cap is $2.4bn making it an ASX200 stock; the share price is up 2.5% over one year and around 5% year to date.

The REIT’s shares appear to be weak with little demand from investors.

Consensus is Strong Buy.

This article does not constitute financial product advice. You should consider independent advice before making financial decisions.