Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Visa, Mastercard both beat on strong cross-border volumes

- Apple busts records with growth in iPhone sales

- Comcast posts mixed results, broadband customers fall

- Caterpillar exceeds estimates, flags tariff hit

- SAP shares plummet as cloud growth slows

- Sandisk shares soar on sales spike

- Royal Caribbean surges on high guidance

_______________________________________________________________________________________

8:54 am (AEDT):

Good morning and happy Friday! Harlan Ockey here to walk you through the day's earnings.

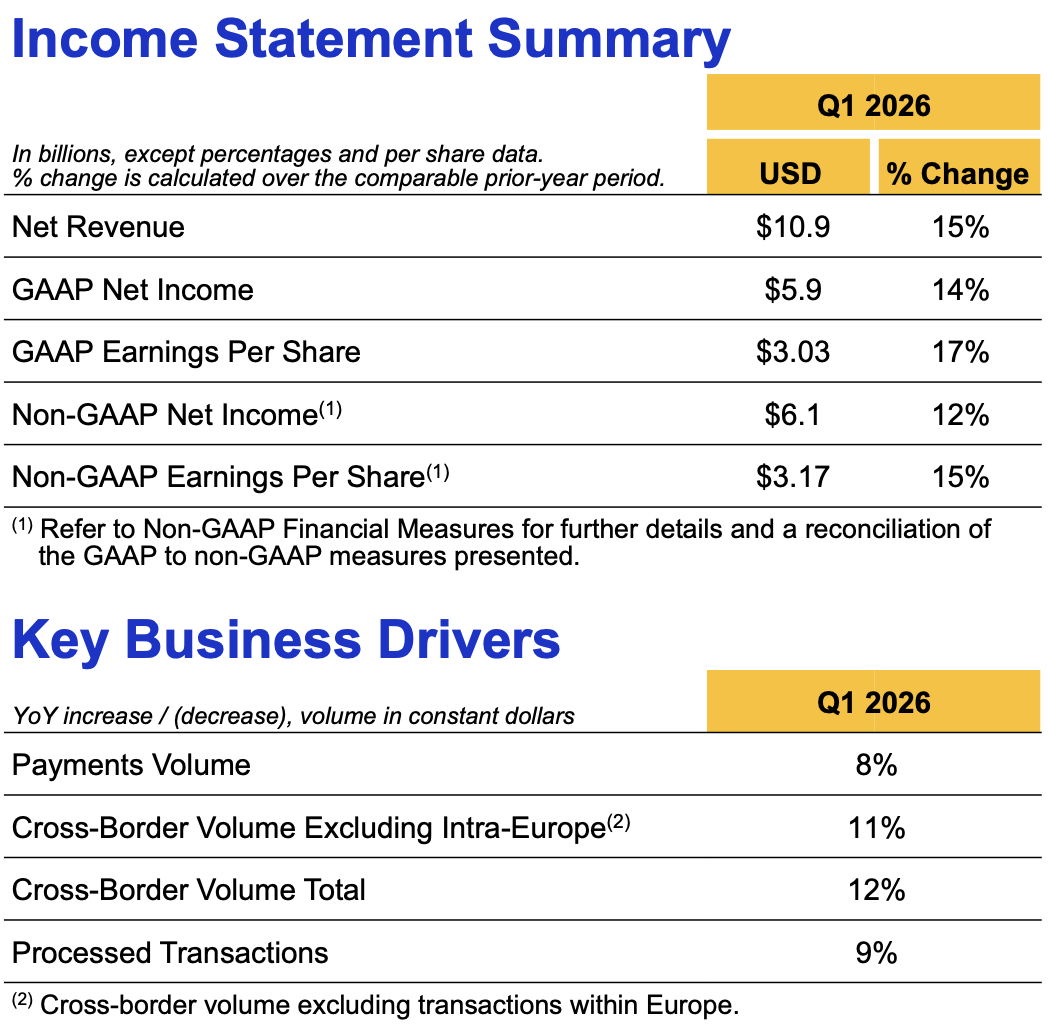

Starting off on the NYSE, Visa (V) beat revenue estimates for a fourth consecutive quarter, driven by a surge in cross-border volumes.

Revenue was up 15% to US$10.90 billion, above Zacks estimates by 1.87%. Earnings per share rose 15% to $3.17, besting estimates of $3.14.

"Visa delivered a very strong fiscal first quarter with net revenue up 15% year-over-year, GAAP EPS up 17% and non-GAAP EPS up 15%, driven by resilient consumer spending and a strong holiday season, as well as continued strength in value-added services and commercial and money movement solutions," said CEO Ryan McInerney.

Total cross-border volumes increased 12% during the quarter, and by 11% excluding transactions within Europe. Processed transactions also grew by 9%, and payments volume climbed 8%.

Operating expenses rose 27% to $4.16 billion, driven largely by growth in litigation provisions. During the quarter, it settled a class-action suit alleging Visa and Mastercard had conspired to maintain artificially high ATM access fees.

Visa's shares closed 1.5% higher, but fell 1.8% after-hours. The company's share price is down 4.2% year-to-date, having been weighed down alongside other payment and banking stocks in recent weeks after U.S. President Donald Trump called for a cap on credit card interest rates.

Read Chloe Jaenicke's full story.

9:22 am (AEDT):

Over to Frankfurt, SAP (SAP) shares collapsed 16.1% after reporting slowing cloud backlog growth.

Revenue last quarter rose 9% to EU€9.68 billion, below estimates of €9.7 billion. Non-IFRS earnings per share was up 16% to €1.62, and operating profit grew 27% to 2.55 billion.

Cloud revenue increased 19% to €5.61 billion. Its cloud backlog grew by 16% to €21.05 billion, but previous forecasts had projected a 26% rise.

“Large transformational deals with high cloud revenue ramps in outer years and termination for convenience clauses required by law negatively impacted fourth quarter constant currency current cloud backlog growth by approximately 1 percentage point,” the company wrote.

SAP also expects its cloud backlog “to slightly decelerate” in 2026, though it projects €25.8-26.2 billion in cloud revenue across the year.

9:43 am (AEDT):

On the Nasdaq, Comcast (CMCSA) posted mixed results last quarter, with broadband customers declining as media and theme park revenue rose.

Revenue increased 1.2% to US$32.31 billion, below LSEG estimates of $32.35 billion. Earnings per share fell 12.4% to $0.84, above estimates of $0.75.

Connectivity & Platforms revenue fell 1.1% to $20.24 billion, with the segment's net customer relationships declining by 181,000 to 50.77 million during the quarter

Domestic broadband customers decreased by 181,000 to 31.26 million, and domestic video customers dropped by 245,000 to 11.27 million. Domestic wireless lines rose by 307,000 to 9.31 million.

Content & Experiences revenue was up 5.4% to $12.74 billion, however, driven by a 21.9% surge in theme park revenue. Media revenue increased 5.5%, while studios revenue fell 7.4%.

Comcast also completed its spinoff of Versant, which includes U.S. cable news properties like CNBC and MS NOW (formerly MSNBC), in early January.

Shares rose 2.9%, but fell 0.8% in after-hours trading.

10:02 am (AEDT):

Back to the NYSE, Caterpillar (CAT) beat estimates, but has flagged a US$2.6 billion tariff hit in 2026.

Revenue was $19.1 billion, rising from $16.2 billion one year ago and passing LSEG estimates of $17.86 billion. Earnings per share were $5.16, up from $5.14 and above estimates of $4.68.

“Our centennial year marked a significant milestone, underscored by the highest full-year sales and revenues in Caterpillar’s history and a single-quarter record of $19.1 billion,” said CEO Joe Creed. “These results demonstrate the strength of our end markets and our disciplined execution."

Operating profit dropped 9% year-over-year, which the company credited in part to manufacturing costs of $1.03 billion that reflect higher tariffs.

“For the full year [2026], incremental tariff costs are expected to be around $2.6 billion, which is $800 million higher than occurred in 2025,” said Creed on an earnings call. The company also expects tariff-related costs of around $800 million in 2026's first quarter.

Read Oliver Gray's full story.

10:20 am (AEDT):

At the NYSE, Blackstone (BX) surpassed profit estimates last quarter as its earnings from asset sales soared.

Distributable earnings per share were US$1.75, above LSEG estimates of $1.54 and up from $1.69 year-over-year. Revenue was $4.36 billion, rising from $3.08 billion.

Net realisations from asset sales were $956.90 million, surging 59% year-over-year.

Total assets under management were $1.27 billion. It reported $71.5 billion of inflows during the quarter, compared with $57.5 billion one year ago.

Garry West has the full story.

10:46 am (AEDT):

Turning to Stockholm, H&M (HM-B) saw profits climb last quarter, but has warned of lower demand in December and January.

Sales were up 2% in the quarter ending 30 November, despite store numbers dropping by 4% year-over-year. Net sales were SEK 59.22 billion (US$6.73 billion).

Operating profit rose 38% to SEK 6.36 billion, well above estimates of SEK 5.53 billion. Earnings per share were SEK 2.72, growing from SEK 1.86 year-over-year.

The company expects sales to decrease by 2% in December and January, it said, due to a slump in demand following strong Black Friday sales.

Chloe Jaenicke has the full story.

11:10 am (AEDT):

Back to the Nasdaq, Apple (AAPL) reached a new earnings per share record, with iPhone sales jumping after the iPhone 17 series' release.

Earnings per share were US$2.84, rising from $2.40 one year ago and above Bloomberg estimates of $2.68. Net sales were $143.76 billion, up from $124.30 billion and beating estimates of $138.4 billion.

Products revenue climbed from $97.96 billion to $113.74 billion, with services revenue growing from $26.34 billion to $30.01 billion.

iPhone revenue led Apple's products, surging from $69.14 billion to $85.27 billion. The iPhone 17 series launched in September 2025.

Mac revenue fell from $8.99 billion to $8.39 billion, and Wearables, Home & Accessories revenue respectively declined from $11.75 billion to $11.49 billion. iPad revenue rose from $8.09 billion to $8.60 billion.

Operating expenses were $18.38 billion, up from $15.44 billion due to a large increase in research and development costs. Operating income grew from $42.83 billion to $50.85 billion.

“Today, Apple is proud to report a remarkable, record-breaking quarter, with revenue of $143.8 billion, up 16 percent from a year ago and well above our expectations,” said CEO Tim Cook. “iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment, and Services also achieved an all-time revenue record, up 14 percent from a year ago."

Gross margins last quarter were 48%, with the company projecting margins will remain at 48-49% in the next quarter. This is due to ongoing strain on the market for memory chips.

Apple's shares closed 0.7% higher, and increased 0.6% after-hours. The company reached $4 trillion in market value for the first time in October.

11:43 am (AEDT):

At the NYSE, Mastercard (MA) surpassed estimates last quarter, supported by growing cross-border volumes like rival Visa.

Earnings per share were up 25% year-over-year to US$4.76, above Zacks estimates by 13.3%. Revenue climbed 18% to $8.81 billion, besting estimates by 0.8%.

Cross-border volume was up 14%, the company said, with gross dollar volumes rising 7%. Purchase volume increased by 9%.

Operating income grew from $3.94 billion to $4.91 billion. Operating expenses rose from $3.55 billion to $3.90 billion.

“2025 was another strong year for Mastercard, with net revenue up 16% year-over-year or 15% on a currency-neutral basis," said CEO Michael Miebach. "The overall macroeconomic environment is supportive and we continue to see healthy consumer and business spending."

Mastercard shares closed 4.3% higher, but dipped 0.7% in after-hours trading.

12:06 pm (AEDT):

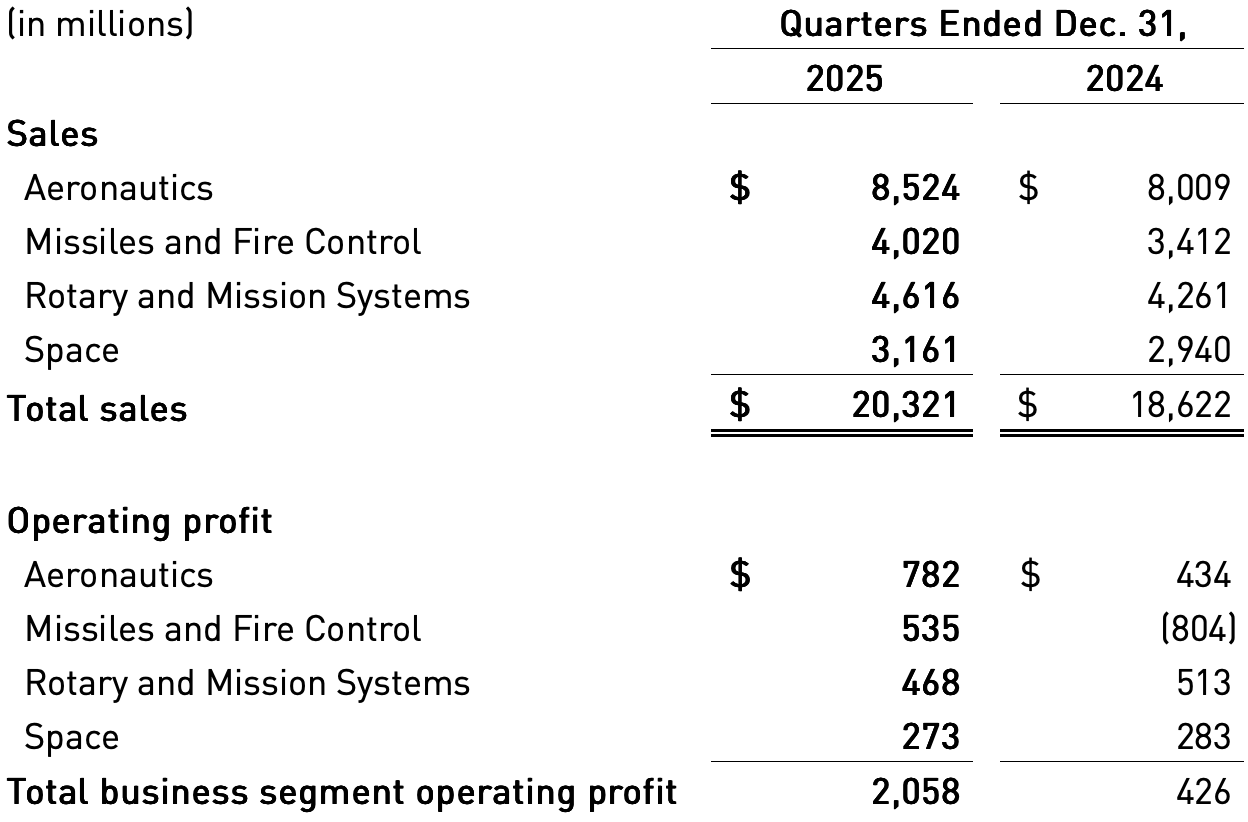

Still with the NYSE, Lockheed Martin (LMT) has raised its outlook and announced a new partnership with the U.S. Department of Defense.

Revenue last quarter increased 9% year-over-year to US$20.32 billion, above FactSet estimates of $19.86 billion. Earnings per share rose 161% to $5.80, just below estimates of $5.81.

Sales were up across all segments. Aeronautics sales grew from $8.10 billion to $8.52 billion, while Rotary and Mission Systems, its second-largest segment by revenue, saw sales rise from $4.26 billion to $4.62 billion.

Consolidated operating profit was $2.33 billion, rising from $696 million. Its order backlog was a record $194 billion at the quarter's end.

For 2026, the company projects $77.50-80.00 billion in sales and $29.35-30.25 in earnings per share. This is largely above estimates of $74.59 billion in revenue and $29.52 in earnings per share.

In the October quarter, it had forecast $74.25-74.75 billion in 2026 sales and $22.15-22.35 in earnings per share.

Lockheed Martin said in a separate release that it would more than quadruple production of Terminal High Altitude Area Defence (THAAD) interceptors for the Department of Defense, aiming to produce 400 interceptors per year for the next seven years. It did not disclose the partnership's financial terms, but said it has invested over $7 billion since 2017.

12:25 pm (AEDT):

At the NYSE, Royal Caribbean Group (RCL) spiked 18.7% after its guidance beat estimates, with the company saying two thirds of its 2026 capacity has already been booked.

Revenue rose to US$4.26 billion, up from $3.76 billion and in line with FactSet estimates. Earnings per share jumped 72% to $2.80, also matching estimates.

Passenger ticket revenues increased from $2.60 billion to $2.94 billion, while onboard and other revenues rose from $1.16 billion and $1.32 billion. It carried 2,484,241 passengers during the quarter, at an occupancy rate of 107.8%.

Cruise operating expenses were up to $2.24 billion from $2.05 billion. Operating income grew from $624 million to $933 million.

Royal Caribbean saw its highest ever seven booking weeks since its October earnings call. Roughly two thirds of 2026 capacity has been booked, “which is within historical ranges and at record rates”, it said.

It projects first quarter earnings per share will be $3.18-3.28, above estimates of $2.93. For 2026, it expects earnings per share of $17.70-18.10, passing estimates of $17.65.

The company also said today that it had partnered with northwestern France's Chantiers de l'Atlantique shipyard to construct Royal Caribbean's new Discovery Class ships. This will include two ships to be delivered in 2029 and 2032, with options for four further ship orders.

12:50 pm (AEDT):

Good afternoon, it’s Chloe Jaenicke here to take over the blog for a little while.

Starting off, Honeywell (NASDAQ: HON) announced a strong end to the 2025 fiscal year.

The industrial conglomerate reported fourth quarter earnings per share of US$2.59 from adjusted sales of $10.1 billion.

This was higher than last year’s US$2.47 per share from sales of $10.1 billion and ahead of Wall Street estimates of $2.54 per share.

Adjusted operating profit was also just ahead of Wall Street predictions at $2.3 billion.

For the 2026 fiscal year, the company expect sales of $38.8 billion to $39.8 billion with organic sales growth between the 3% to 6% range.

Adjusted earnings per share for 2026 are expected to rise 6% to 9% to between $10.35 and $10.65.

The company will also be separating its automation and aerospace business in a transaction expected to be completed in the third quarter.

1:08 pm (AEDT):

On the NYSE, Stryker (SYK) beat estimates in its Q4 earnings.

The medical technologies corporation saw its adjusted earnings per share rise 11.5% to US$4.47. This surpassed Zacks consensus estimates of $4.40 per share.

The company’s net sales also increased by 11.4% to $7.2 billion.

“We had an outstanding finish to 2025, driving double-digit sales and adjusted earnings per share growth for the fourth quarter and full year while delivering adjusted operating margin expansion of at least 100 basis points for the second consecutive year,” Stryker CEO Kevin Lobo said.

For the full year, the company reported earnings of $13.63 per share, up 11.8% from last 2024, and net sales rose 11.2% to $25.1 billion.

Lobo said surpassing the $25 billion mark in sales has allowed the company to “enter 2026 with significant momentum”.

In its 2026 outlook, the company said it expects earnings per share within the range of $14.90 to $15.10.

1:22 pm (AEDT):

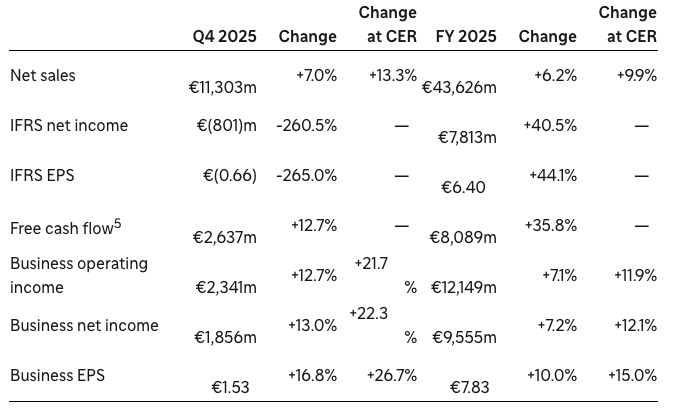

Sanofi (EPA: SAN) reported growth in the final quarter of the year but failed to impress investors.

The medicinal company announced sales growth of 13.3%, driven by strong sales in Pharma and Dupixent but offset by a 2.5% decrease in vaccine sales.

Overall net sales reached EU€11.303 billion in Q4 2025.

“Growth was supported by new medicines and Dupixent, reaching a new quarterly high,” CEO Paul Hudson said in a statement.

The decline in vaccine sales comes thanks to changes in the U.S. vaccine policy.

The company also announced earnings per share of €1.53 (US$1.82), marking a 26.7% increase year-over-year.

In the earnings release, the company said it expected sales to grow by a high single-digit percentage in 2026. The company also intends to execute a share buyback program in 2026 of €1 billion.

“In 2026, we expect sales to grow by a high single-digit percentage and business EPS to grow slightly faster than sales,” Hudson said.

“We anticipate profitable growth to continue over at least five years."

1:55 pm (AEDT):

Thank you, Chloe! Harlan Ockey back with you now.

On the Nasdaq, Nasdaq, Inc (NDAQ) beat estimates last quarter with growth across segments.

Revenue rose 13.5% year-over-year to US$1.39 billion, above Zacks estimates of $1.37 billion. Earnings per share grew from $0.76 to $0.96, passing estimates of $0.91.

Solutions revenue increased 13% to $1.07 billion. This includes 14% growth in Financial Technology revenue, which reached $498 million and bested estimates of $491.35 million.

Market Services net revenue was also up 16% to $311 million. Its Index sub-segment was up 23% to $232 million, with $35 billion in net inflows during the quarter.

“It was an excellent year of execution for Nasdaq, as we achieved strong organic growth, accelerated innovation, and successfully delivered across our three strategic priorities: Integrate, Innovate, and Accelerate. For the first time, Nasdaq exceeded $5 billion in annual net revenue and $4 billion in annual Solutions revenue, reflecting the power, resilience and adaptability of our platform," said CEO Adena Friedman.

Nasdaq's shares closed 0.6% lower.

2:23 pm (AEDT):

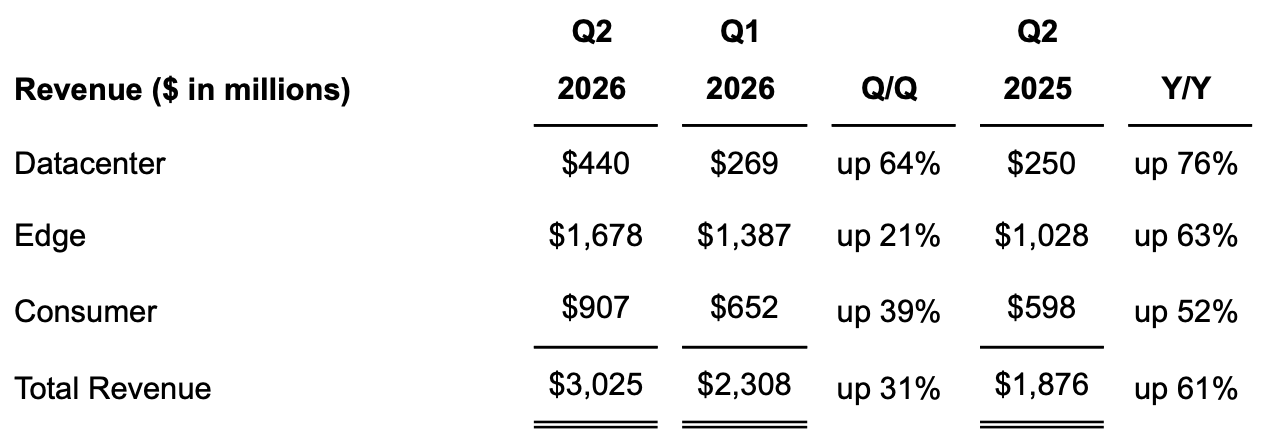

Still with the Nasdaq, Sandisk (SNDK) spiked 17.2% after-hours, having solidly surpassed estimates last quarter.

Sales were up 61% year-over-year to US$3.03 billion, beating FactSet estimates of $2.69 billion. Earnings per share rose 404% to $6.20, well above estimates of $3.62.

Data centre revenue increased 76% to $440 million, with edge revenue up 63% to $1.68 billion and consumer revenue rising 52% to $907 million.

“This quarter’s performance underscores our agility in capitalizing on better product mix, accelerating enterprise SSD deployments, and strengthening market demand dynamics, all at a time when the critical role that our products play in powering AI and the world’s technology is being recognized," said CEO David Goeckeler.

Operating income surged 446% to $803 million.

Its fiscal third quarter outlook includes revenue of $4.40-4.80 billion and earnings per share of $12.00-14.00.

3:01 pm (AEDT):

Over to Helsinki, Nokia (NOKIA) shed 9.4%, despite beating revenue estimates amid rising demand from data centre customers.

Sales rose 2% year-over-year to EU€6.13 billion, passing FactSet estimates of €6.11 billion. Comparable earnings per share dropped 11% to €0.16, and comparable operating profit dipped 3% to €1.06 billion.

Net sales for its Network Infrastructure segment were up 19% to €2.41 billion. This was driven by growing orders in Optical Networks and IP Networks from AI and cloud customers, the company said.

Mobile Networks sales fell 2%, however, with Cloud and Network Services down 11% and Nokia Technologies declining 17%.

It expects €2.0-2.5 billion of comparable operating profit across 2026.

Nokia's U.S.-listed shares (NYSE: NOK) also closed 7.8% lower, and dropped a further 0.2% after-hours.

3:33 pm (AEDT):

On the Nasdaq, semiconductor supplier KLA Corporation (KLAC) fell 8.6% in after-hours trading, although it exceeded revenue, earnings, and guidance estimates.

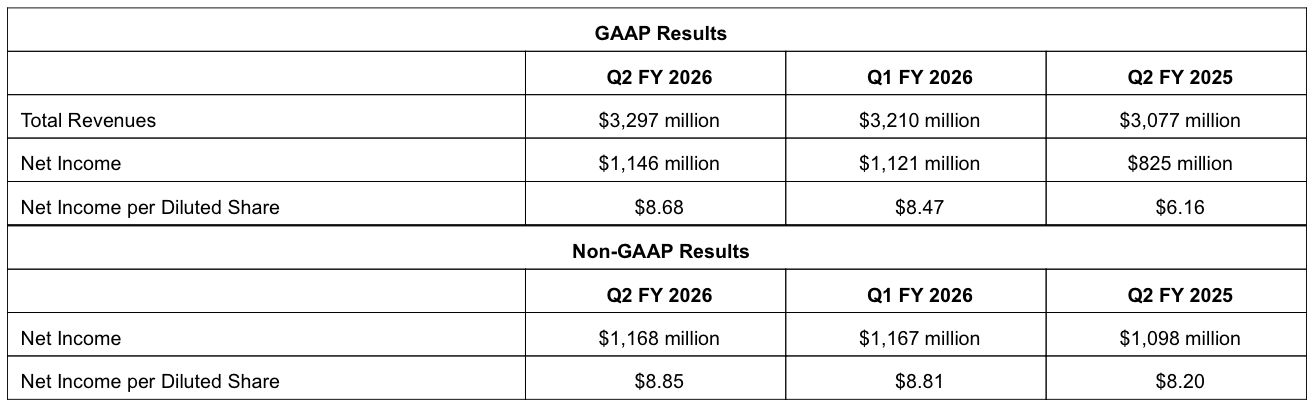

Revenue was US$3.30 billion, up from $3.08 billion one year ago and beating Zacks estimates by 1%. Earnings per share were $8.85, rising from $8.20 and above estimates of $8.82.

Product revenue grew from $2.41 billion to $2.51 billion, and service revenue increased from $667.39 million to $786.05 million.

“KLA delivered a record quarter and calendar 2025 for revenue, non-GAAP operating income, and free cash flow generation. This performance was fueled by our differentiated product portfolio and solid company execution in an environment where the relevance of process control at the leading edge for foundry/logic and memory is increasing,” said CEO Rick Wallace.

Its guidance for its second fiscal quarter includes revenue of $3.35 billion, plus or minus $150 million, and earnings per share of $9.08, plus or minus $0.78. This is above estimates of $3.29 billion in revenue and $8.94 in earnings per share.

4:03 pm (AEDT):

Finishing off at the NYSE, Parker Hannifin (PH) has lifted its guidance after its aerospace segment posted a jump in sales.

Total sales increased 9% to a record US$5.14 billion, above Zacks estimates by 2.6%. Earnings per share were $7.65, rising from $6.53 and besting estimates of $7.15.

Aerospace Systems sales grew from $1.49 billion to $1.71 billion, and Diversified Industrial sales were up from $3.35 billion to $3.47 billion.

“This was another outstanding quarter that reflected the performance of our global team, the power of our business system The Win Strategy™, and the strength of our transformed portfolio,” said CEO Jenny Parmentier. “We delivered record sales with organic sales growth of nearly 7% and growth across all reported businesses.

The company lifted its guidance for the fiscal year ending 30 June, and now forecasts reported sales growth of 5.5-7.5%. It expects adjusted earnings per share of $30.40-31.00.

Its full-year guidance from November had included sales growth of 4-7% and adjusted earnings per share of $29.60-30.40.

Parker Hannifin's shares closed 3.5% higher.

Thank you for joining us today. We'll see you next time!